Angel One Account Opening Guide

A full-service broker in India offering a wide range of investment and trading services at the same cost as that of discounted brokers. It has an active client base of 41,86,988 till September 2022.

Angel One Demat Account Opening Process Step by Step.

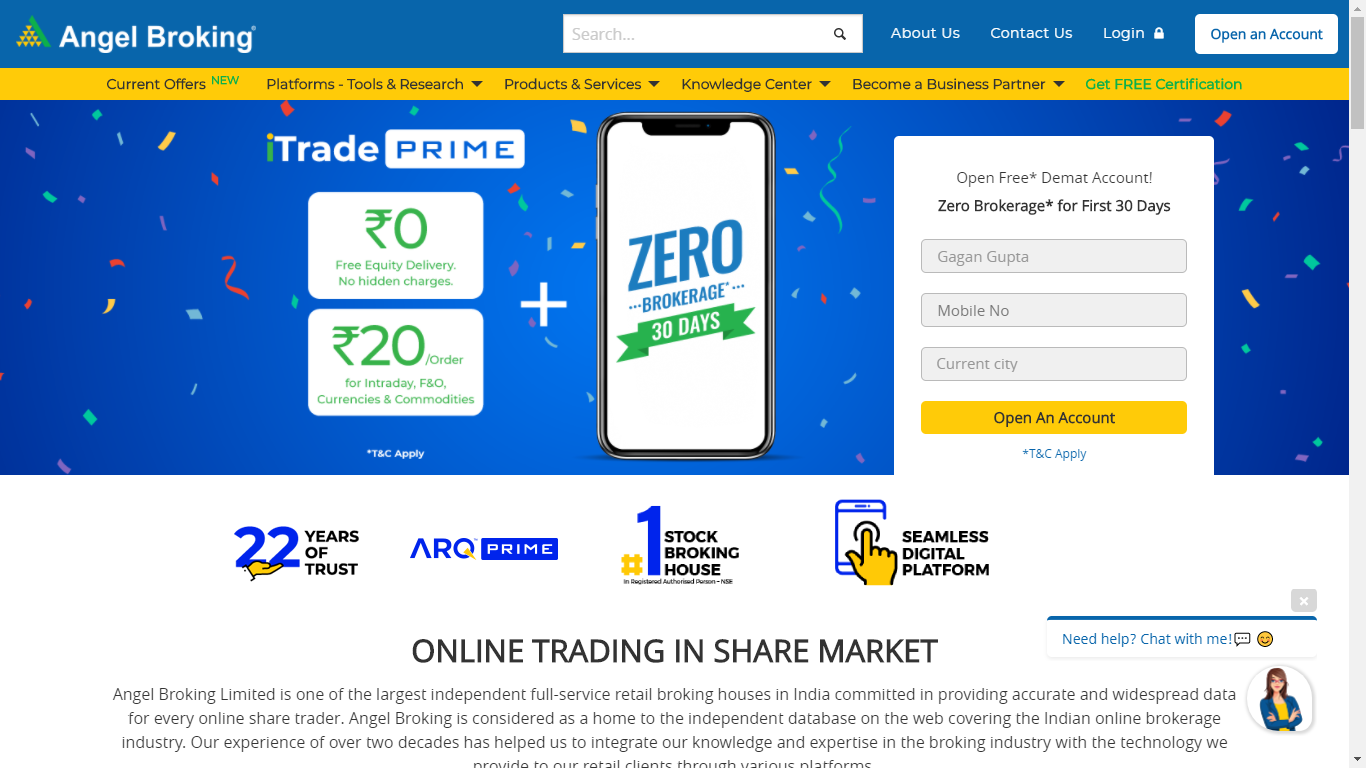

Steps 1

Click on ‘Open Your Account’ to visit Angel broking and start your account opening process. Now, enter your name, mobile number and current city in the box on the right side of the webpage. Click open an account to continue.

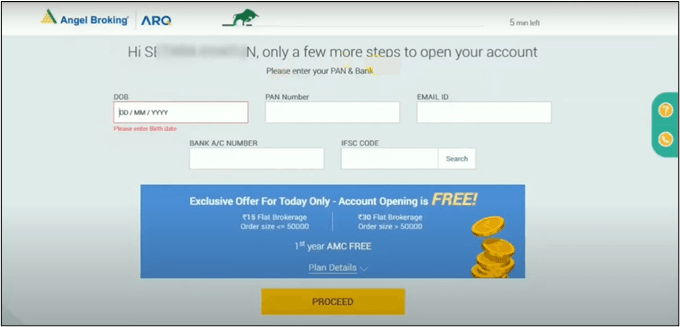

Steps 2

Now enter DOB, PAN Number, Email Id, Bank A/C number and IFSC code in their respective boxes. Click Proceed to continue.

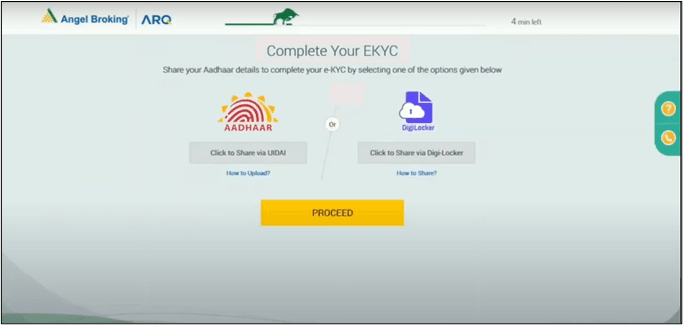

Steps 3

Now, to complete your eKYC you have two options: Either download your details from UIDAI or upload your Aadhaar front and back image enclosed in zip format. You can also share it via Digilocker. Click proceed to continue further.

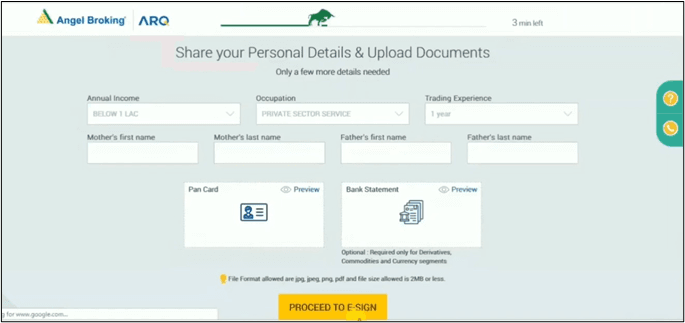

Steps 4

Enter your personal details, a scanned copy of the PAN card and last 6 months bank statement in less than 2 MB in size. Click Proceed to E-sign to continue.

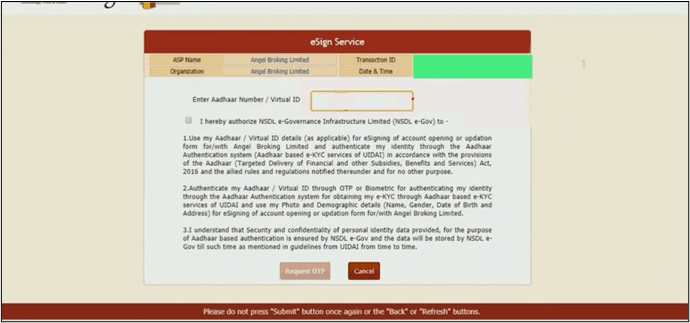

Steps 5

Now, Enter your aadhaar number and check the declaration box. Click Request OTP to generate OTP to your registered mobile number.

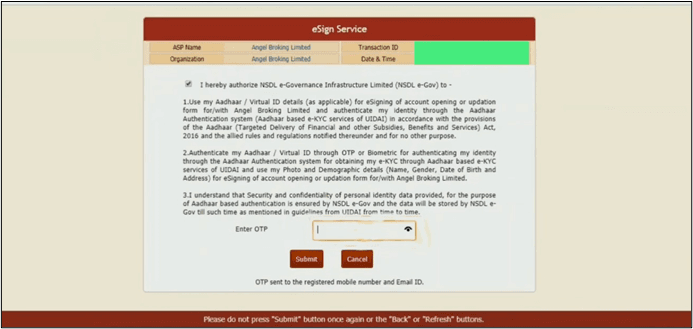

Steps 6

Type-in the generated OTP and click the Submit button to continue further.

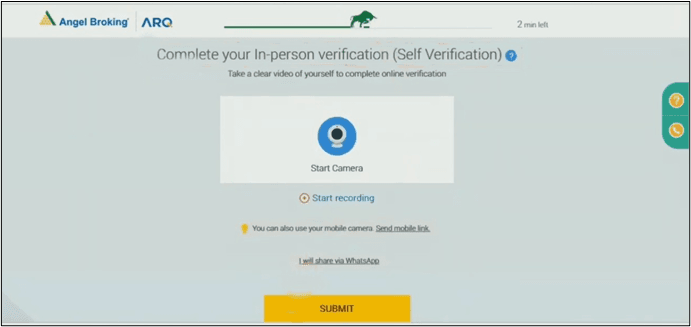

Steps 7

Now to complete your IPV verification, you need to take a clear video of yourself. Click the start Camera button and start recording to record and click the stop recording once you are done. Click the Submit button to proceed.

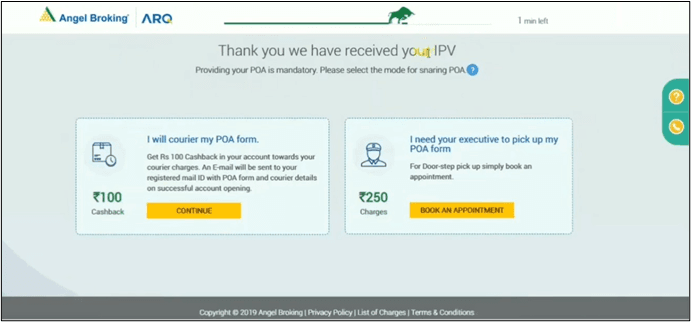

Steps 8

In order to allow the Broker to debit the shares from your Demat account, you need to sign the Power of Attorney(POA) document. Open your registered email-id after clicking the continue button to get the POA form if you wish to send it by courier. You would be refunded with Rs 100 for your courier charges. Or you can select a door-step pickup and an executive would do this process for you. An amount of Rs 250 would be charged for this process. Click Book an appointment to complete this step.

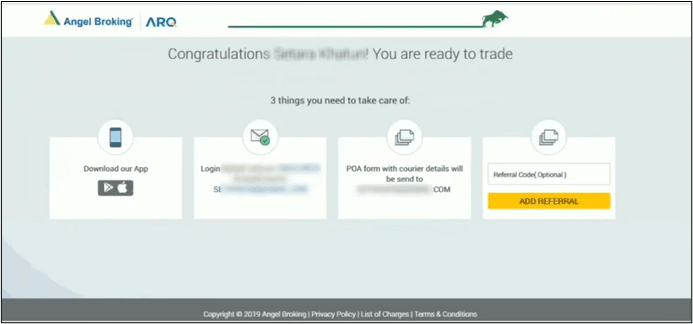

Steps 9

You would now get the login credentials to enter the trading platform.

Angel One Demat Account Opening - Documents Required.

Documents List

- A scanned copy of your PAN card

- A scanned copy of Aadhar Card

- Cancelled Cheque/Bank statement to link your bank account

- A scanned copy of your signatures - Income Proof (Only required if you wish to trade in Futures & Options, Currency or Commodities)

Additional terms and conditions

- You must have an active mobile number linked with your Aadhaar card. This is to complete the eSign-in/DigiLocker process which requires OTP verification. If your mobile number is not linked with your Aadhar card, then visit the nearest Aadhaar Seva Kendra to get it linked.

- Make sure that the bank statement you are uploading has an Account number, IFSC and MICR code printed on it. If these are not clearly visible, then your application may be rejected.

- The cheque must have your name clearly inscribed on it.

- Signature should be done with a pen on a blank paper and should be clearly visible. Use of pencils, sketch pens or markers will get your application rejected.

- You can submit any of the following documents as an income proof:

Form-16

Income Tax Return Acknowledgment

Latest 6-month Bank statement

Latest salary slip

Networth certificate from a CA

Rate it

0.0 / 5

0 Review