Anand Rathi Demat Account Opening Process Step by Step.

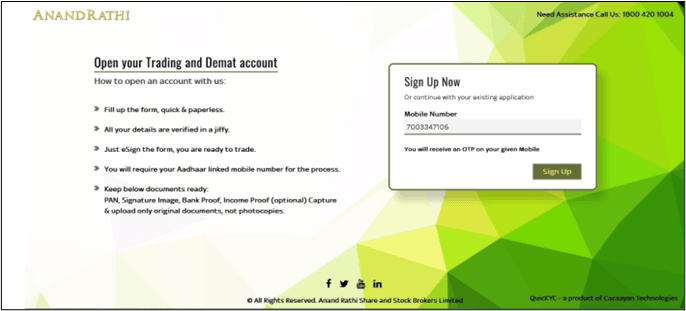

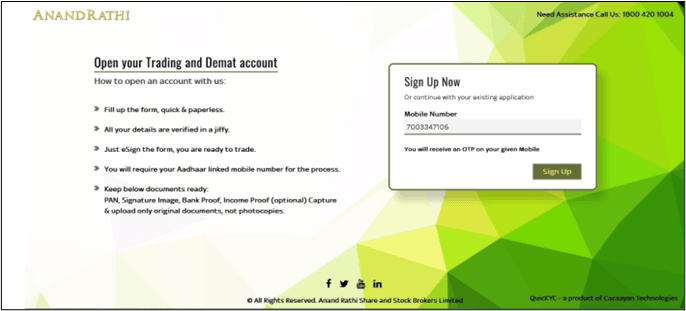

Steps 1

Click on ‘Open Your Account’ to visit Anand Rathi and start your account opening process. Enter the mobile number and click the sign-up button to continue.

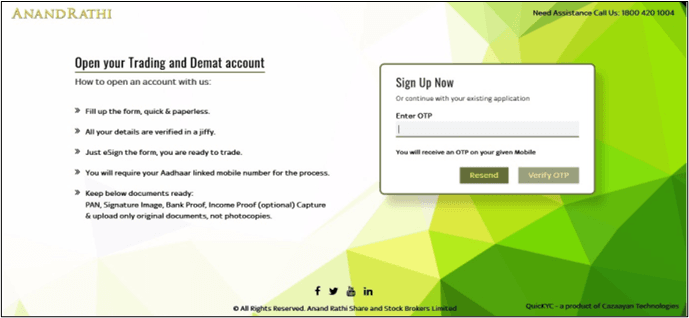

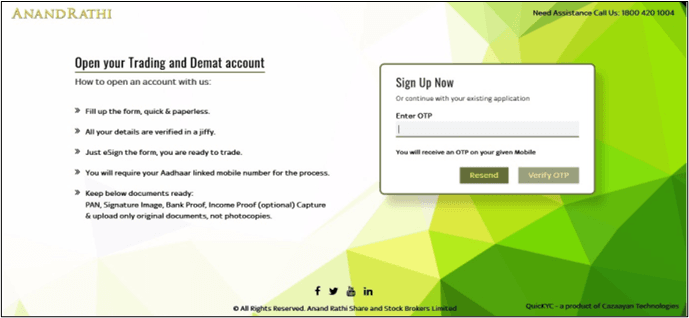

Steps 2

Enter the OTP received on your mobile number. Click Verify OTP to proceed further.

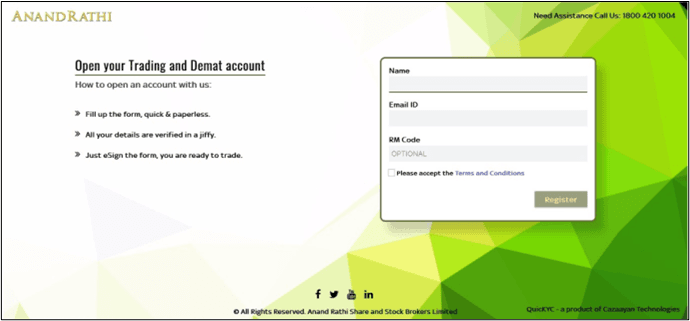

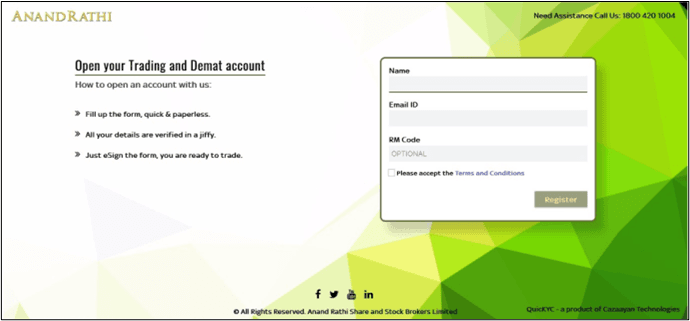

Steps 3

Enter the name, Email id and check the declaration box. Click Register to continue.

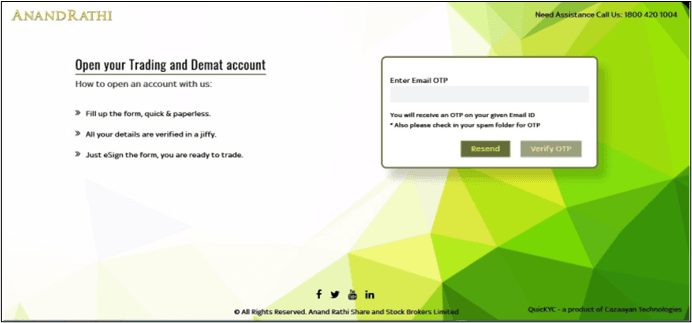

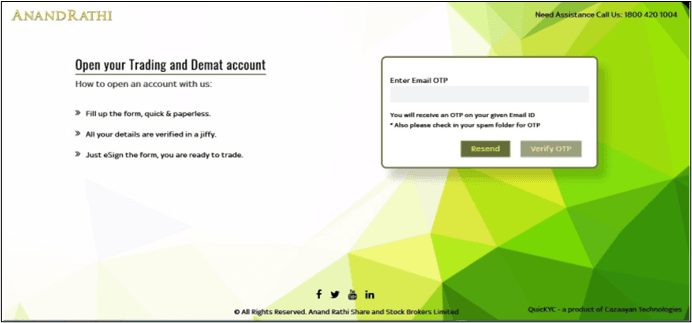

Steps 4

Now enter the OTP received on your email id. Click Verify OTP to continue.

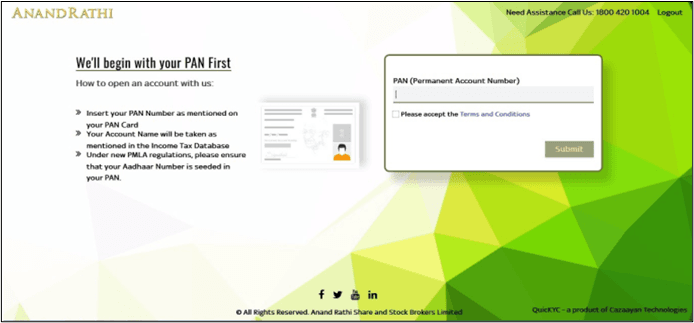

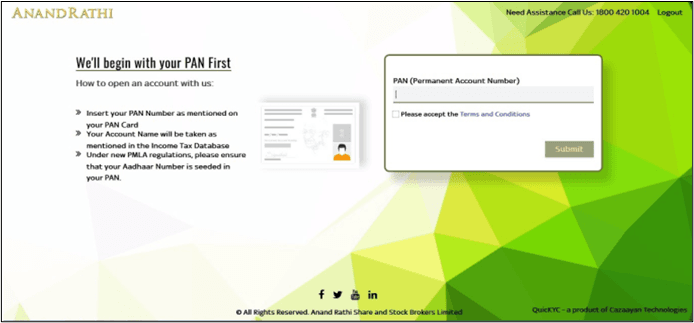

Steps 5

Enter the PAN number, check the declaration box and click the Submit button to continue.

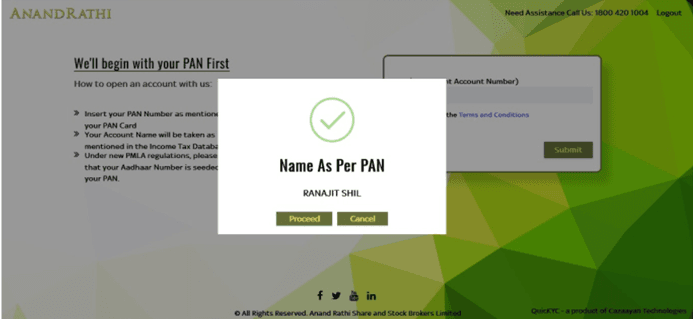

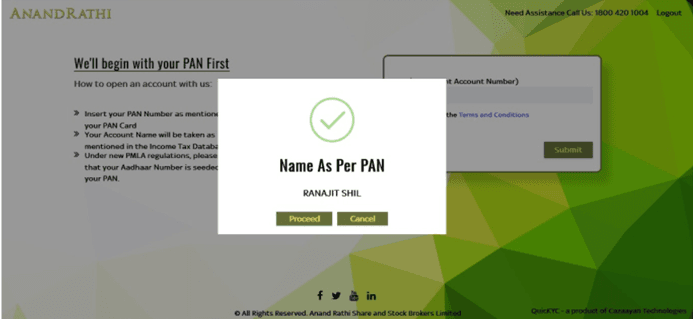

Steps 6

Now click proceed to continue if the name matches the PAN card details you entered.

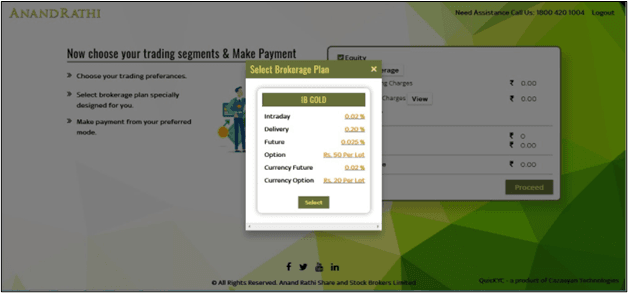

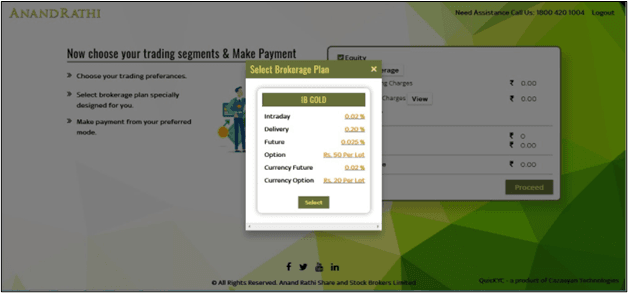

Steps 7

Select the brokerage plan as per your convenience. Press the select button to continue

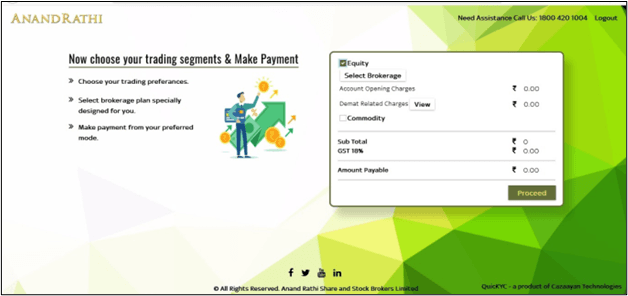

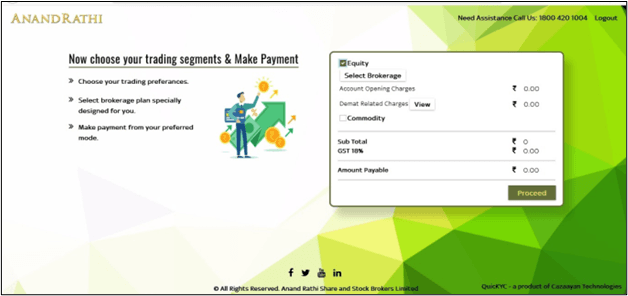

Steps 8

Select the segments you wish to trade in and click the proceed button for further process.

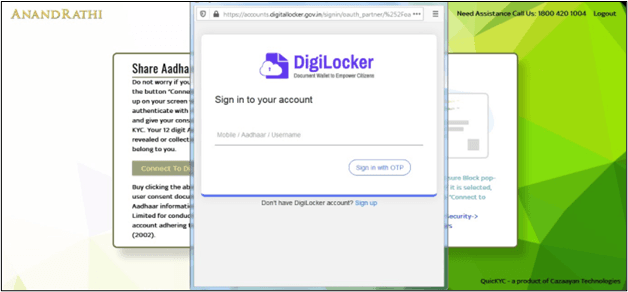

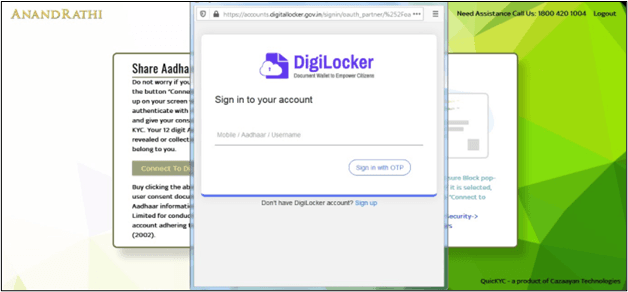

Steps 9

Now click Connect to Digilocker button to allow Anand Rathi brokerage to get access to your address proof.

Steps 10

Enter the mobile number / Aadhaar details to sign in to your Digilocker account. Click Sign in with OTP.

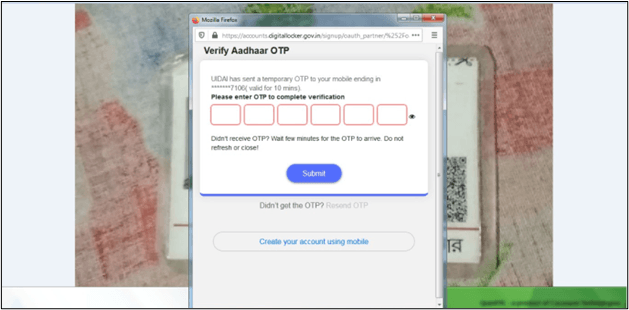

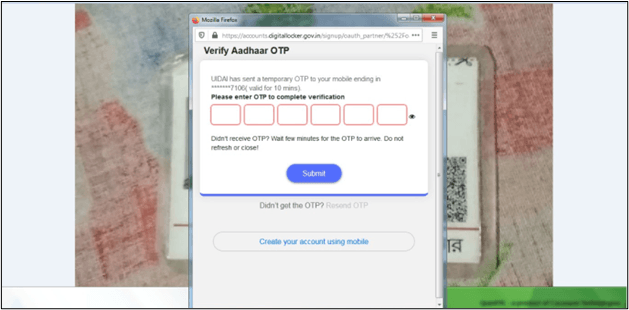

Steps 11

Enter the OTP received on your registered mobile number. Click Submit to continue.

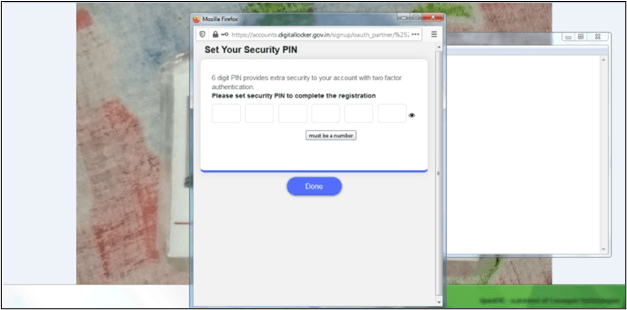

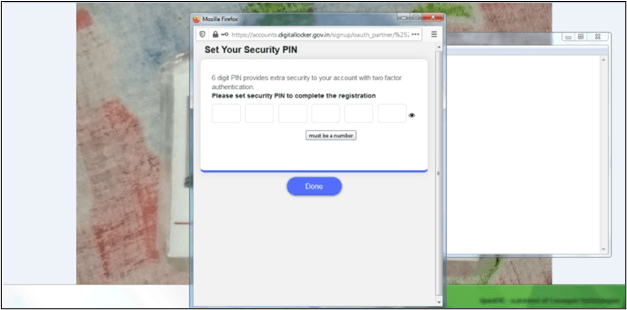

Steps 12

Now enter the security pin to log-in to your account. Click done to continue.

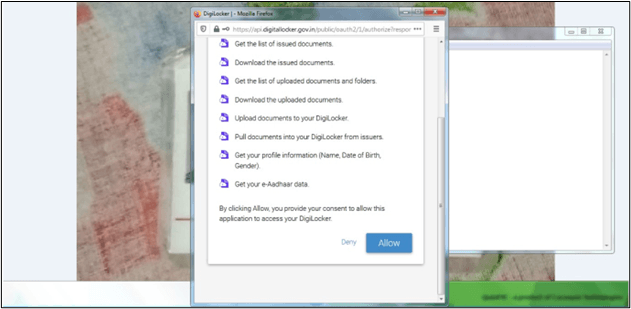

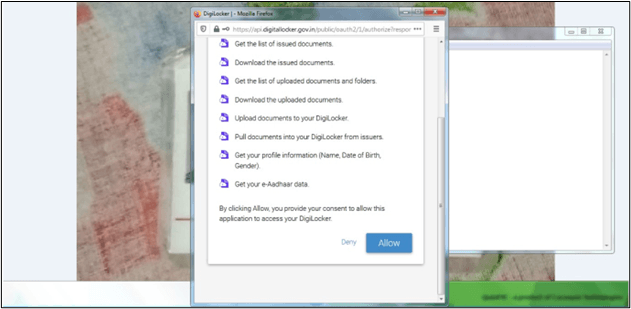

Steps 13

Now click the allow button to continue. This would allow Digilocker to share your address proof with Anand Rathi.

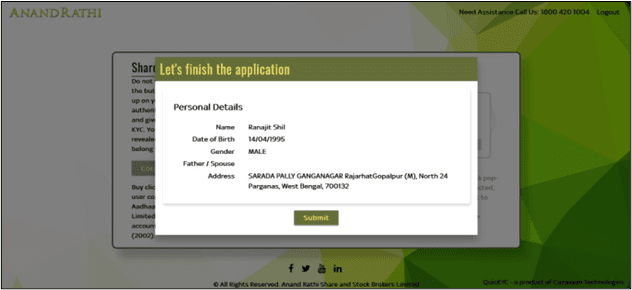

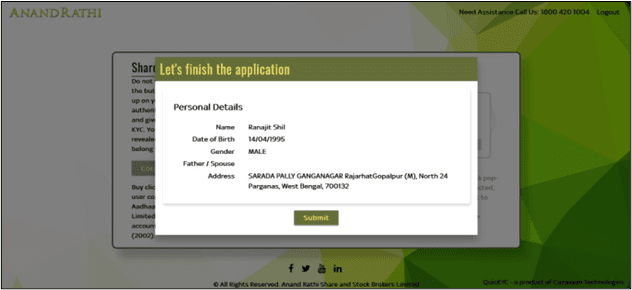

Steps 14

Check your personal details and click the Submit button once the details entered are correct.

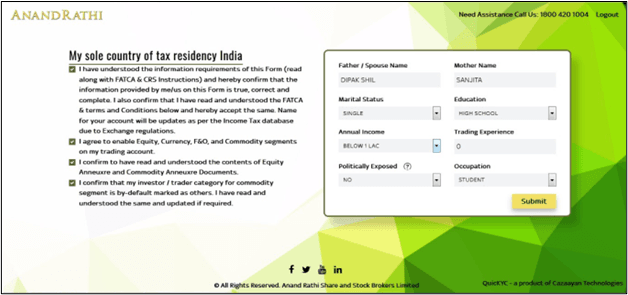

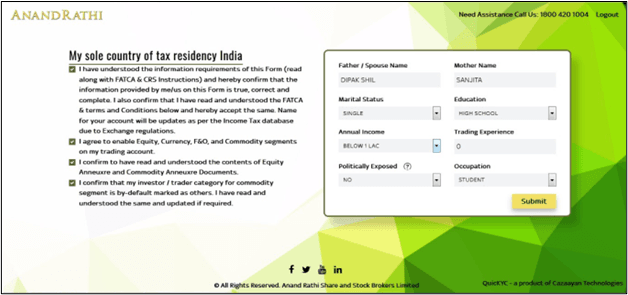

Steps 15

Check all the declaration boxes and enter your details which includes your parent details, Annual income, trading experience etc.

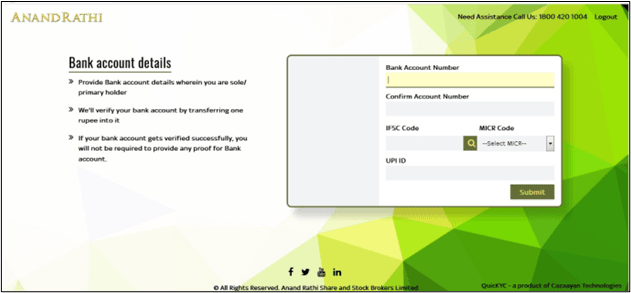

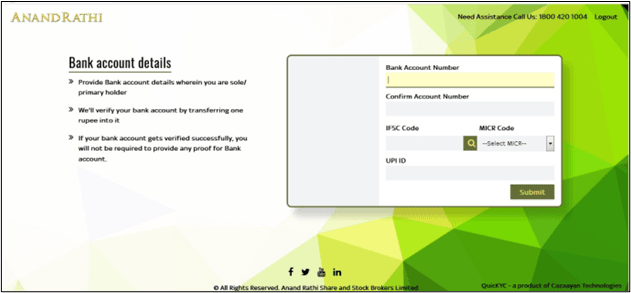

Steps 16

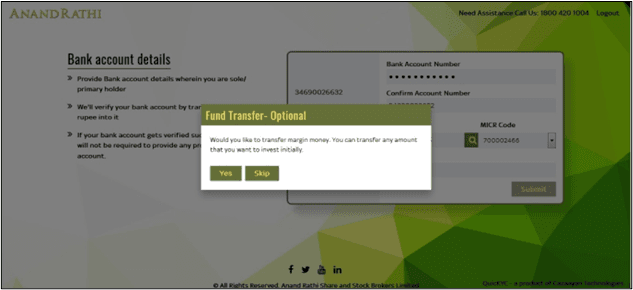

Enter your bank account details and click submit to continue.

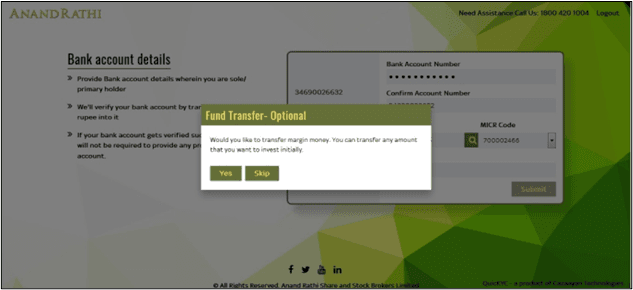

Steps 17

You can add some initial funds as a margin to your account. You can skip this step as this is optional.

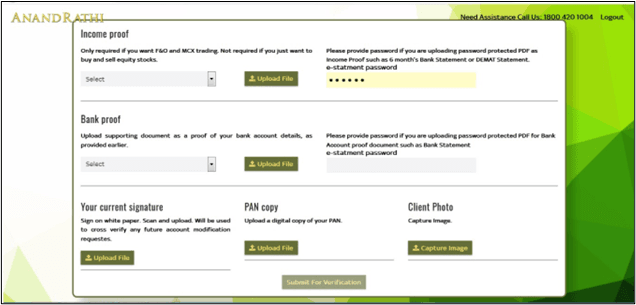

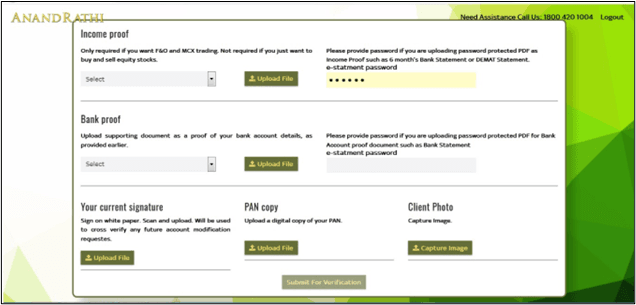

Steps 18

Now upload your document which includes Income Proof, Bank Proof, Current signature, Scanned copy of PAN card and your photo. Click Submit for Verification to continue.

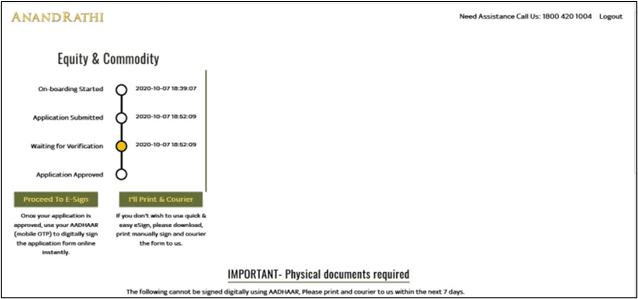

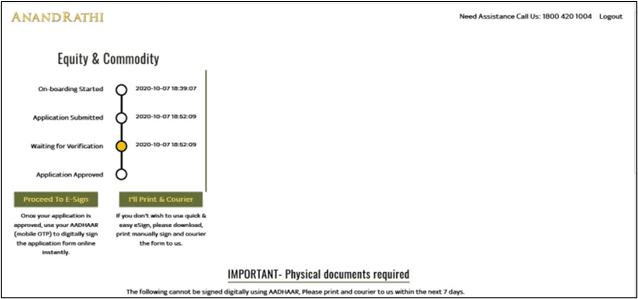

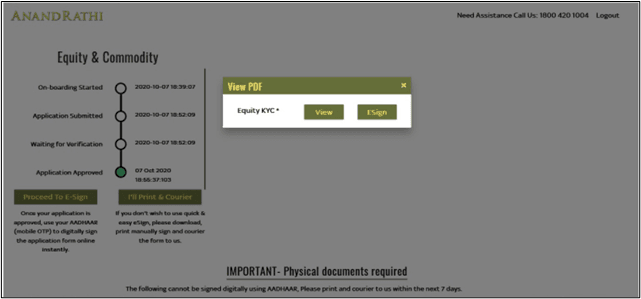

Steps 19

Now click proceed to E-sign to complete your KYC process.

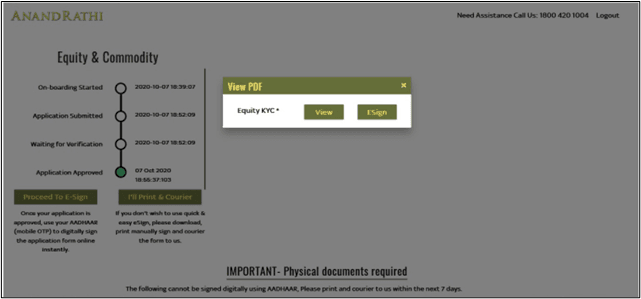

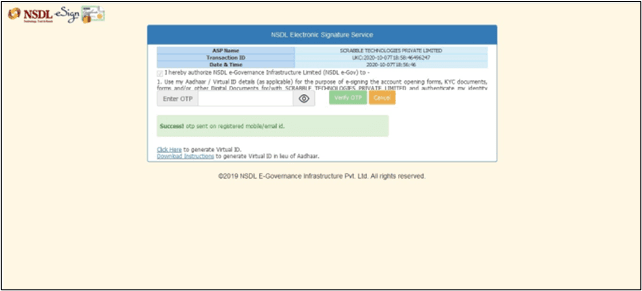

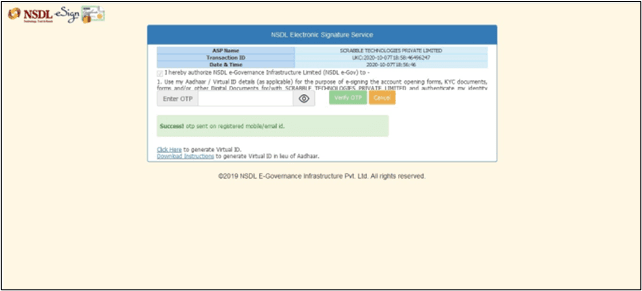

Steps 20

Click the E-sign button to continue. You may also view your document.

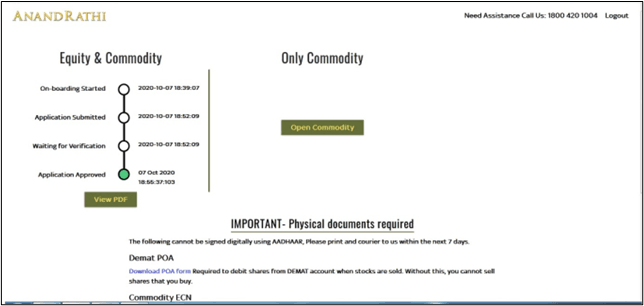

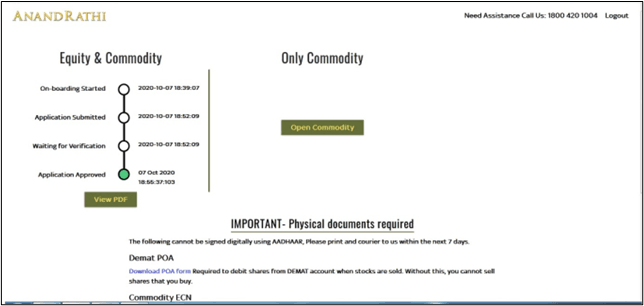

Steps 21

You will be redirected to the finish page where you can download your filled in application form. Your account has been created and will be activated in the next 24 hours after your application has been further processed.

Steps 22

You would receive a welcome mail from the broker containing login credentials to your trading account in the next 24-48 hours of submission of your application.