Axis Direct Demat Account Opening Process Step by Step.

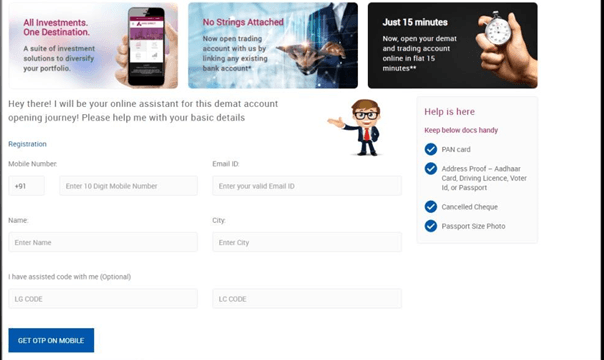

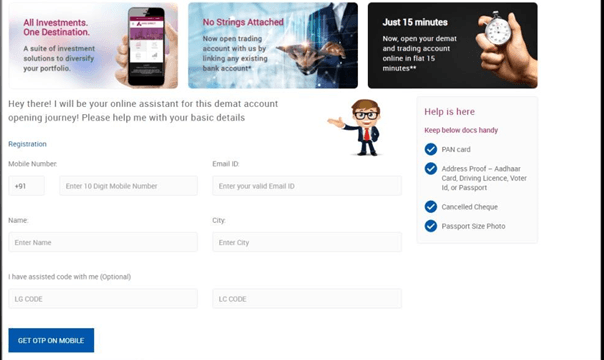

Steps 1

Click on ‘Open Your Account’ to visit Axis Direct and start your account opening process. Enter your mobile number and other details to get the OTP. Check the declaration box and click get OTP on mobile to continue.

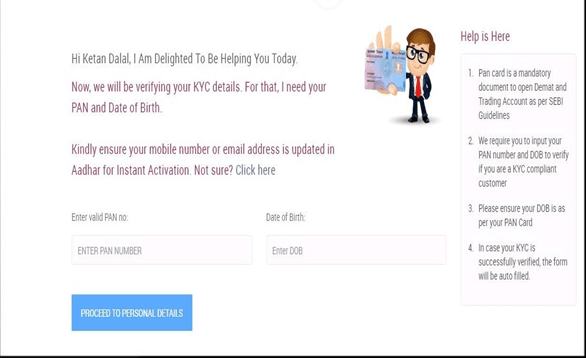

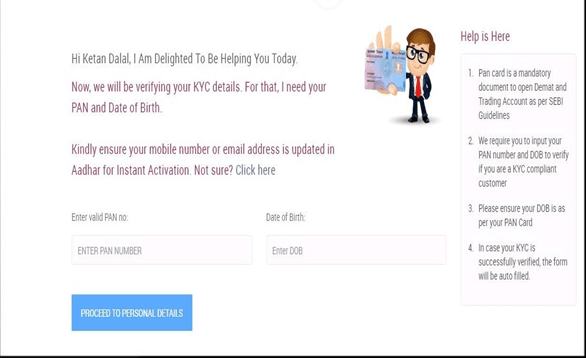

Steps 2

Enter your PAN Card details, date of birth and click to proceed further.

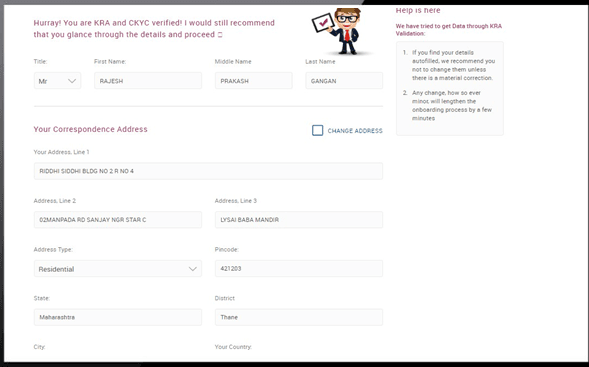

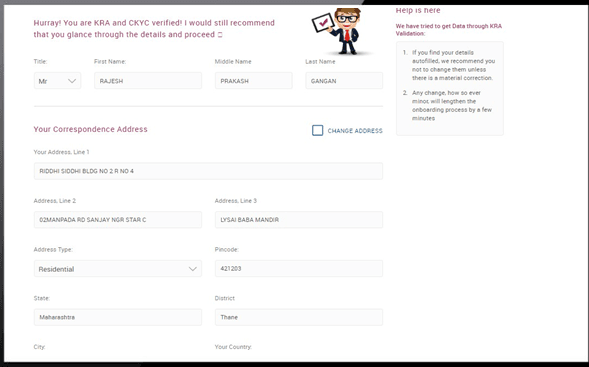

Steps 3

Now you need to enter the address details as per your Aadhar card and click proceed.

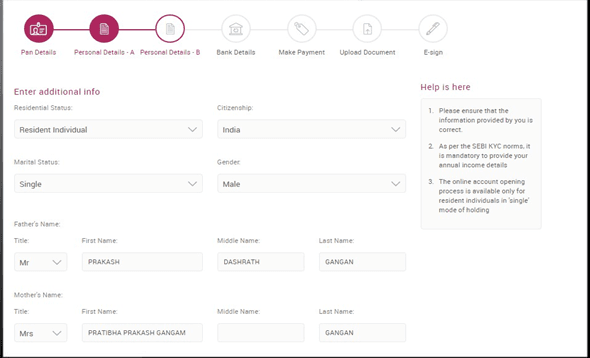

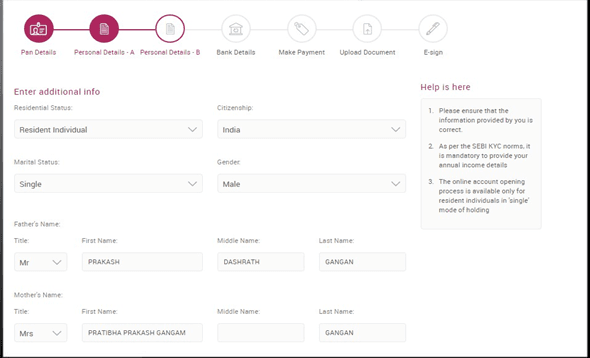

Steps 4

Now fill in the other required details in the specified format. Click on Proceed to Bank Details to continue.

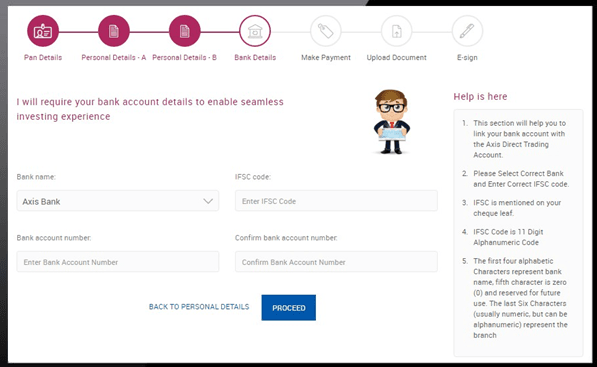

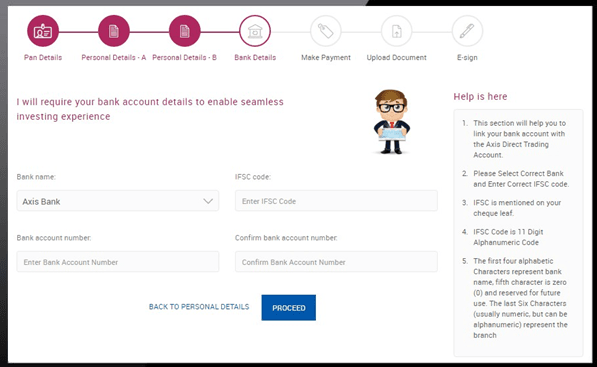

Steps 5

Now, select the default bank name to be linked, enter details like Account number & IFSC code you want to link with your Demat account. Click to Proceed to select the Plans and Segment you want to register.

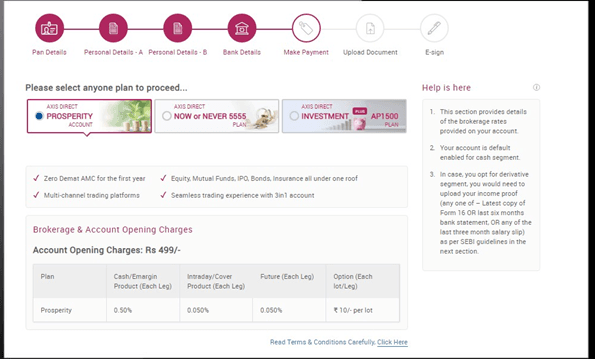

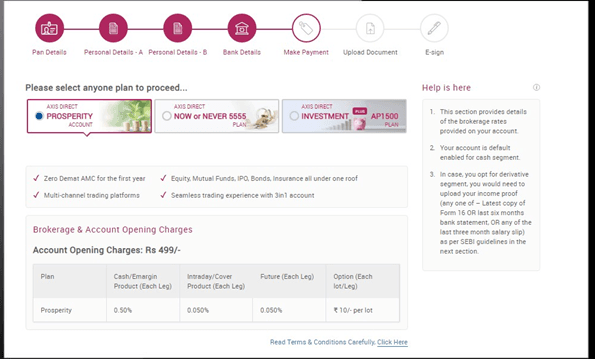

Steps 6

Choose any one of the available brokerage plans & select the segments to be enabled for trading.

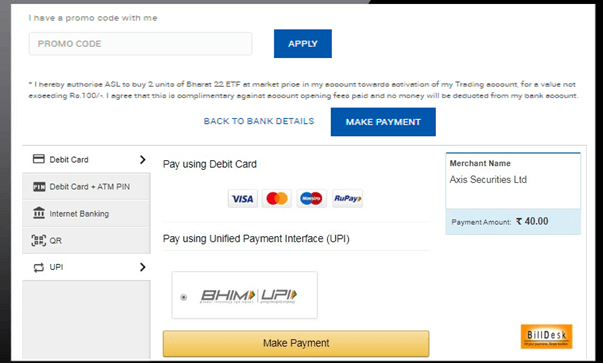

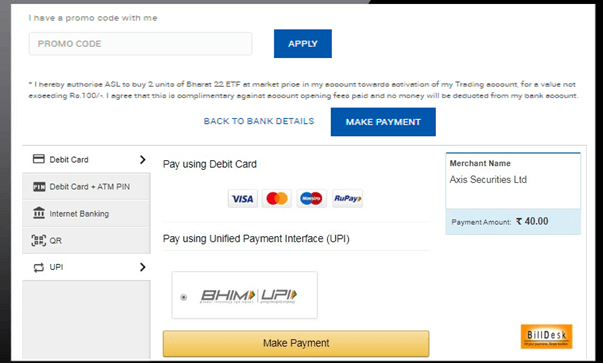

Steps 7

Now Click on “Make Payment” to make an instant payment using any of the available options.

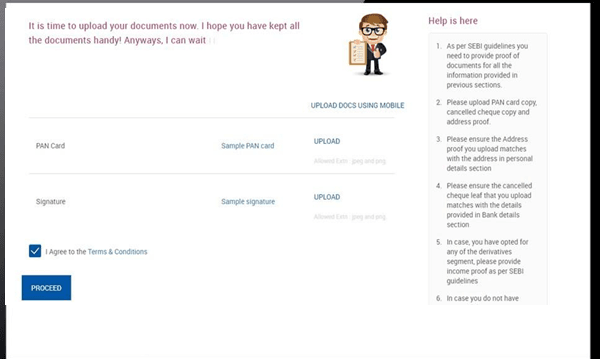

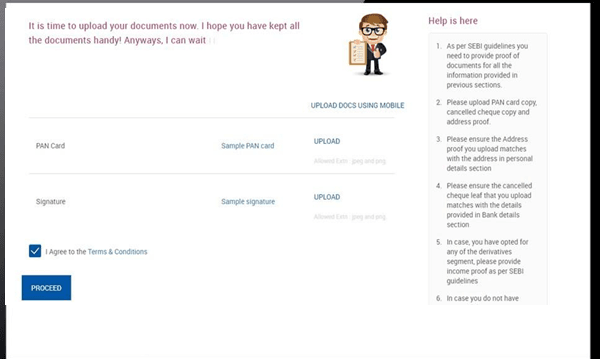

Steps 8

In case your “CKYC Verified,” the documents would be auto fetched i.e., those available with CKYC. If not CKYC Verified, KYC documents would need to be uploaded as per the requirements.

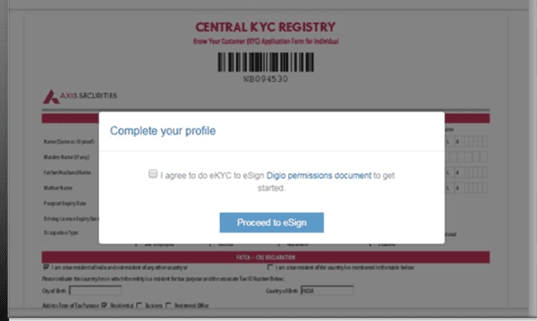

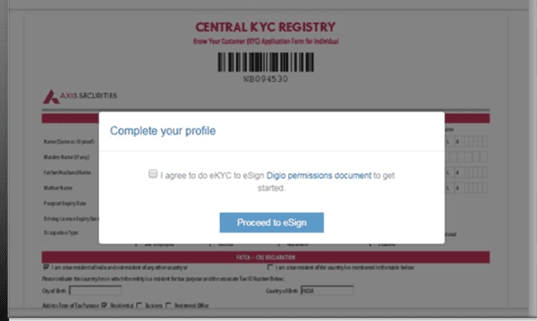

Steps 9

In the next step, you will be redirected to the e-sign process where you will be using the Aadhaar Authentication option. You will receive an OTP on the Aadhaar linked mobile. In case the mobile number is not linked with Aadhaar, you would need to submit a physical Account Opening Form. Now click on the Sign now button.

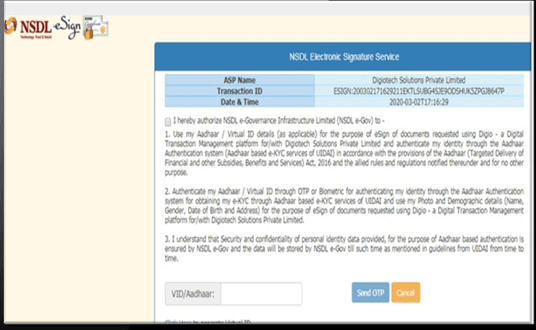

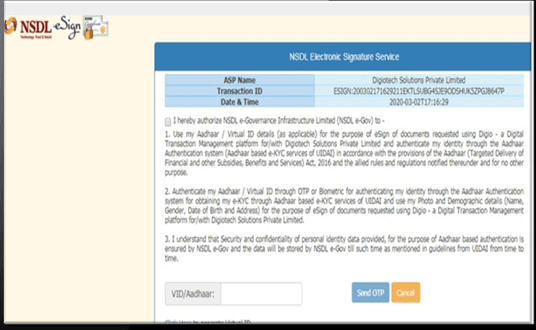

Steps 10

Enter your Aadhaar number in order to receive OTP. Click on the Send OTP button to continue.

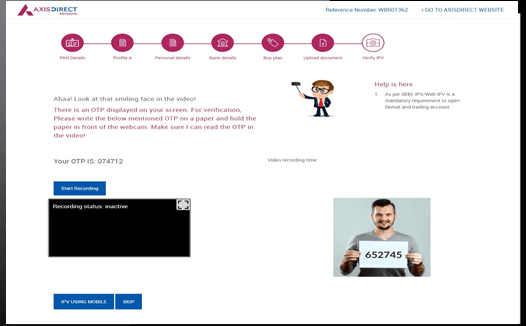

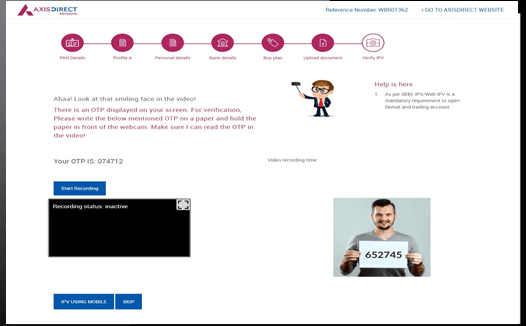

Steps 11

Last step IPV, can be done in one of the 2 ways,

VIPV – write the OTP displayed on the screen and hold the paper in front of the webcam. OTP & face should be clearly visible.

Assisted IPV - can be scheduled by the agent through Digital Back Office (DBO)

(IPV is not applicable only if a customer is both -CKYC & KRA verified)

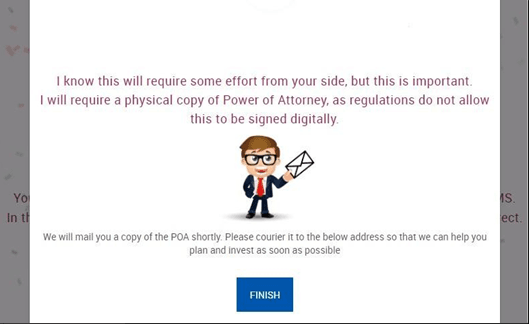

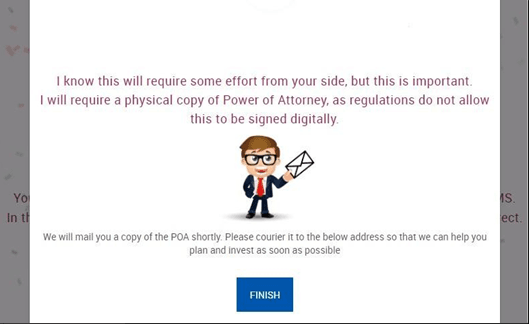

Steps 12

In this step, you can download the POA form sign and courier it to Axis Direct office i.e., (TIO Post Scanning Axis Securities Ltd. 2nd Floor, Centrum,

Phoenix Market City, LBS Marg, Kurla (West), Mumbai 400 070).

And can start investing.