X

Paytm Money is one of India’s largest Investment platforms with over 6,02,988 active client base till September 2022. In a relatively short time in this industry, they have launched pioneering products and are one of the fastest-growing broking houses.

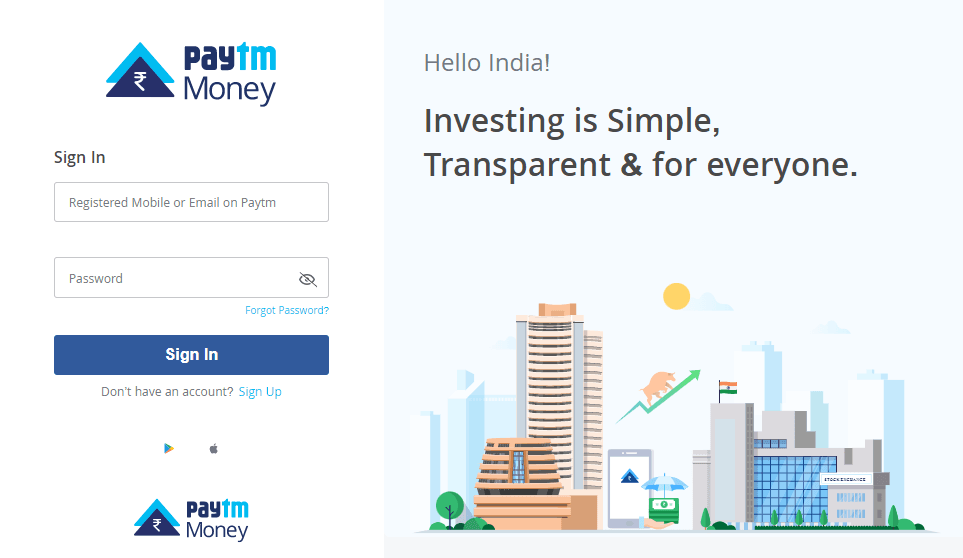

Steps 1

Click on ‘Start Investing’ to visit Paytm Money and start your account opening process. Enter your Email address and mobile number in the box on the left side of the webpage. Click on Sign In.

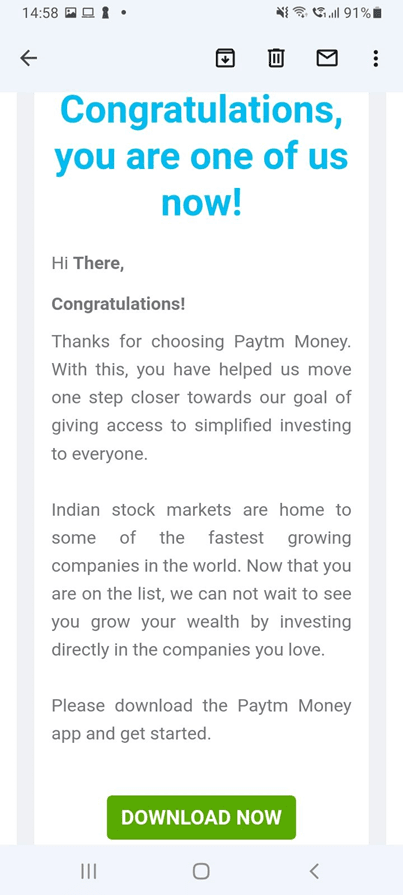

Steps 2

Once you submit your email id and mobile number, you will receive a link in your text message and email id to download the Paytm Money app.

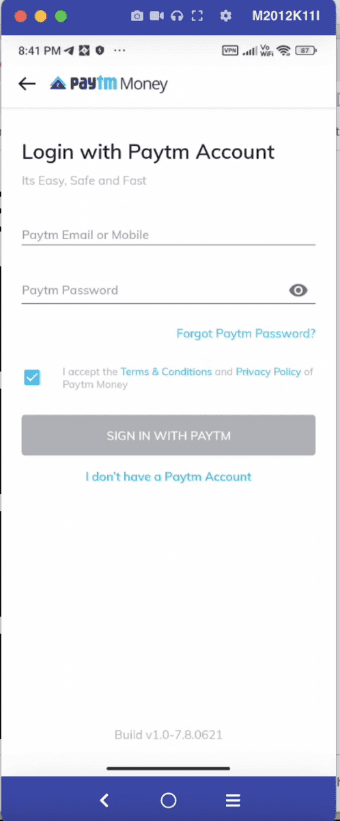

Steps 3

As you download and open the Paytm app, click on ‘Continue with Paytm Login’ and then add your email id or mobile no. and password.

Click on ‘Sign in with Paytm’.

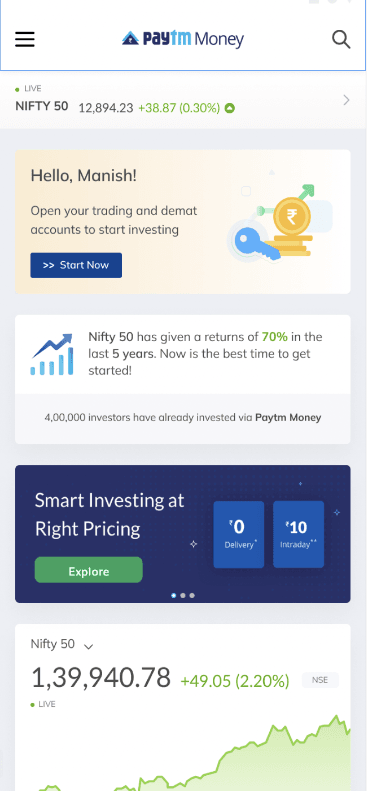

Steps 4

After getting logged in, Click on ‘Start Now’ to initiate the process of opening a Demat account.

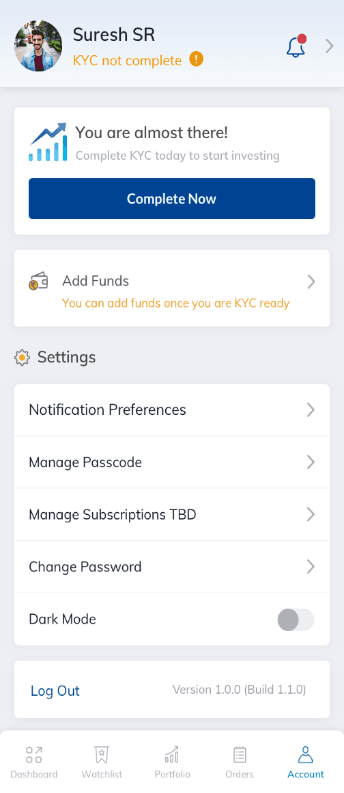

Steps 5

You will be asked to complete your KYC before you start your investing journey. Click on ‘Complete Now’ to initiate the process.

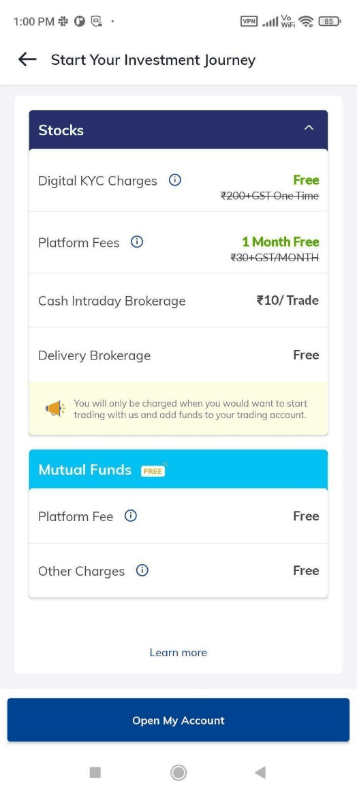

Steps 6

Once you understand all the details visible on your screen. Click Open my account to continue.

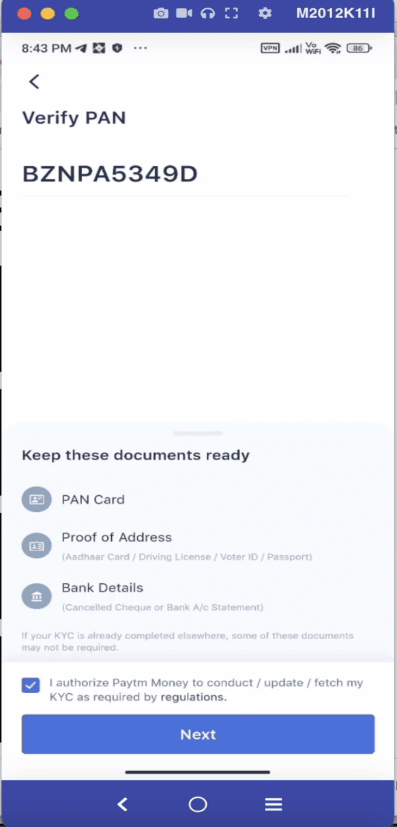

Steps 7

Now enter your PAN details. Click Next to continue.

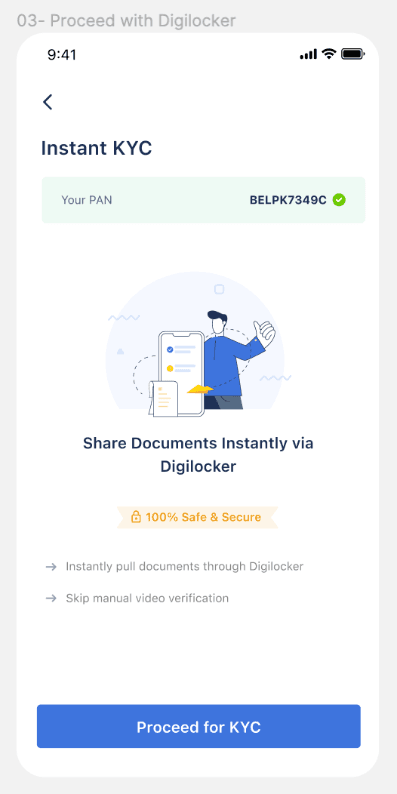

Steps 8

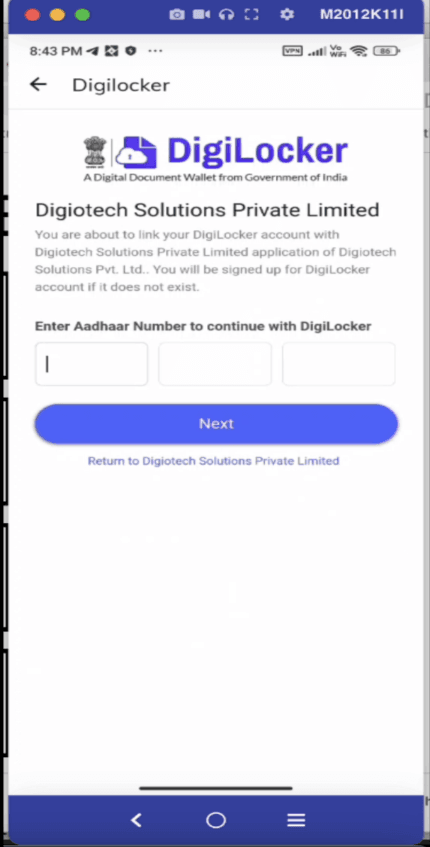

Once your PAN is verified, click on ‘Proceed for KYC’ and share your documents through DigiLocker. It is an initiative by the Government of India to save your essential documents on the cloud. It is linked with your Aadhaar card and thus provides complete security.

Steps 9

Provide consent to Digilocker to fetch your PAN and Aadhar Details. Then enter your Aadhar number to proceed further.

Steps 10

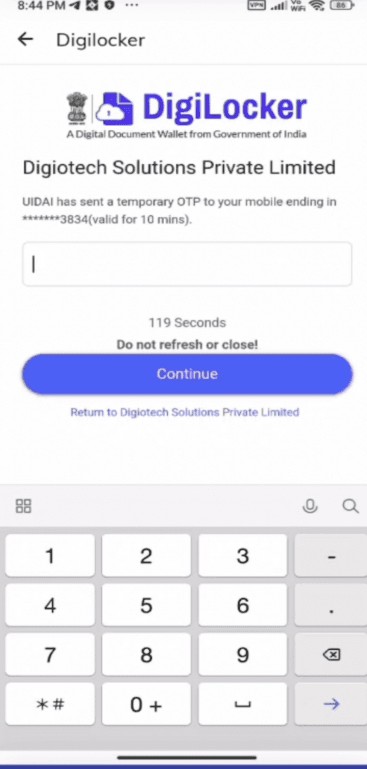

Enter the OTP sent to your registered mobile number.

Steps 11

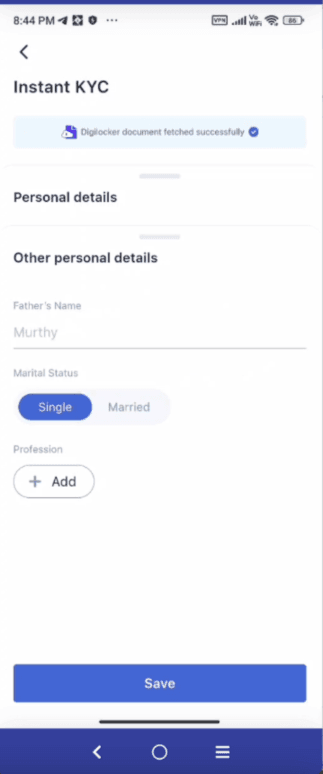

Now enter additional details about you which include your gender, marital status, annual income, profession, politically exposed, and country of residence.

Steps 12

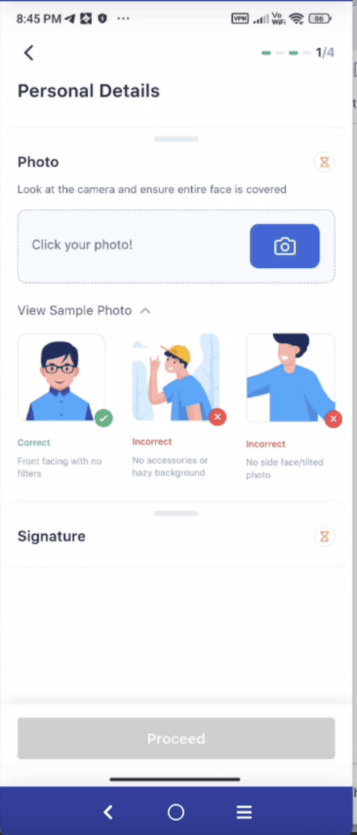

Now upload your picture with a clear background. Click on Proceed to continue.

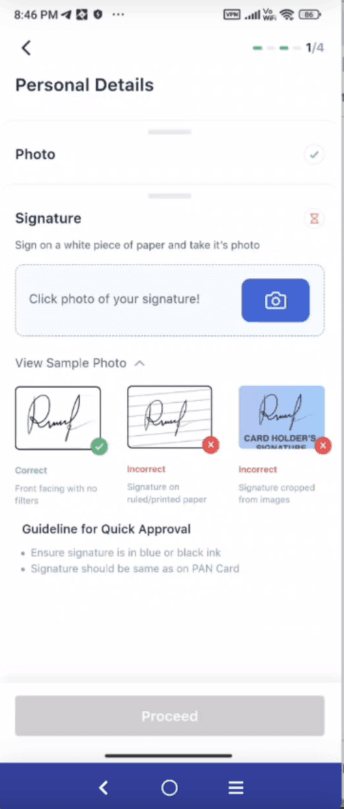

Steps 13

Now click a photo of your signature and upload it.

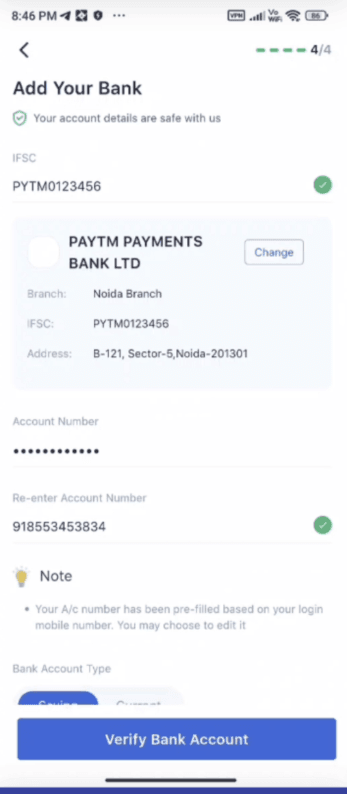

Steps 14

Now enter the IFSC code and your bank account number. Click Verify Bank Account to continue.

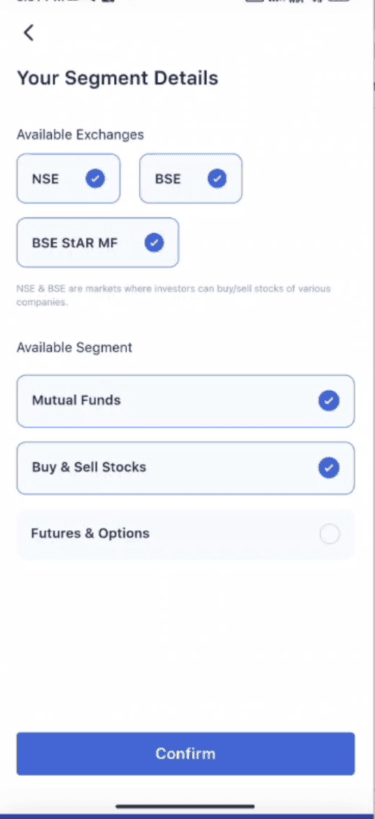

Steps 15

Once you are done uploading your bank details, you will be asked to submit an account opening form. Choose the segments in which you wish to invest or trade-in. Click on Confirm to continue.

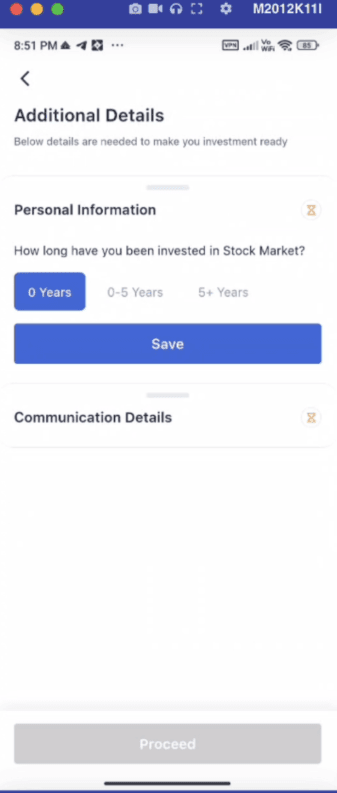

Steps 16

Now you will be asked to add your personal information like your investment in experience in the stock market. Choose according to your respective experience and click on save to continue.

Steps 17

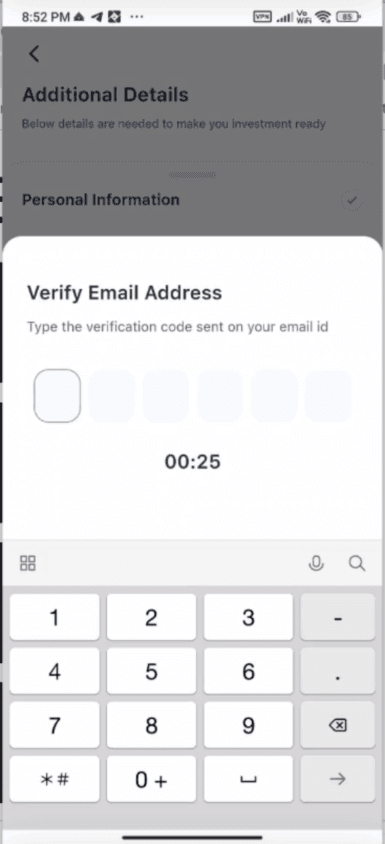

Now enter your mobile number and email address under the Communication Detail tab. You will receive an OTP in your mail for the verification process.

Enter OTP and verify your email address.

Steps 18

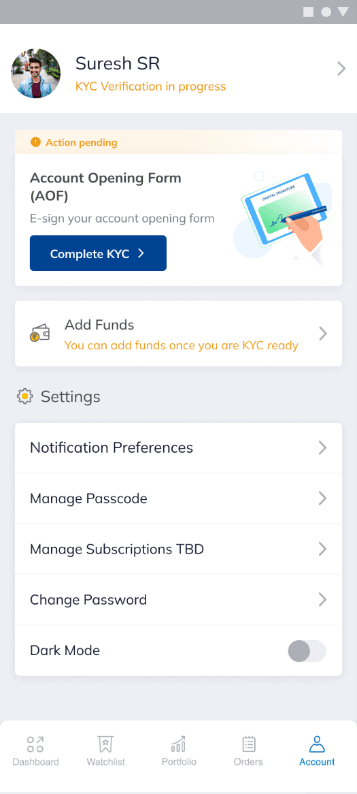

Once you verify your email address, you will be asked to sign an account opening form. Click on ‘Complete KYC’ to e-sign the form.

Steps 19

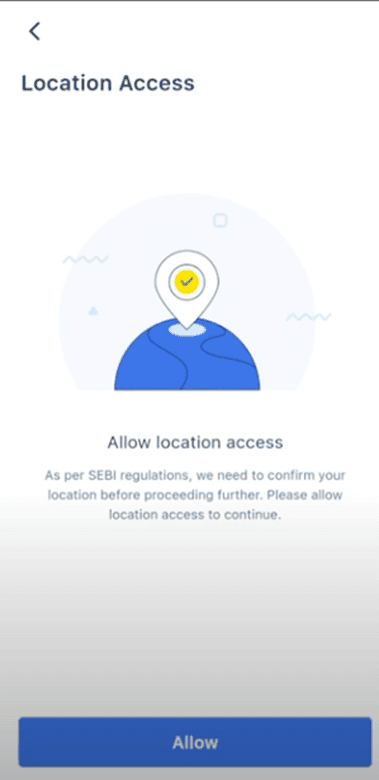

Allow Location Access to process further.

Steps 20

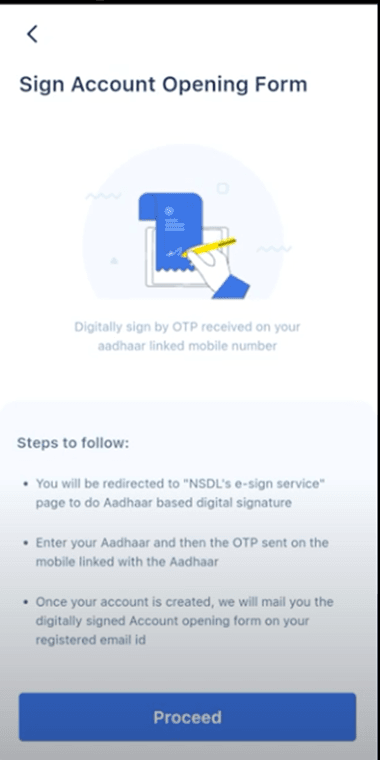

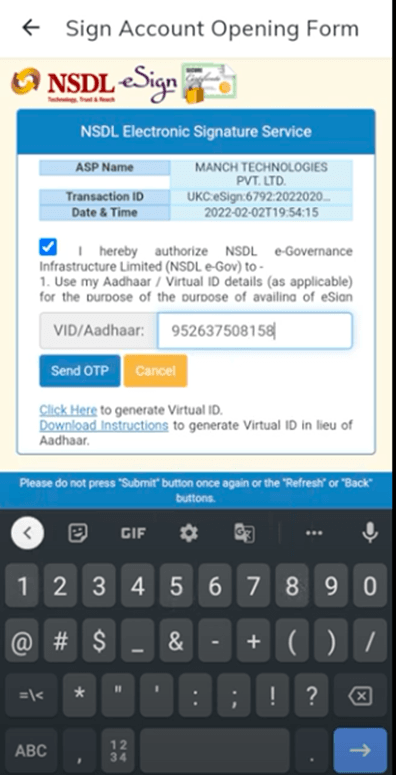

You will be redirected to NSDL’s page for the e-signature process. Click on ‘Proceed’ to continue.

Steps 21

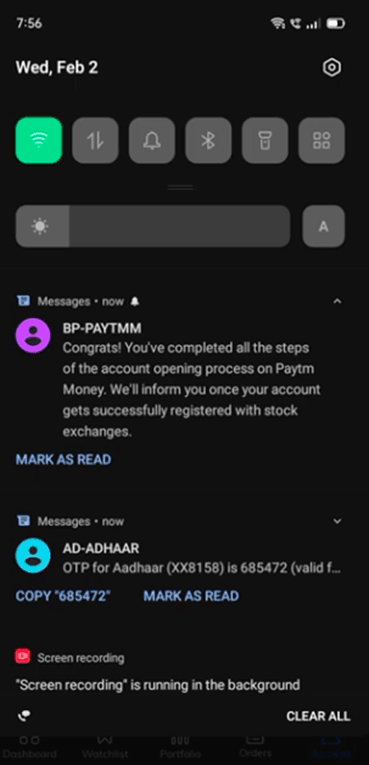

Enter your Aadhar and then the OTP sent on the mobile number linked with Aadhar.

Steps 22

Once your account is created, you will get a digitally signed Account Opening Form on your registered mail id and a text message on your mobile number confirming all the steps completed regarding the account opening process.

Congratulations, you have completed your account opening process. You can download your e-signed documents sent to your registered email id.

It takes 1-2 days to open your account. You can check the status of your application. You will also get the login credentials to your trading account in the welcome mail.