Groww Demat Account Opening Process Step by Step.

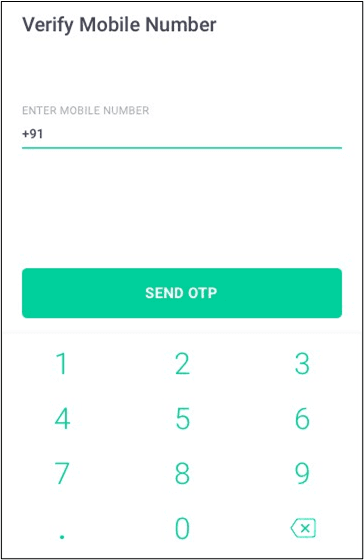

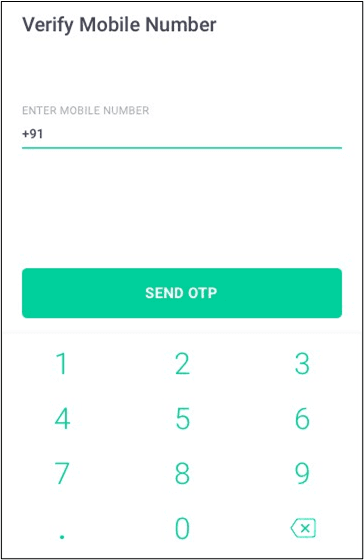

Steps 1

Click on ‘Open Your Account’ to visit Groww and start your account opening process. Enter your mobile number to continue.

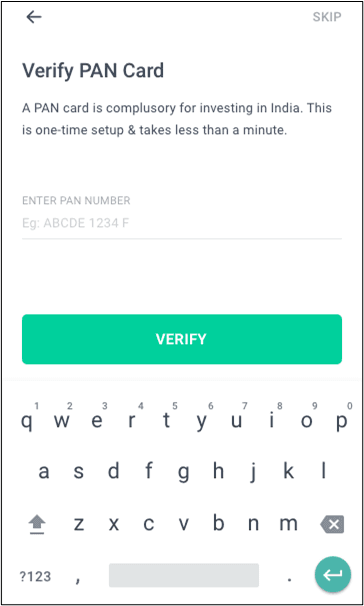

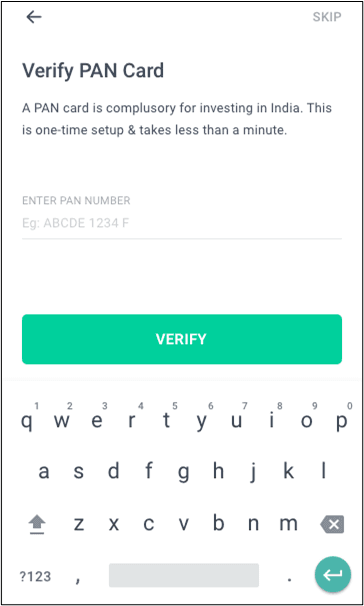

Steps 2

Now enter your PAN number to continue. Click verify to proceed.

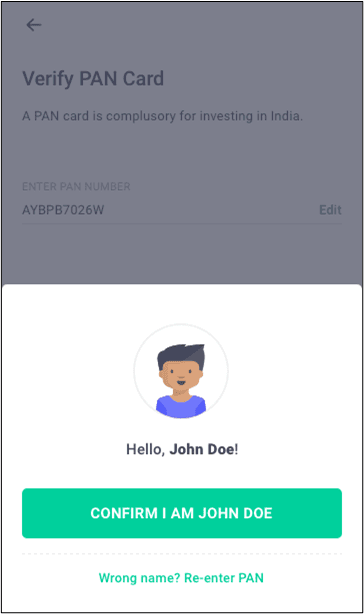

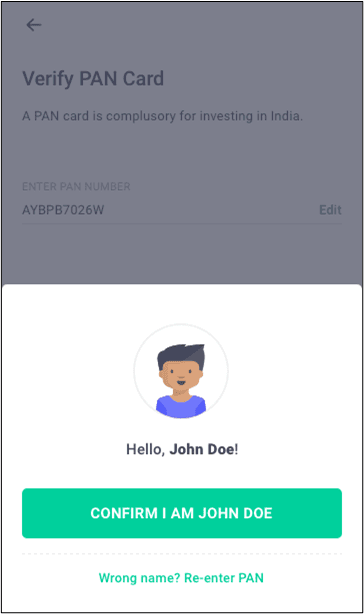

Steps 3

Confirm your identity by clicking the confirm button.

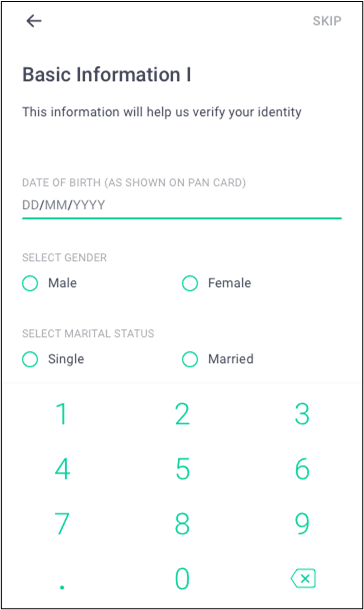

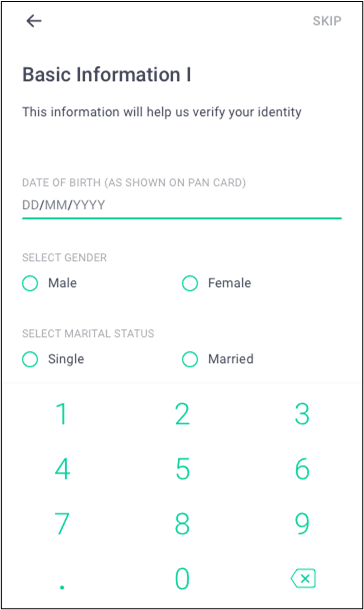

Steps 4

Now enter your Date of Birth, Gender and marital status. Click the next button to continue.

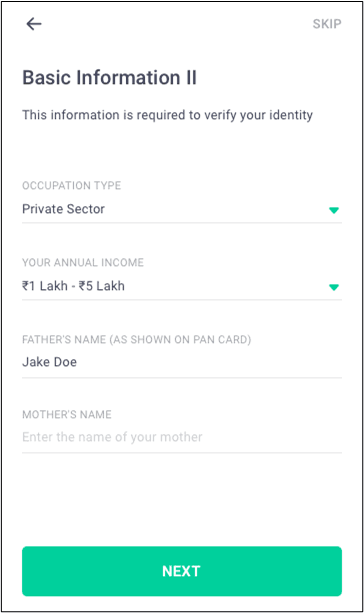

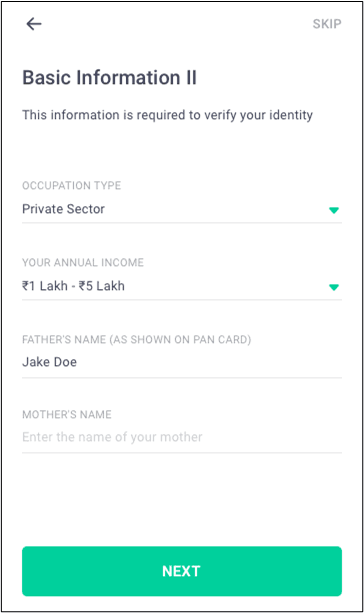

Steps 5

Now enter your Occupation type, annual income and parents name. Click next to continue.

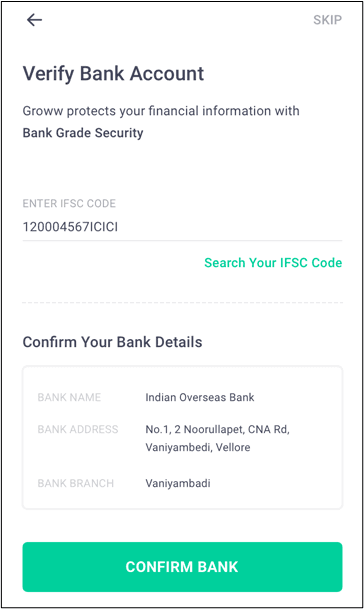

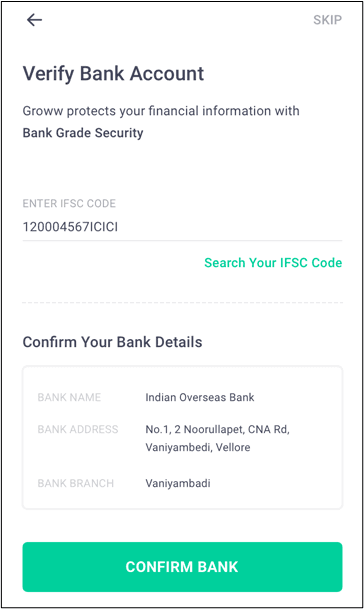

Steps 6

Now enter your bank IFSC Code and wait for the system to detect the branch. Click Confirm bank to continue.

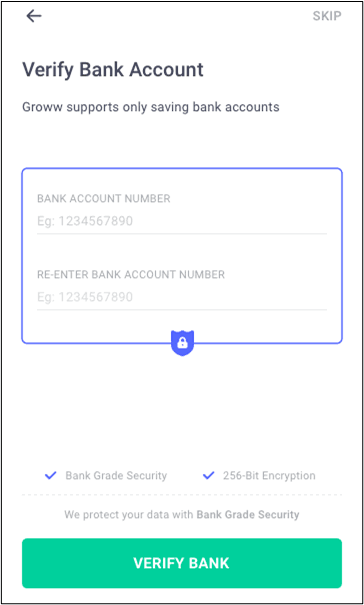

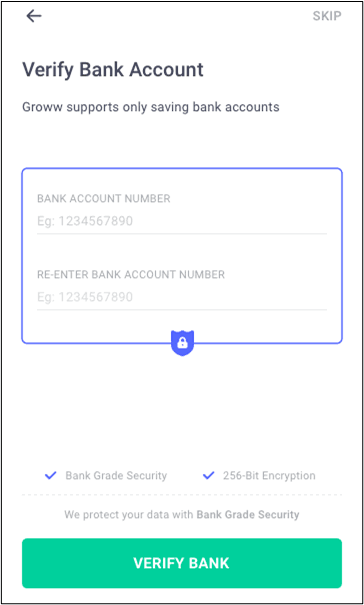

Steps 7

Now enter your bank account number. Re-enter it to confirm the bank account number. Click verify bank to continue.

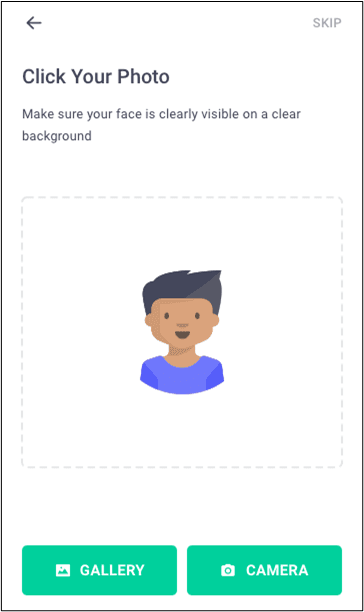

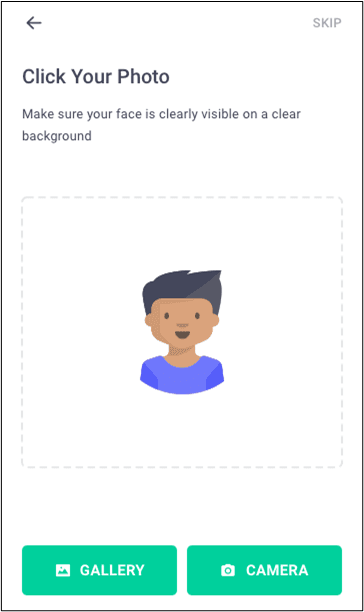

Steps 8

Now click your picture on a clear background. Click the camera button to capture your photo.

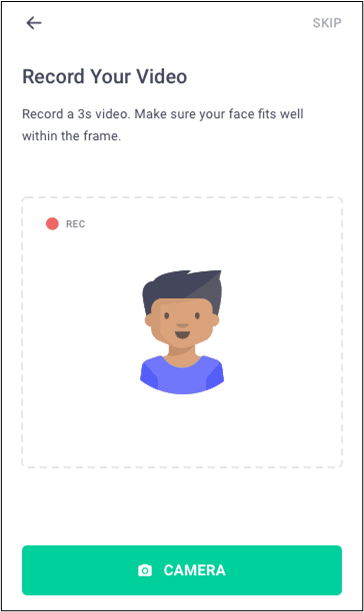

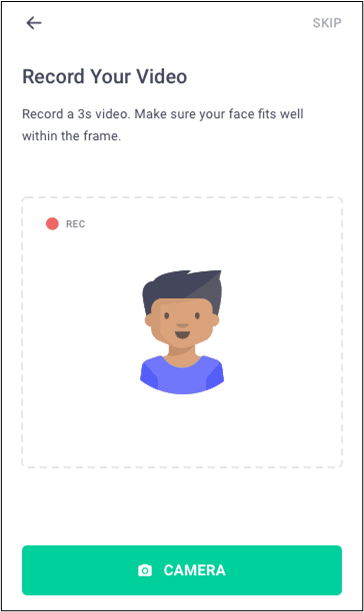

Steps 9

Now you need to record a 3-second video of yourself to do the IPV process. Make sure your face fits within the frame.

Steps 10

Now upload a clear picture of your PAN card. Click the Camera to capture it. You can also upload a scanned image of the PAN card from your gallery.

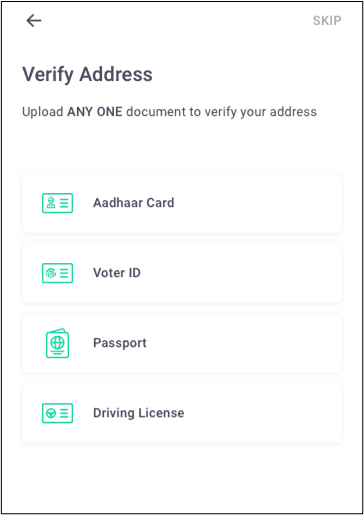

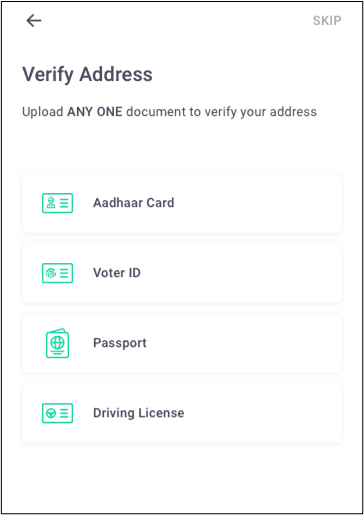

Steps 11

Now verify your address by uploading any one of the documents (Aadhaar card, Voter ID, Passport, Driving License). Click Next to continue.

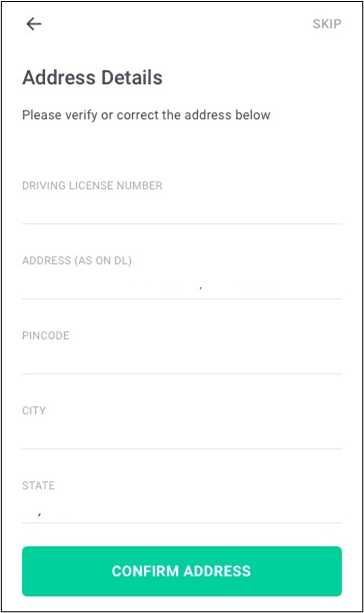

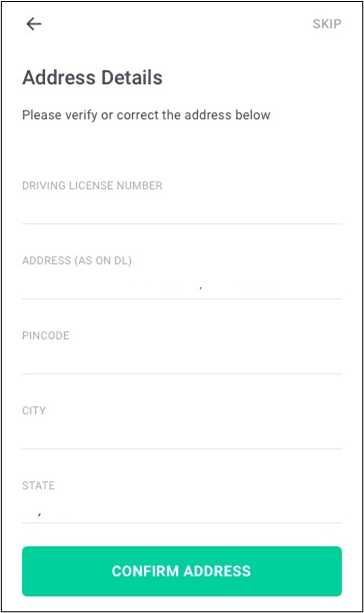

Steps 12

Now enter your same address details which you have mentioned on your uploaded documents.

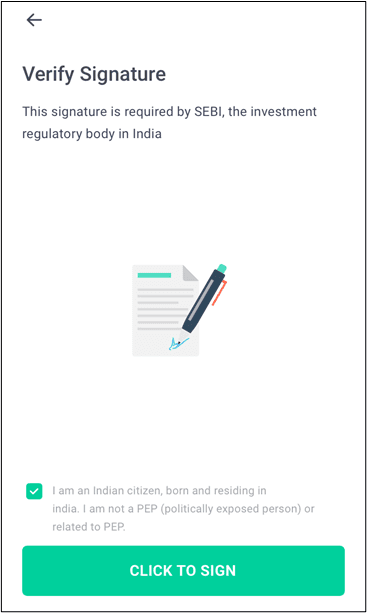

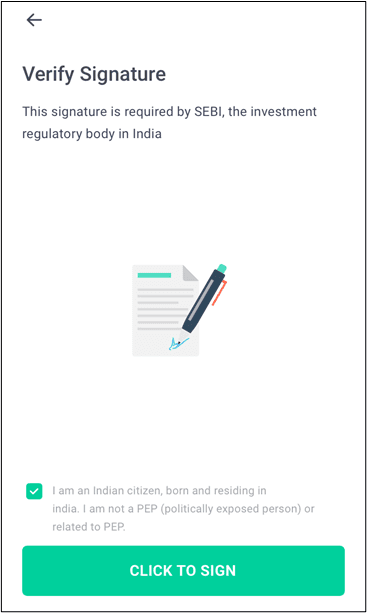

Steps 13

Now you need to upload your signature. Check the declaration box and hit “click to sign button”. You will be welcomed by a screen where you need to sign using your fingers. Click submit. Your account has been successfully created. You can now start trading using the app.