Alice Blue Demat Account Opening Process Step by Step.

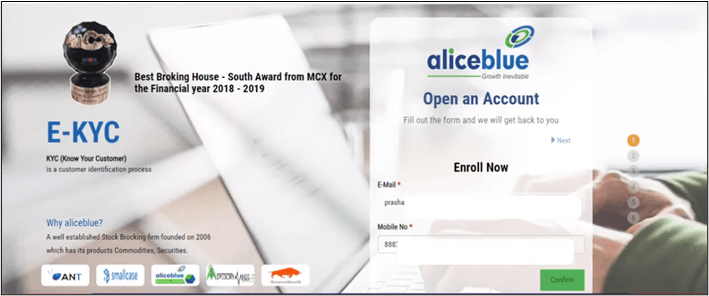

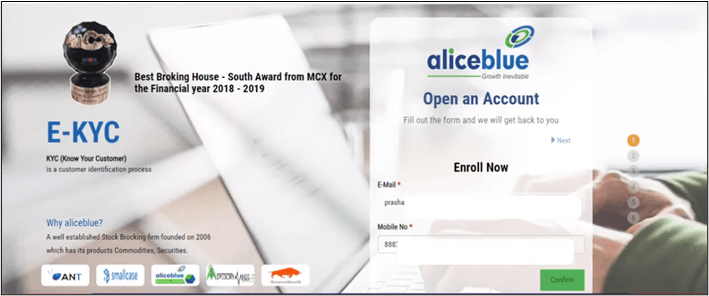

Steps 1

Click on ‘Open Your Account’ to visit Alice Blue and start filling details in the prompt box on the right side of the screen. Click Submit to continue.

Steps 2

Now check the filled in details and if it is incorrect then fill the correct details again. Click confirm to go on the next step.

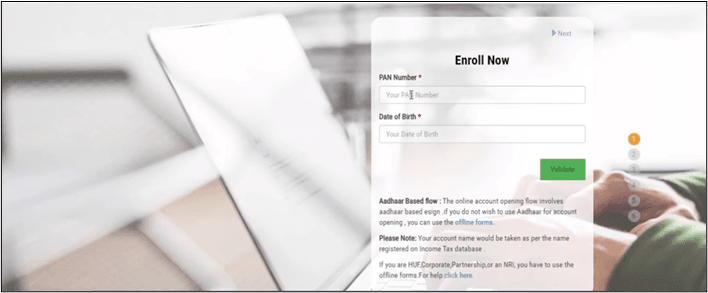

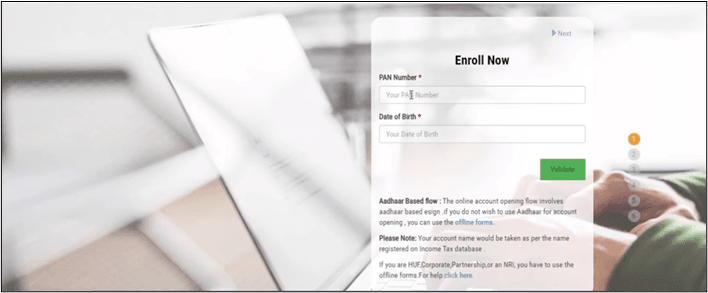

Steps 3

Now, enter the PAN details and Date of Birth. Click Validate to continue..

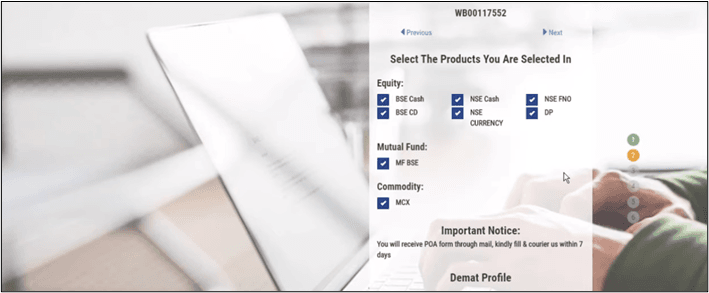

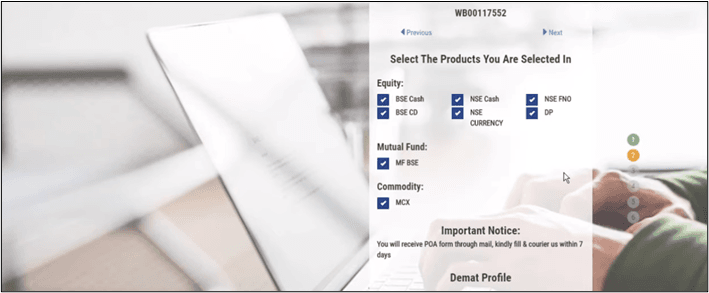

Steps 4

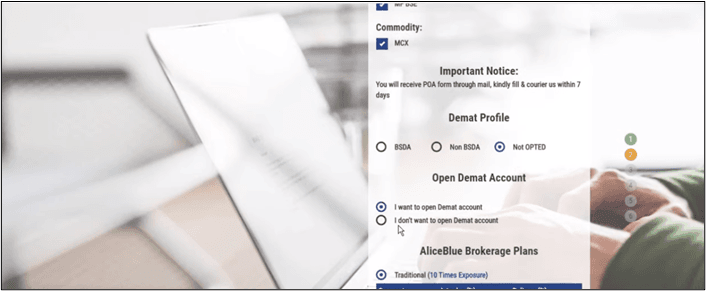

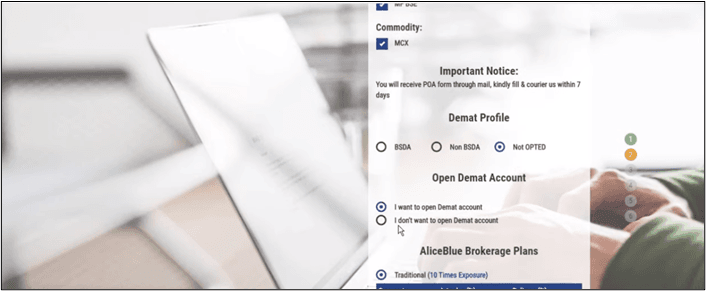

Select the type of securities you want to trade in and scroll down for subsequent details.

Steps 5

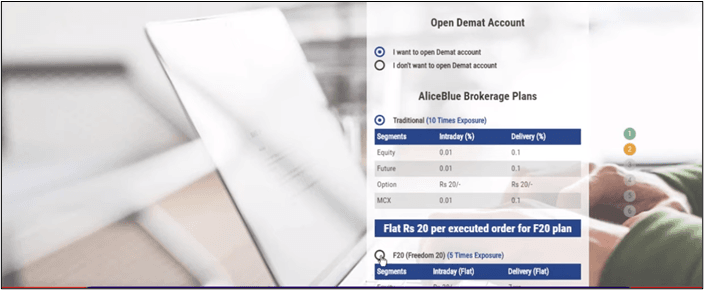

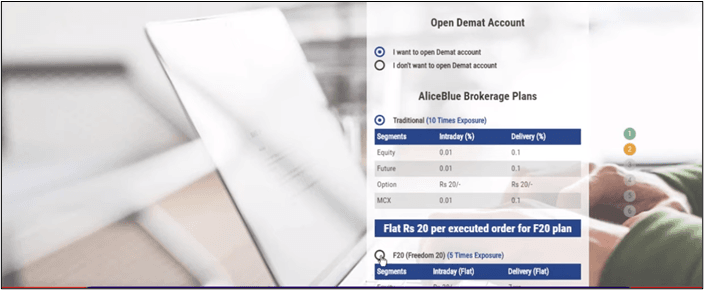

Now, select Not OPTED option in Demat Profile section. Select “I want to open Demat Account” and then select your Brokerage Plan.

Steps 6

Select the F20 plan if you wish to pay less brokerage and click next to continue.

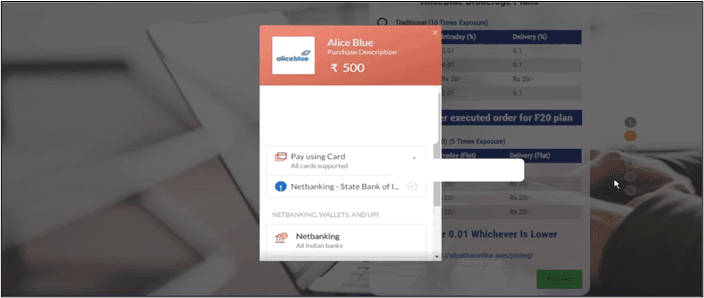

Steps 7

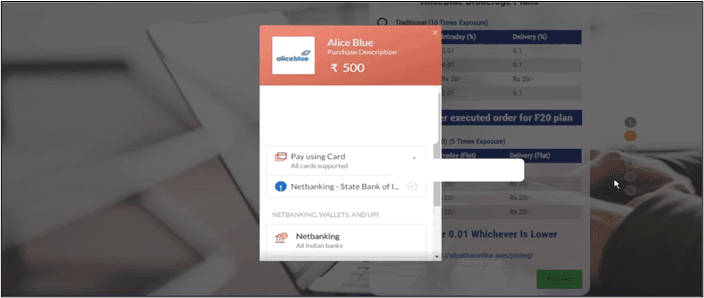

Pay the account opening fee using any of your preferred mediums.

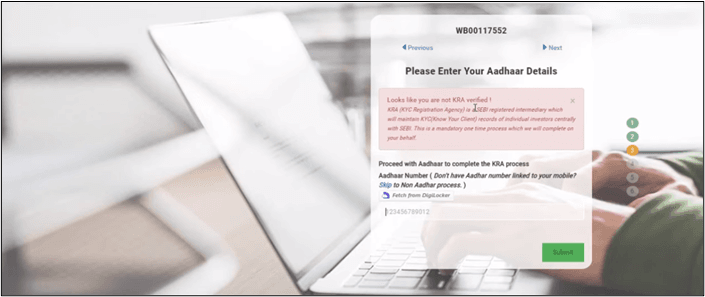

Steps 8

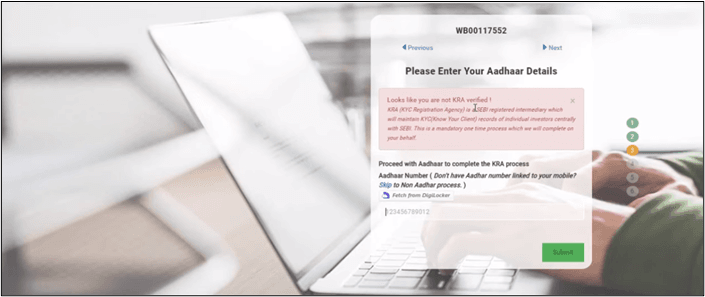

Now enter your aadhaar details to process your application further. Make sure the mobile number linked with Aadhaar card is active. Verify the aadhaar details by entering the OTP received.

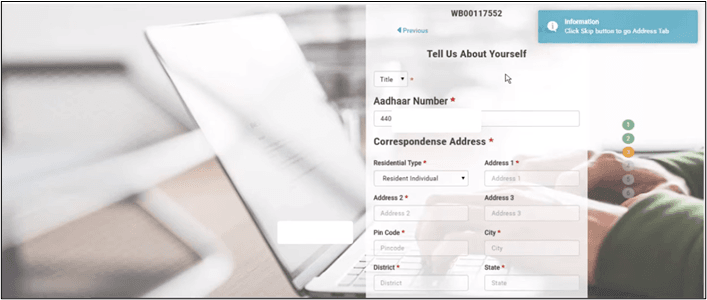

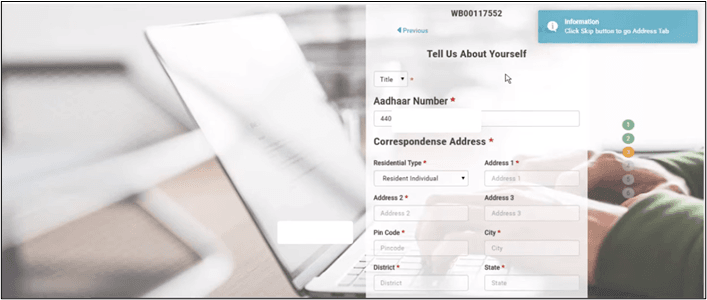

Steps 9

Now enter details about yourself which include your address and name. Click next to continue

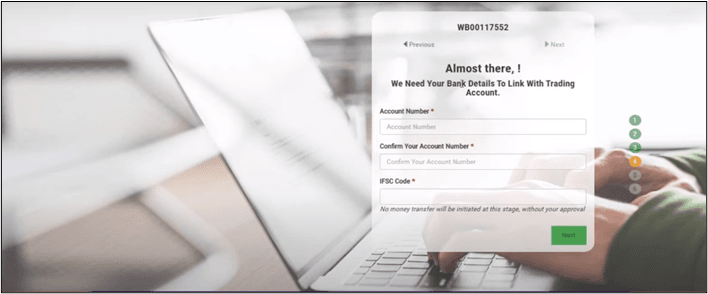

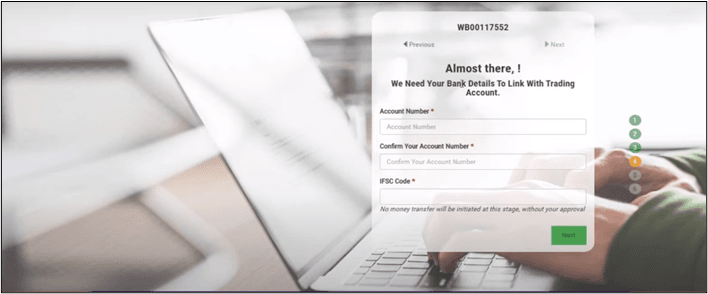

Steps 10

Now, enter your bank account details and click next to proceed.

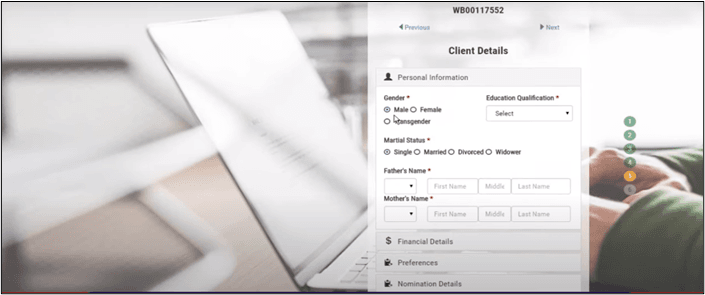

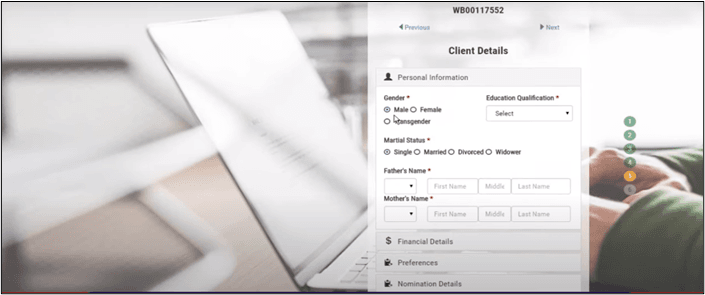

Steps 11

Here you will have to provide some more details about yourself. Select yes, if you wish to nominate someone else to your Demat account in the Nomination Details section.

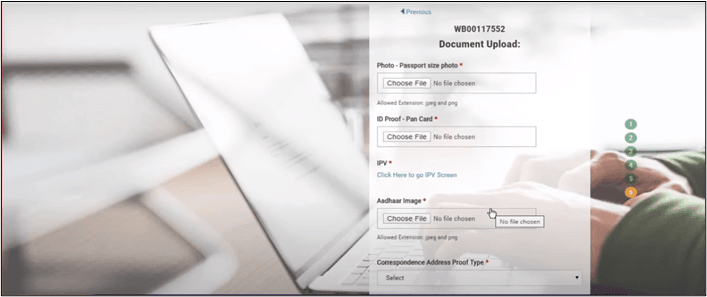

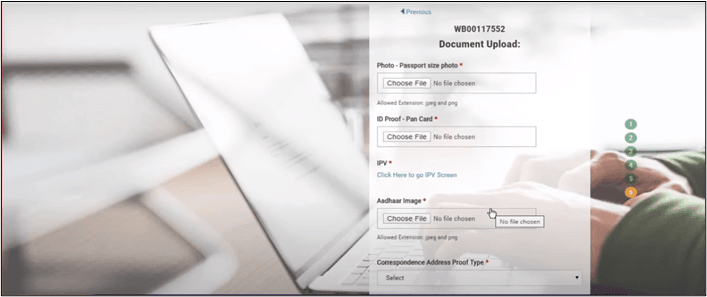

Steps 12

Upload the scanned of your documents. Use your Aadhaar card as the ID Proof.

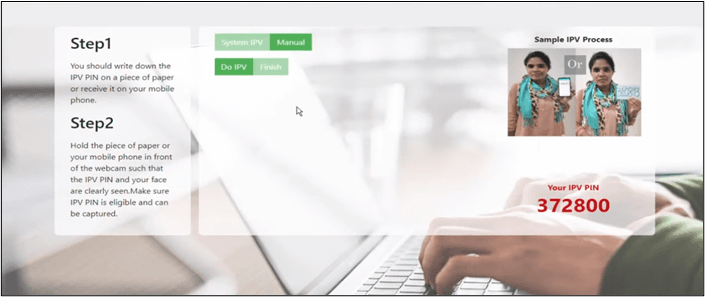

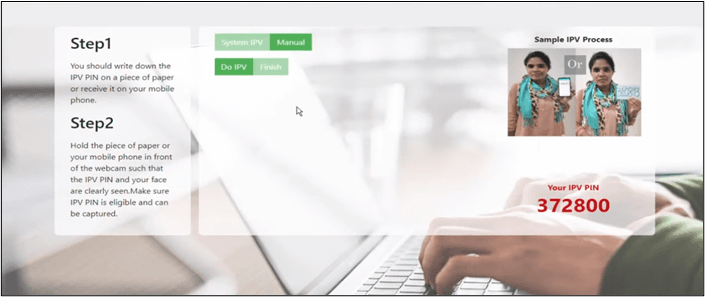

Steps 13

For IPV Process you can either do it manually or by System. For manual write down the IPV PIN on a white piece of paper and if doing it by system, hold your mobile phone with the received pin, in front of the camera after clicking Do IPV button. Now select the finish button to complete the IPV process.

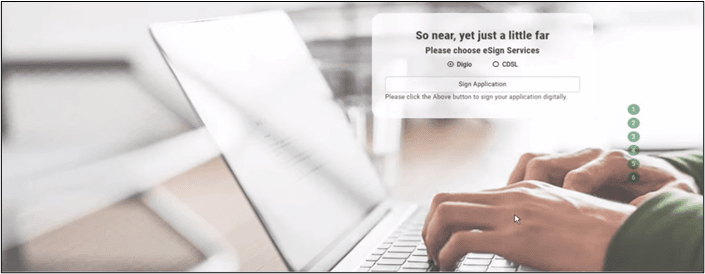

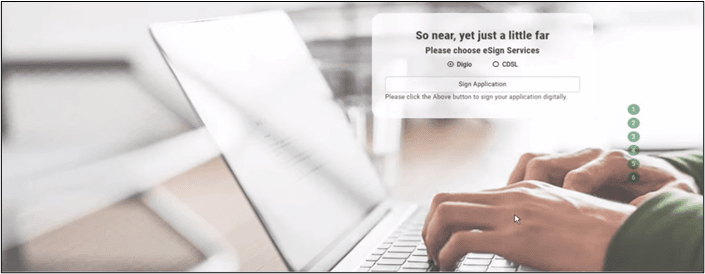

Steps 14

Now choose your preferred e-Sign service to validate the eKYC process. You will be asked to enter your aadhaar card and verify it after receiving the OTP.

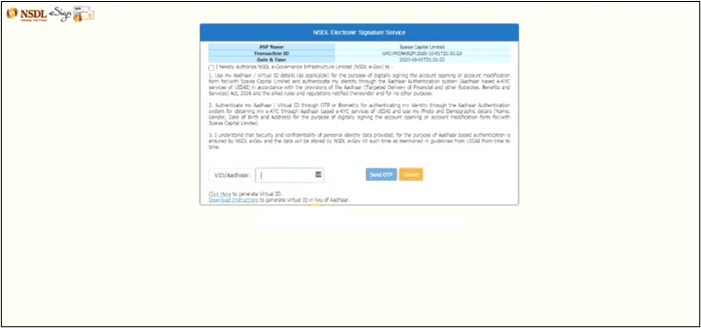

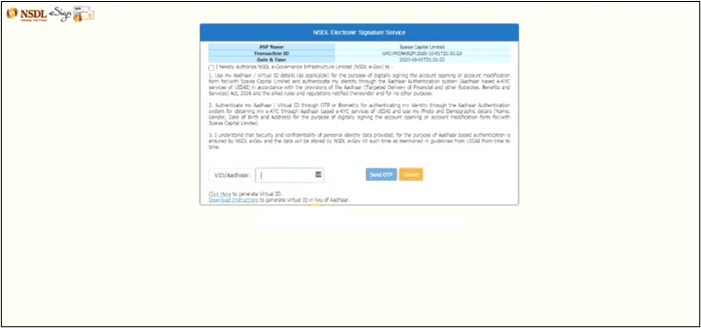

Steps 15

To e-Sign in with your depository, you need to verify your aadhaar number again. Click send OTP after entering your Aadhaar number.

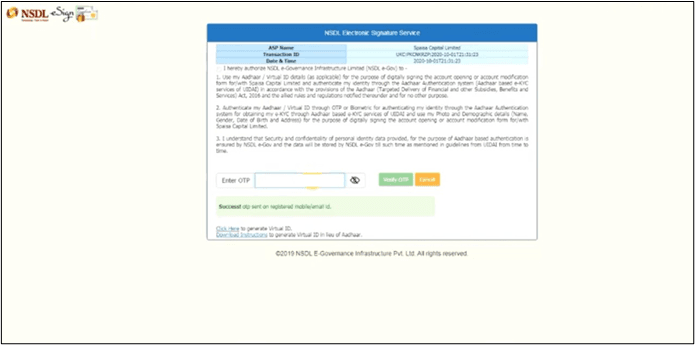

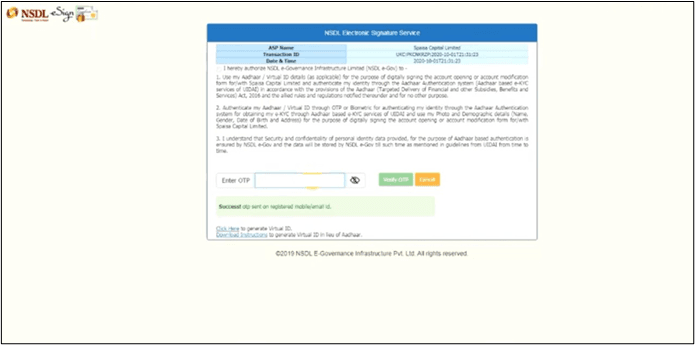

Steps 16

Enter OTP to further verify it. Click verify OTP to complete your application.

Steps 17

You will be redirected to the finish page where you can download your filled in application form. Your account has been created and will be activated in the next 24 hours after your application has been further processed.