Dhan Account Opening Process Step by Step.

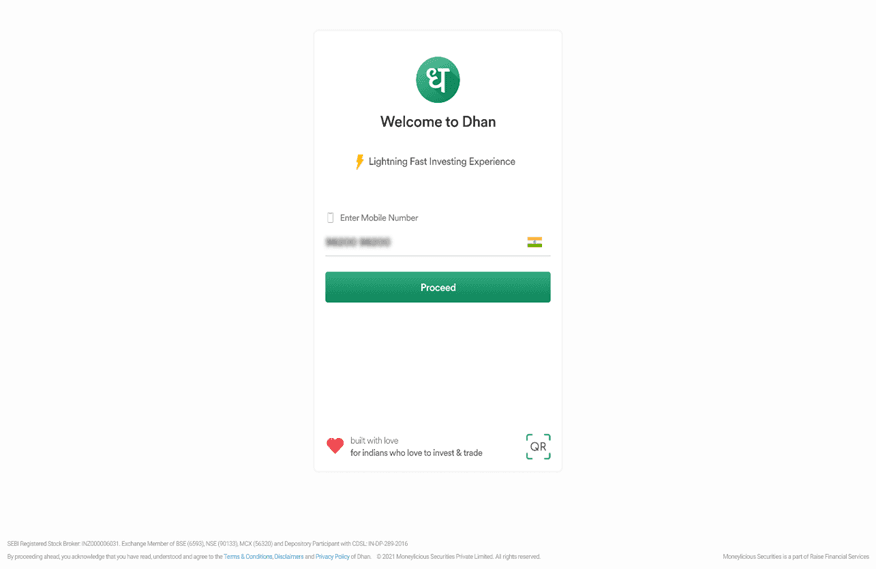

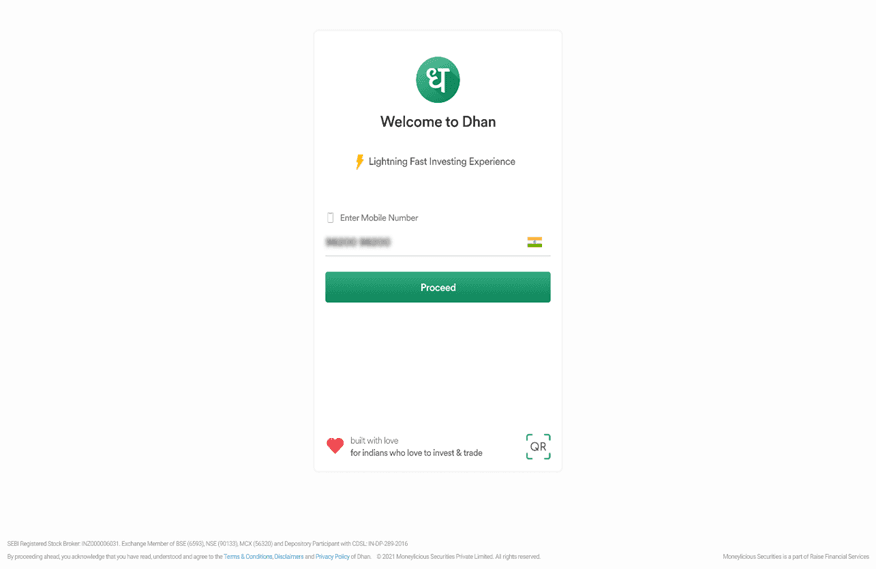

Steps 1

Click on ‘Open Your Account’ to visit Dhan and start your account opening process. Enter your mobile number in the field provided in the app.

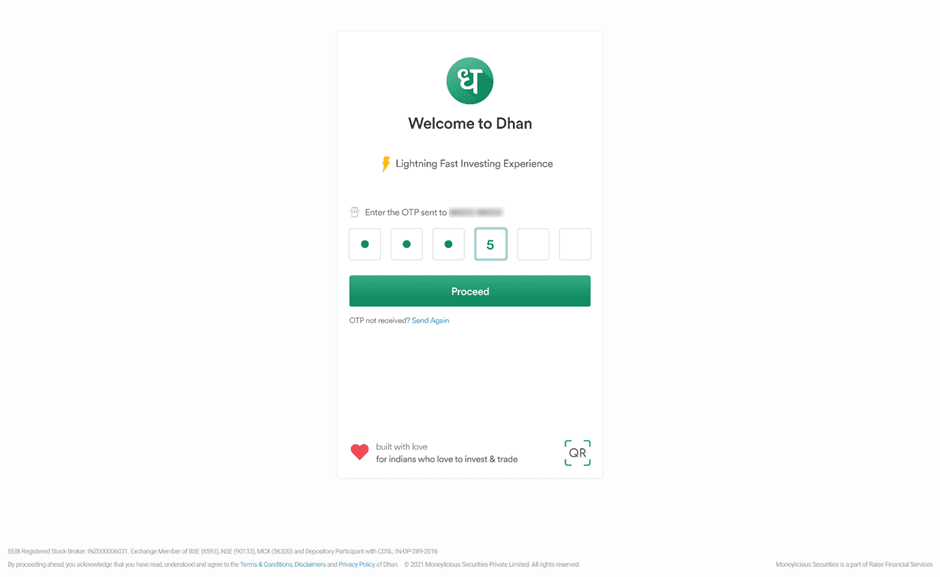

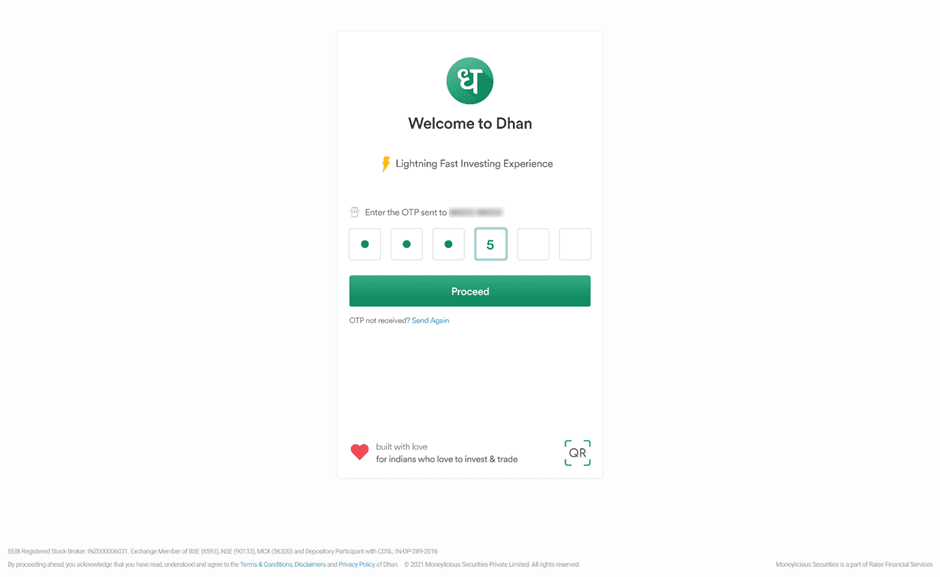

Steps 2

Enter the OTP received on your mobile number. Click Sign Up to continue.

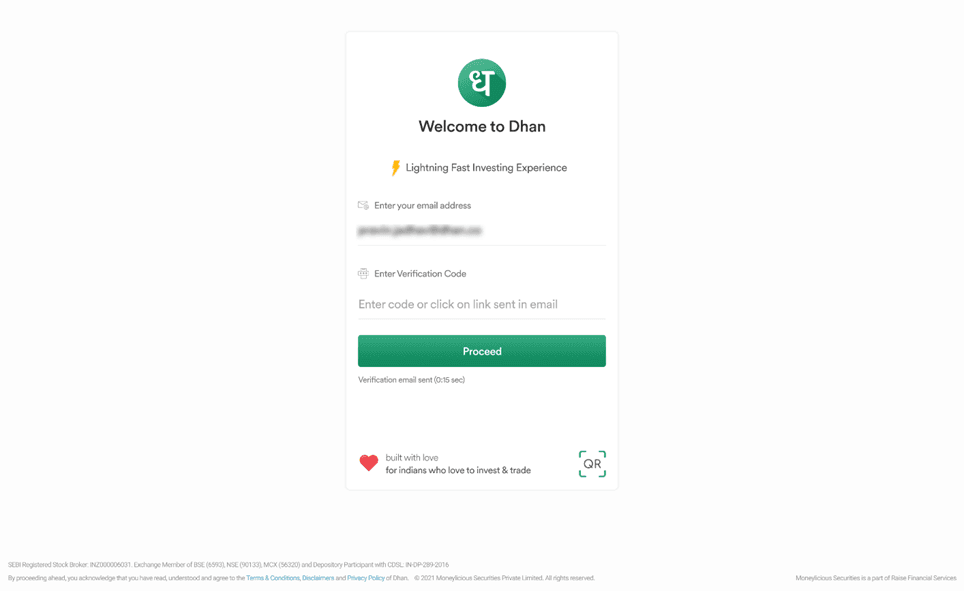

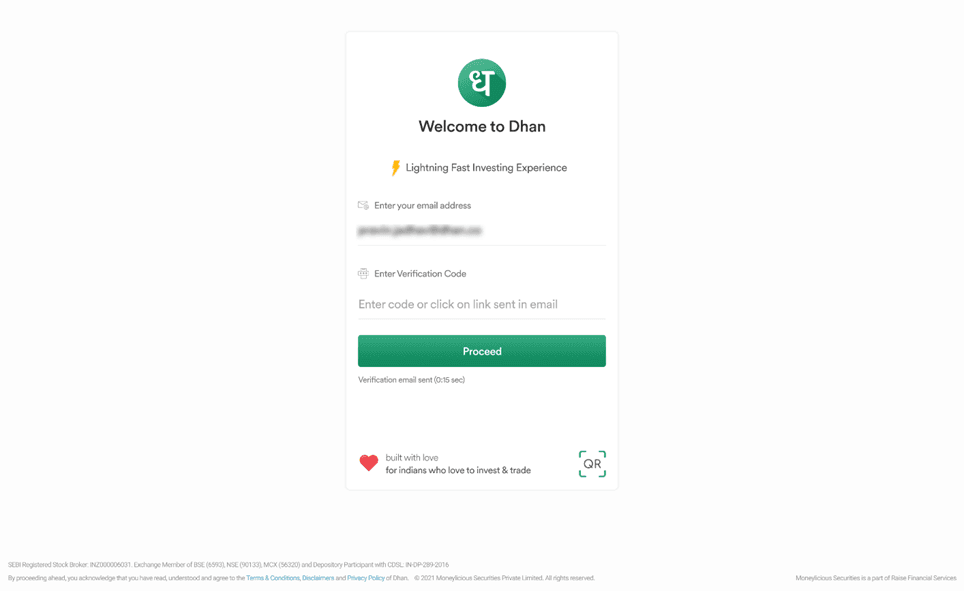

Steps 3

Enter your email address. Once you receive a verification code in the mail ID entered in the top field, input the verification code in the field below.

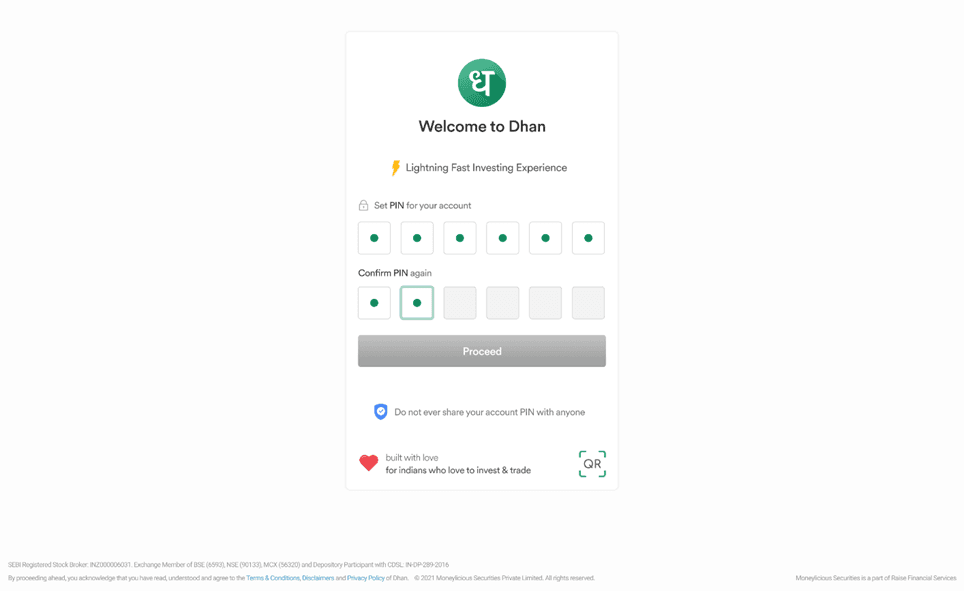

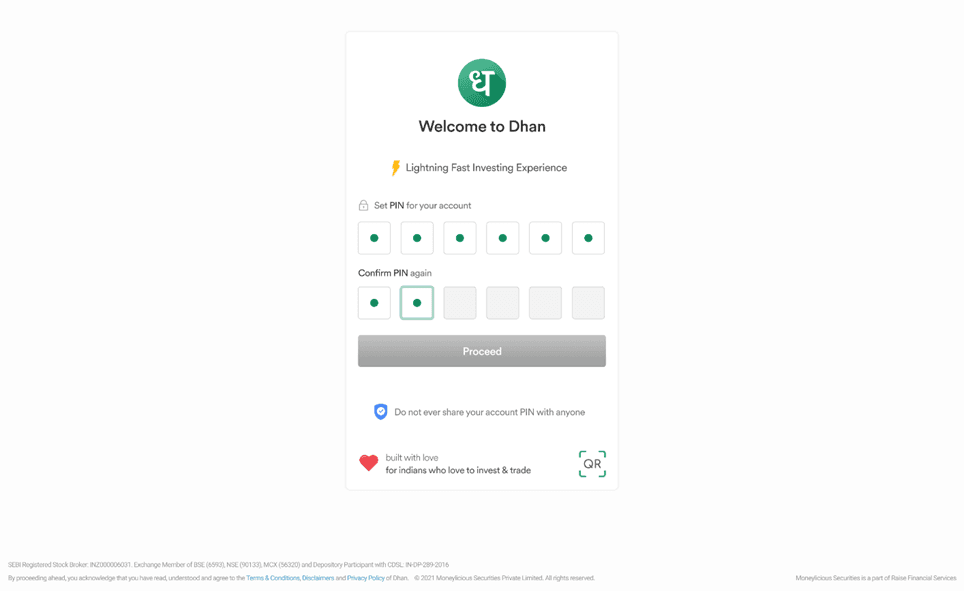

Steps 4

Now set a six-digit pin for your account.

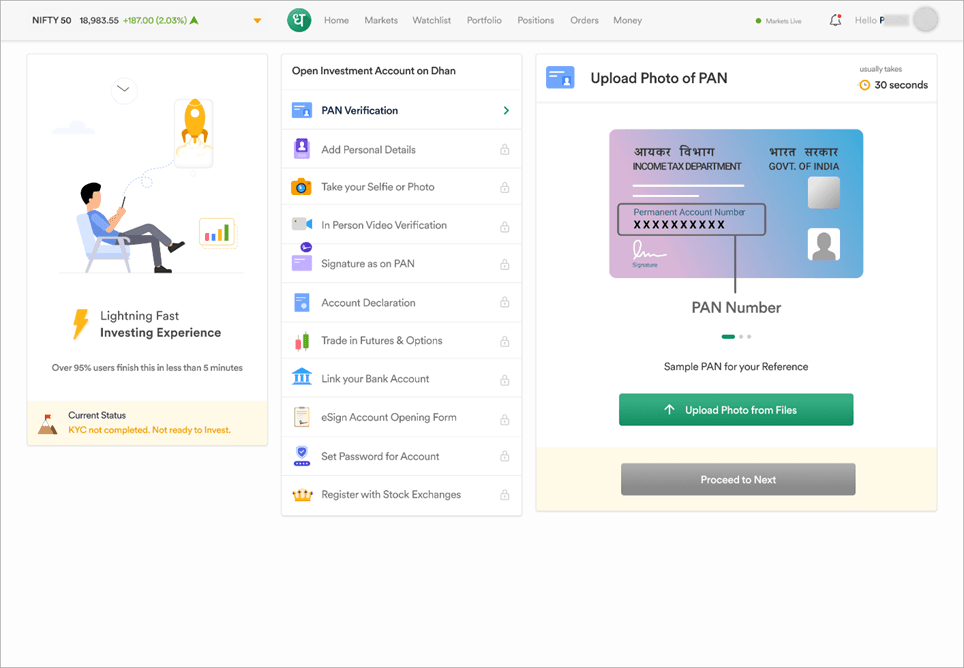

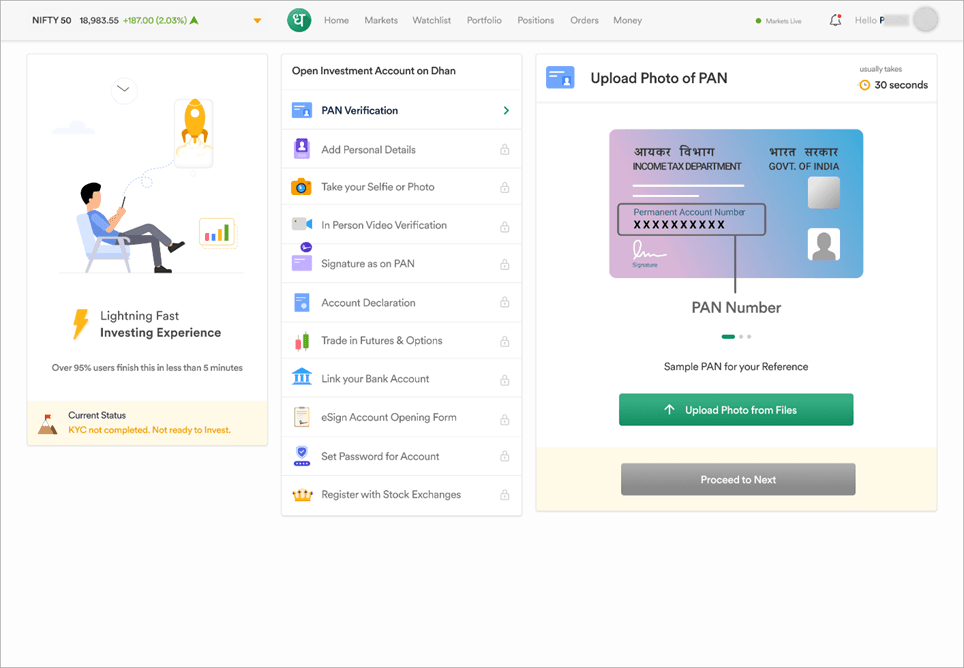

Steps 5

Upload a picture of your PAN card from your device or scan your PAN card using your phone’s camera. Click next to continue.

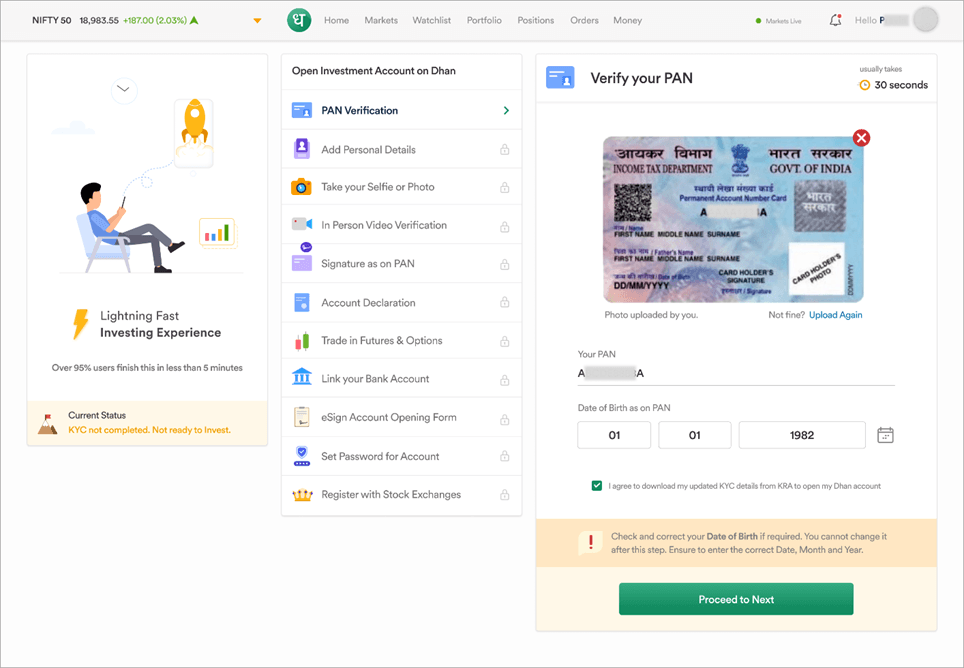

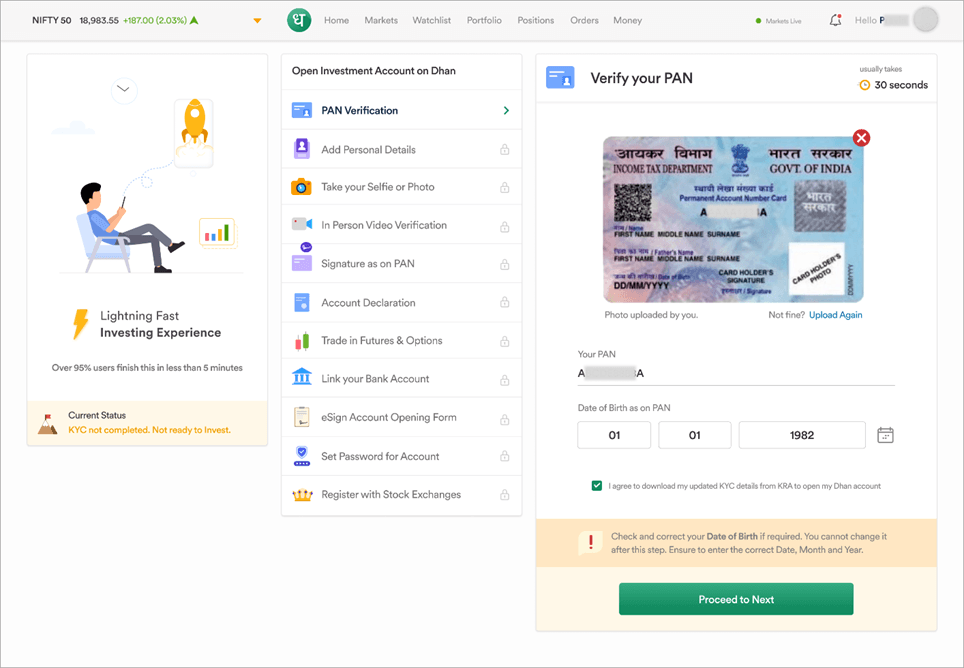

Steps 6

Wait for your scanned/uploaded PAN to be verified. This usually takes around 30 seconds.

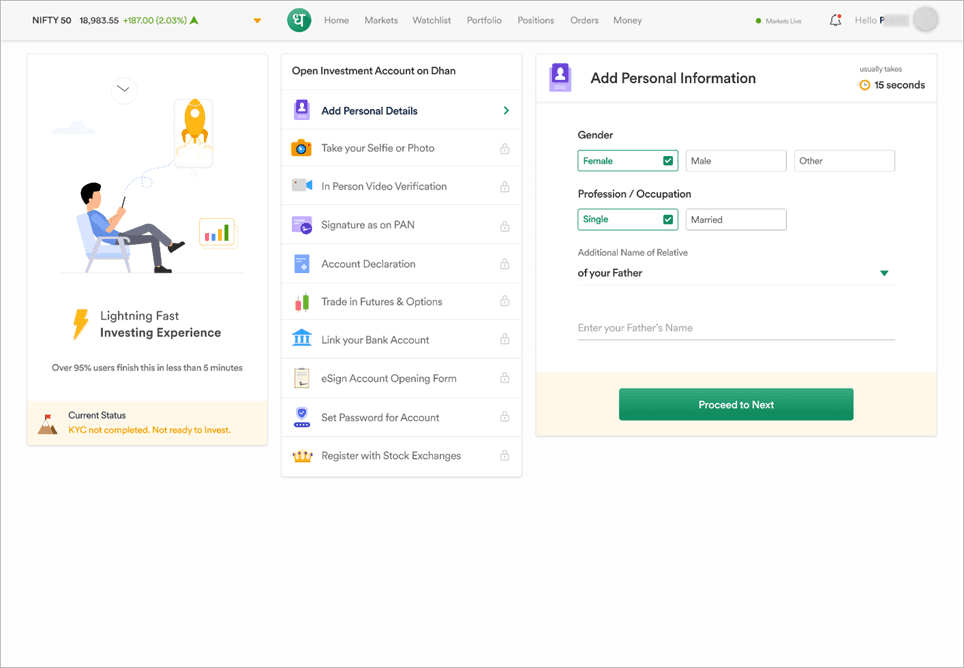

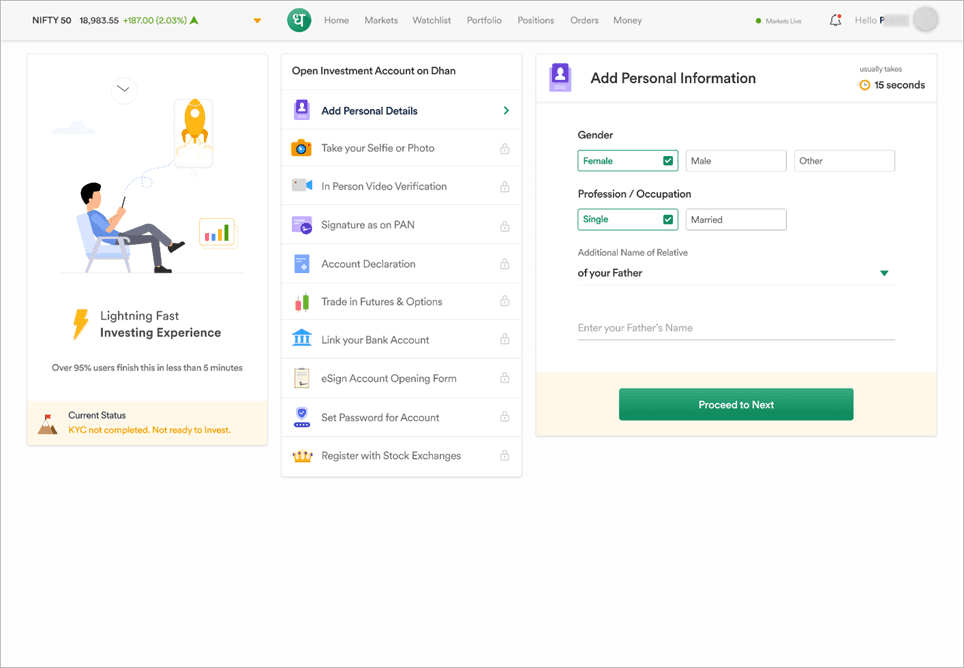

Steps 7

Add your personal information, like Gender, Occupation/Profession, etc.

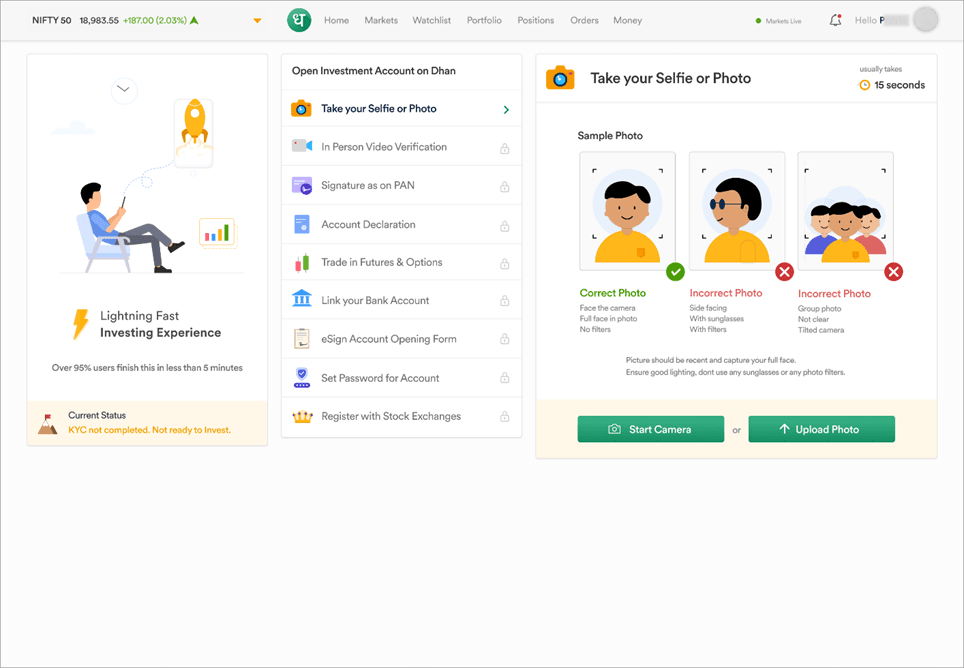

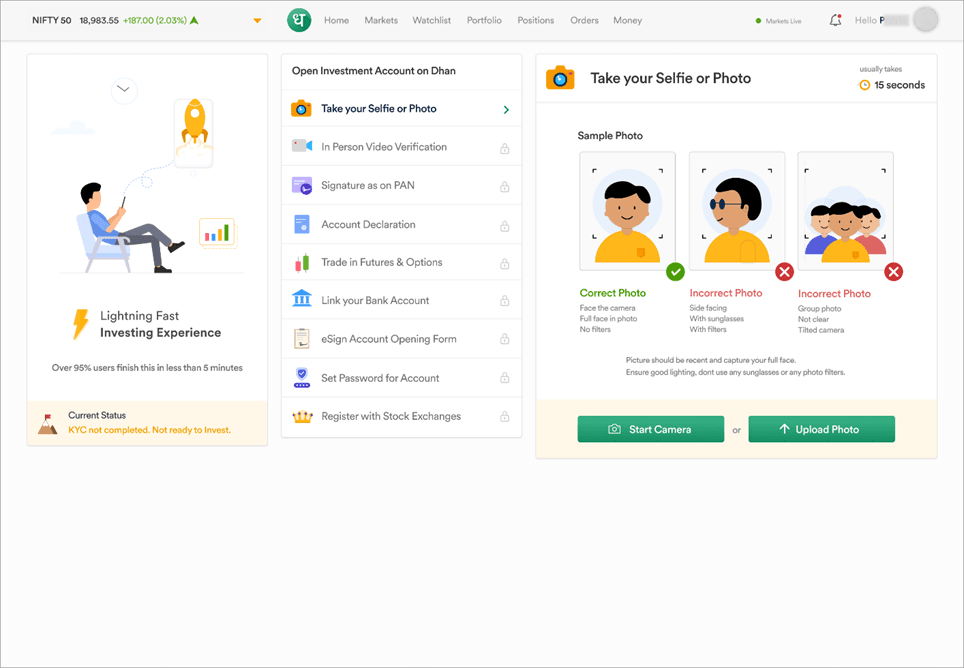

Steps 8

Upload your picture from your device or take a selfie to add your picture to your account. Click Next after uploading documents.

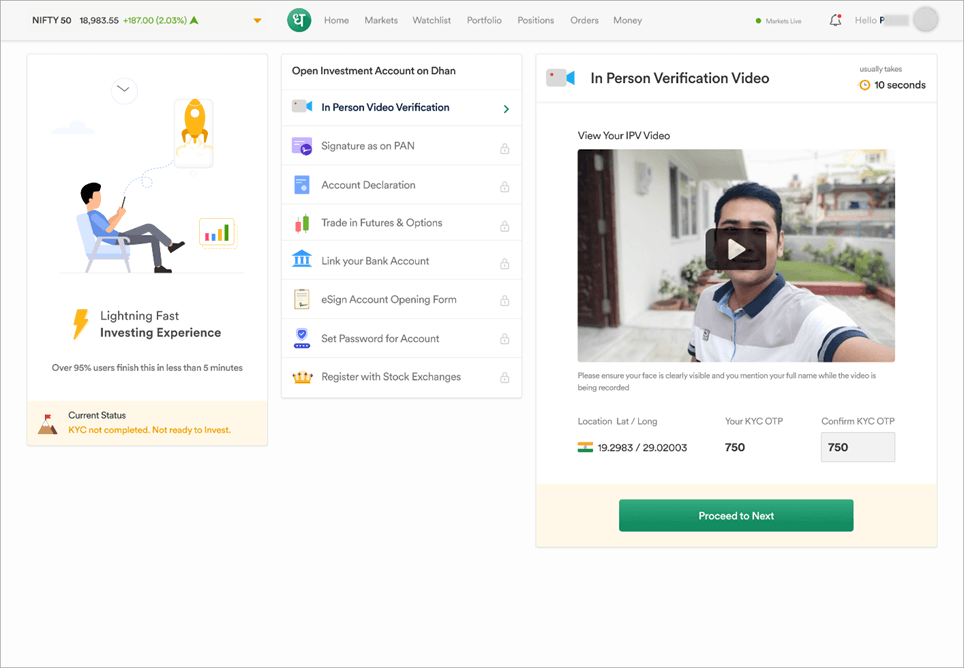

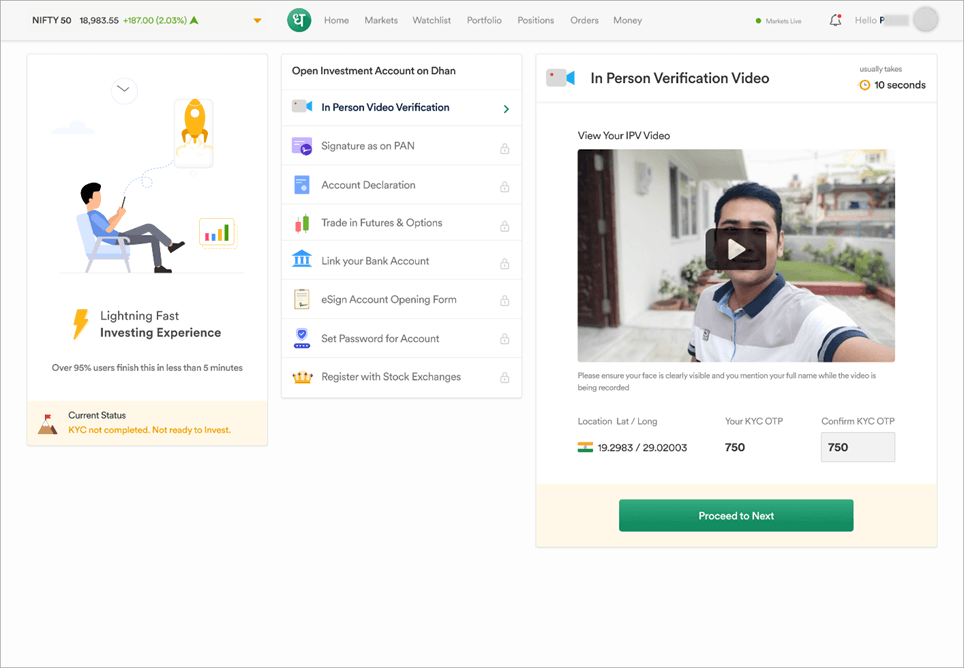

Steps 9

Next comes Complete your “In-Person Verification” by recording and uploading your video.

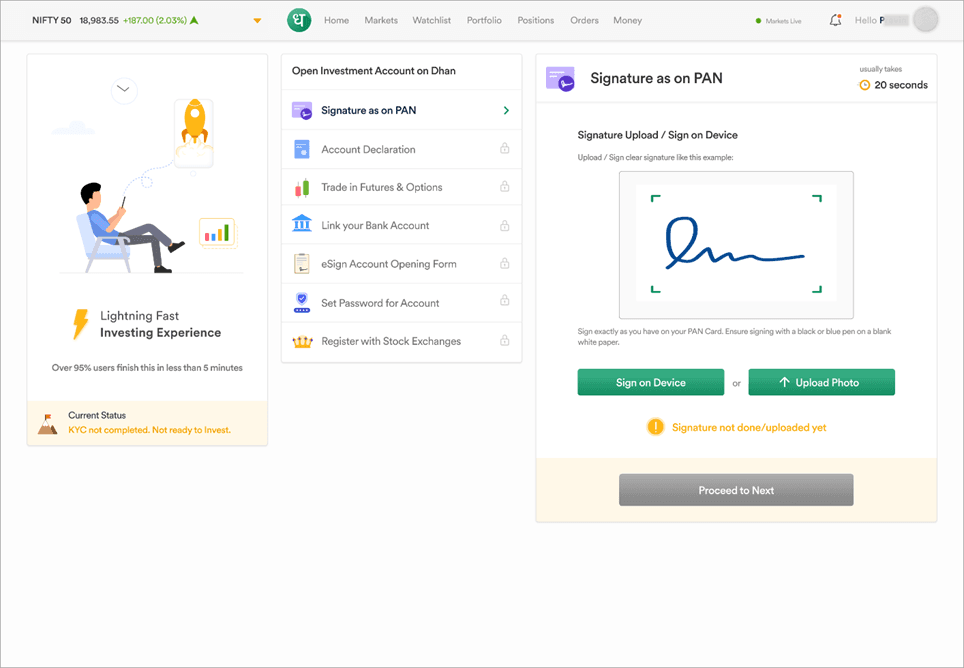

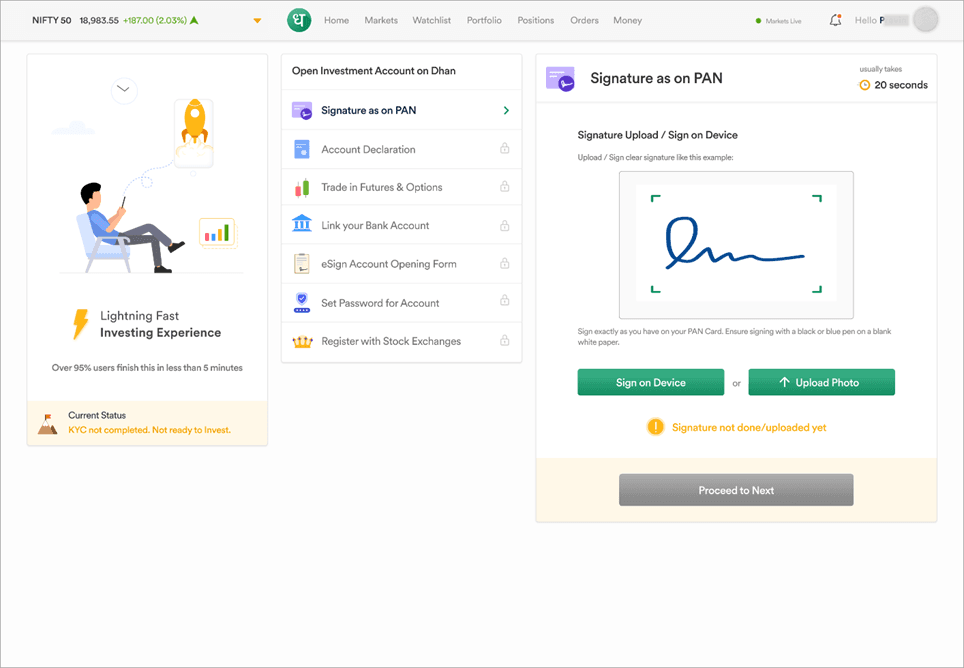

Steps 10

Now, upload a picture of your signature (as on PAN) or sign in the field provided in the app itself. Click Next to continue.

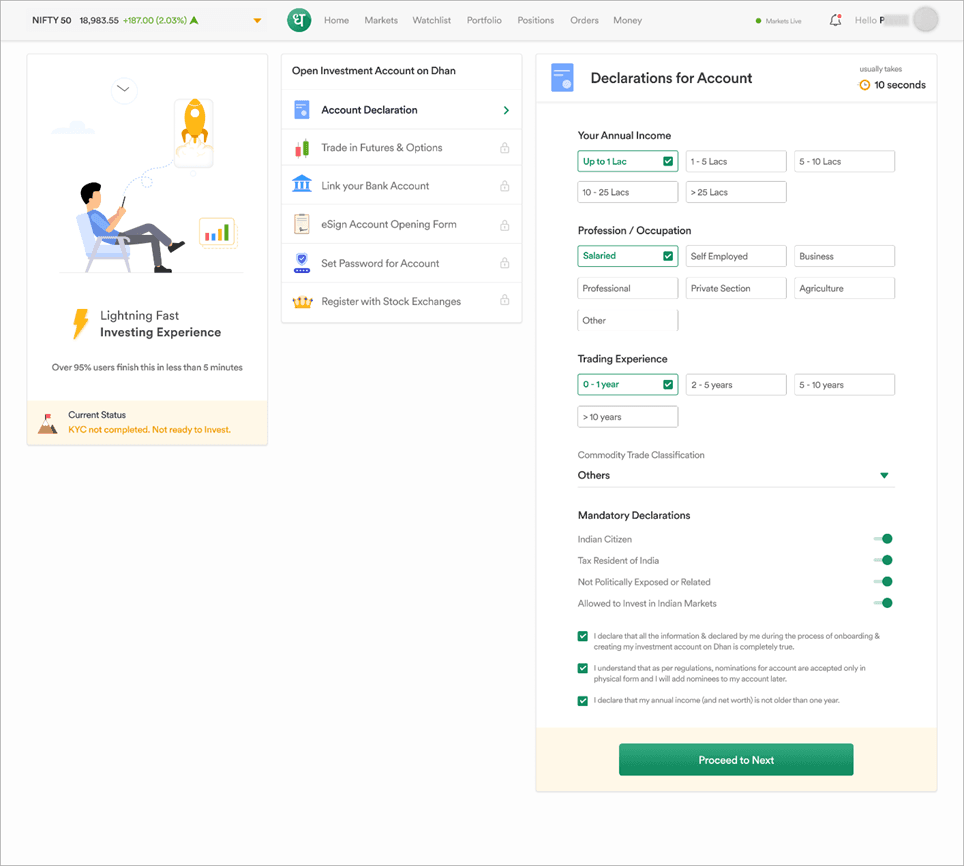

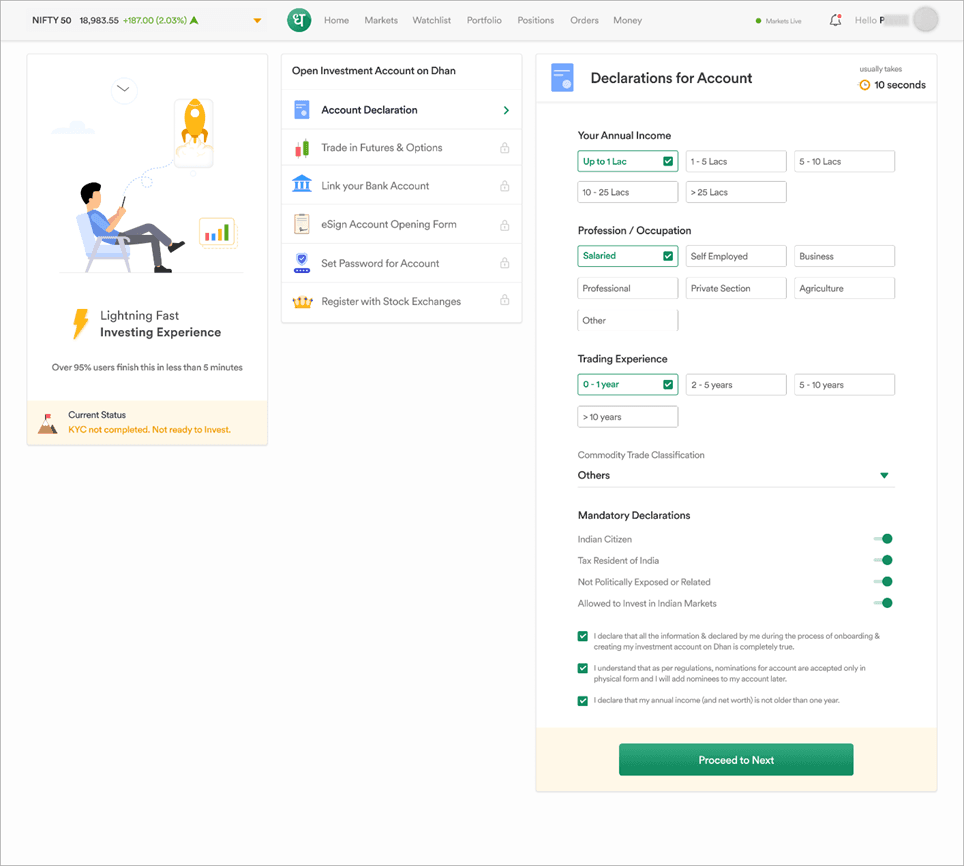

Steps 11

Enter your income information and other relevant declarations for your account. Click continue to proceed to the next step.

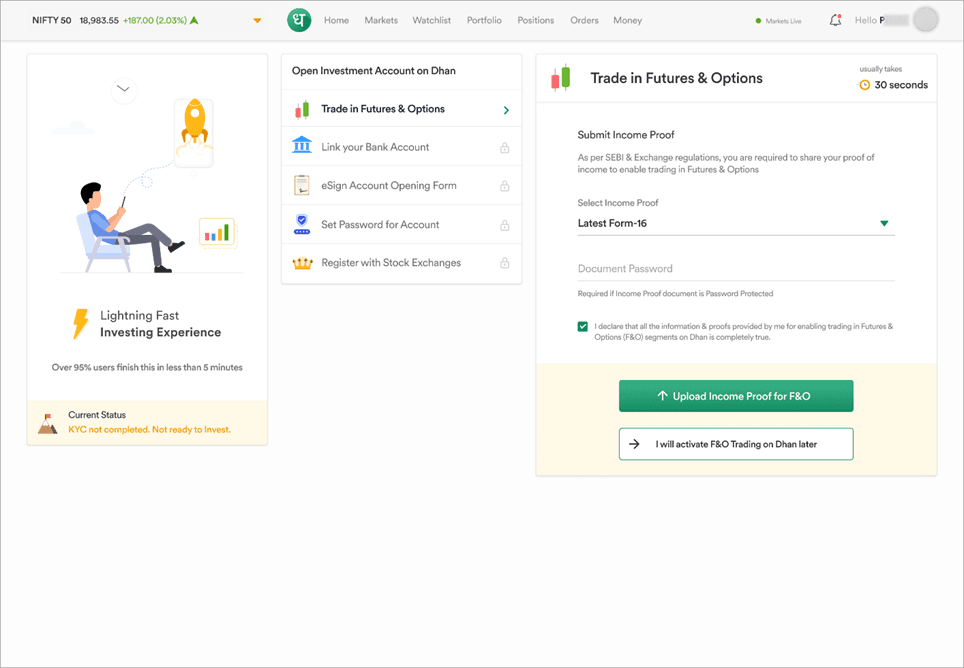

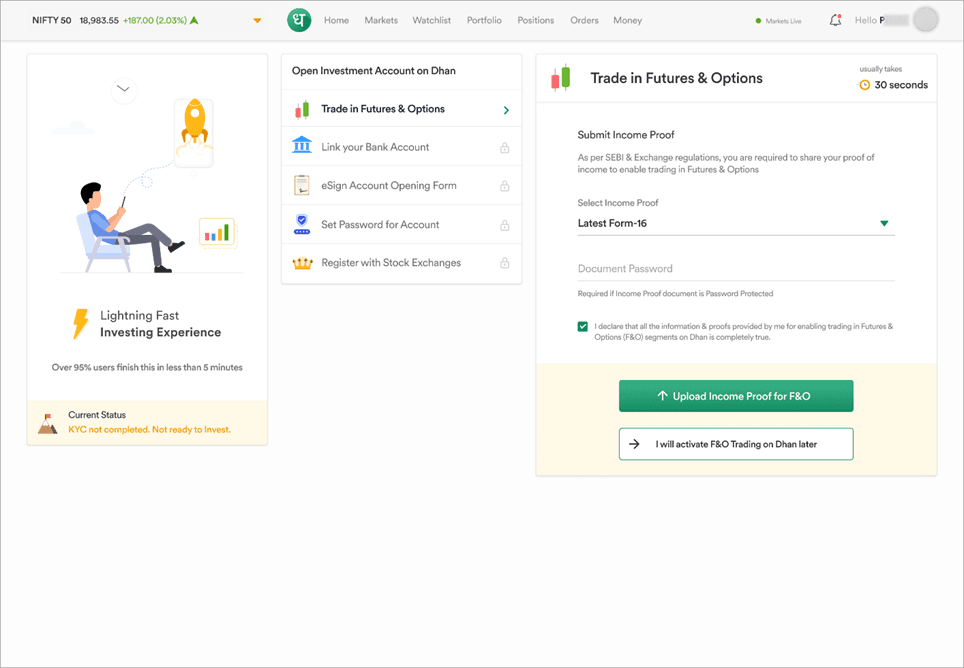

Steps 12

To activate F&O Trading, provide proof of your income by uploading an electronic document for the same.

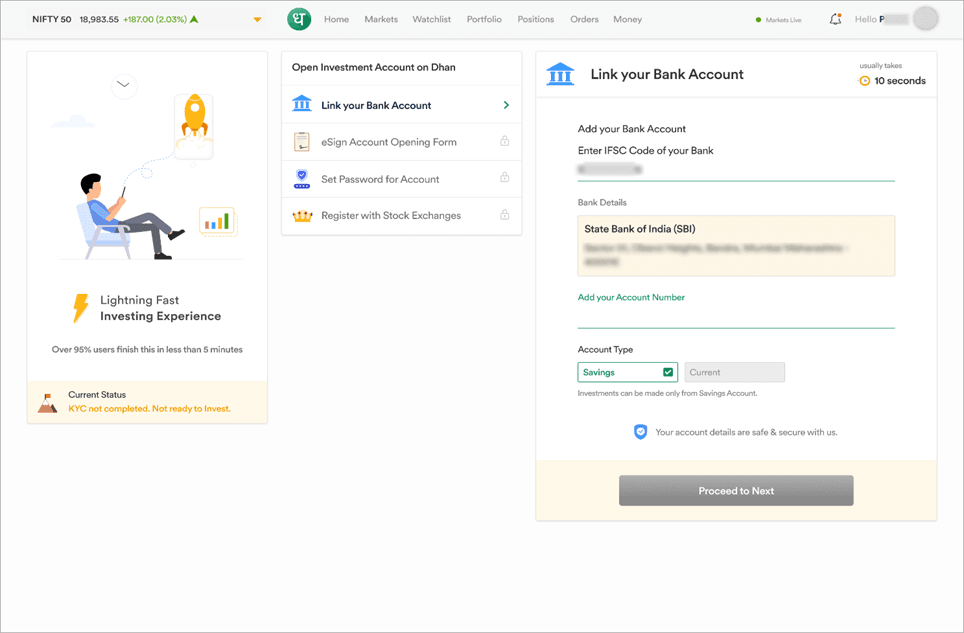

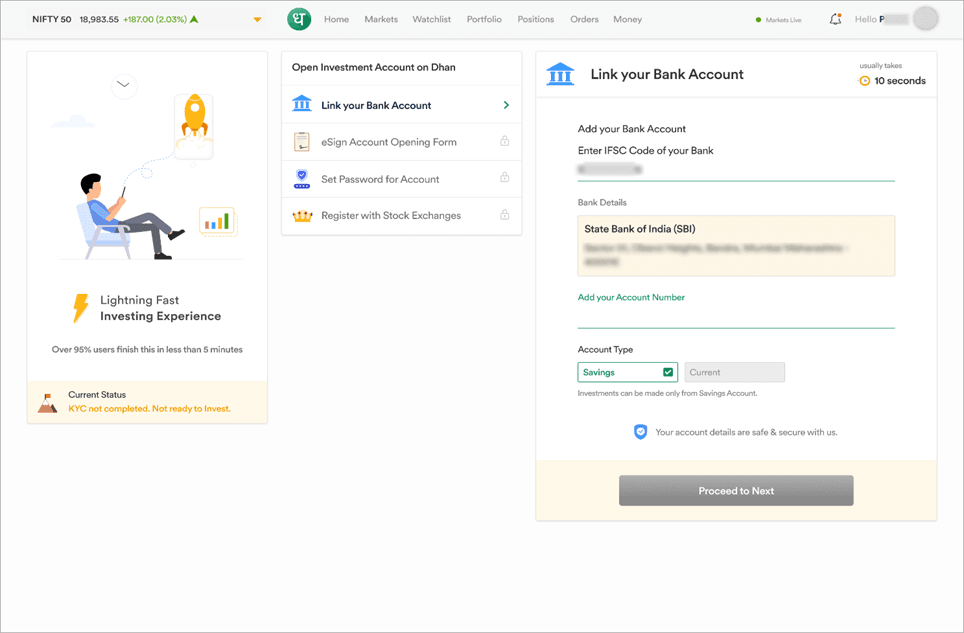

Steps 13

Now add your bank details to link your bank account with your Dhan App account. Click next to continue.

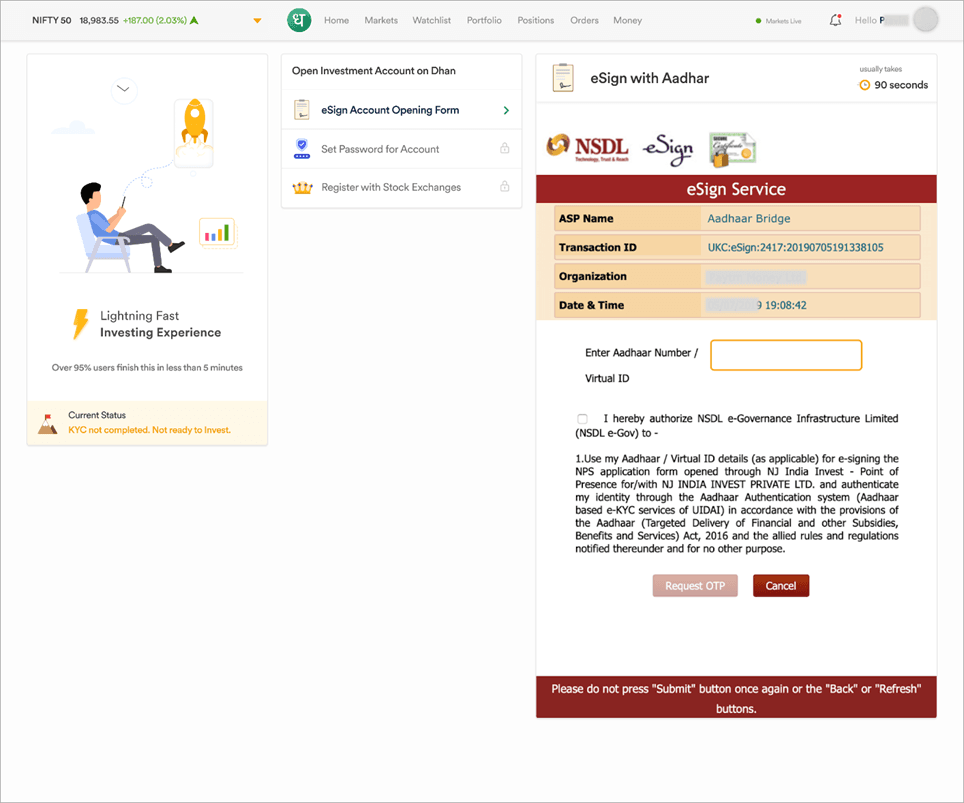

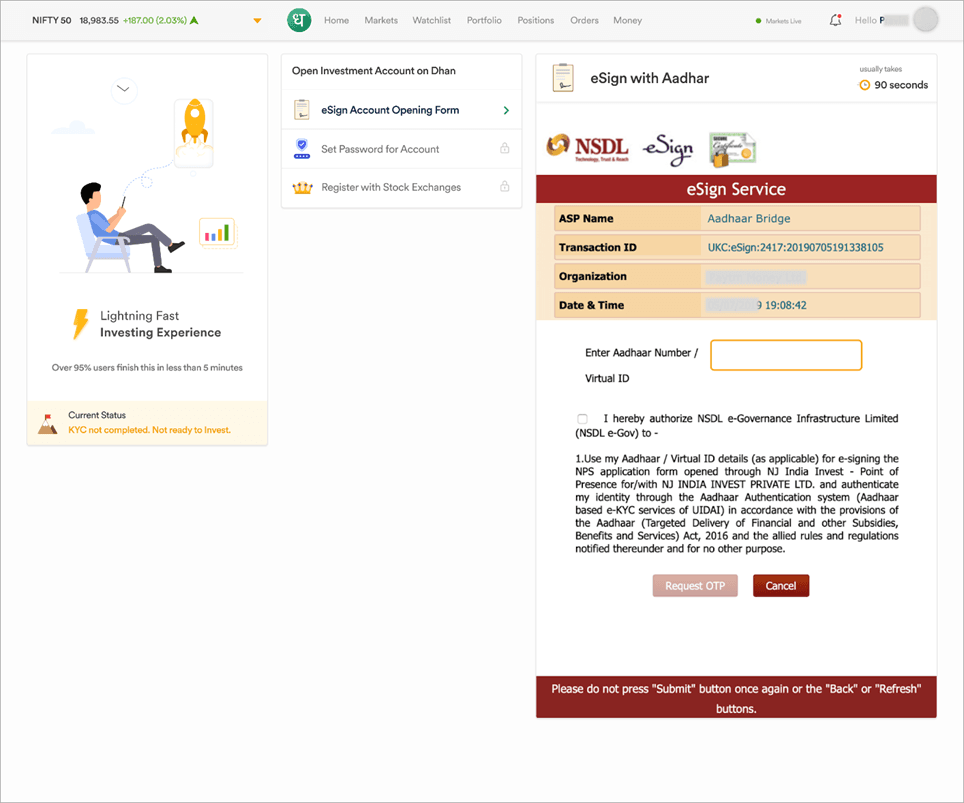

Steps 14

Verify your e-sign through Aadhar OTP verification and select continue to proceed further.

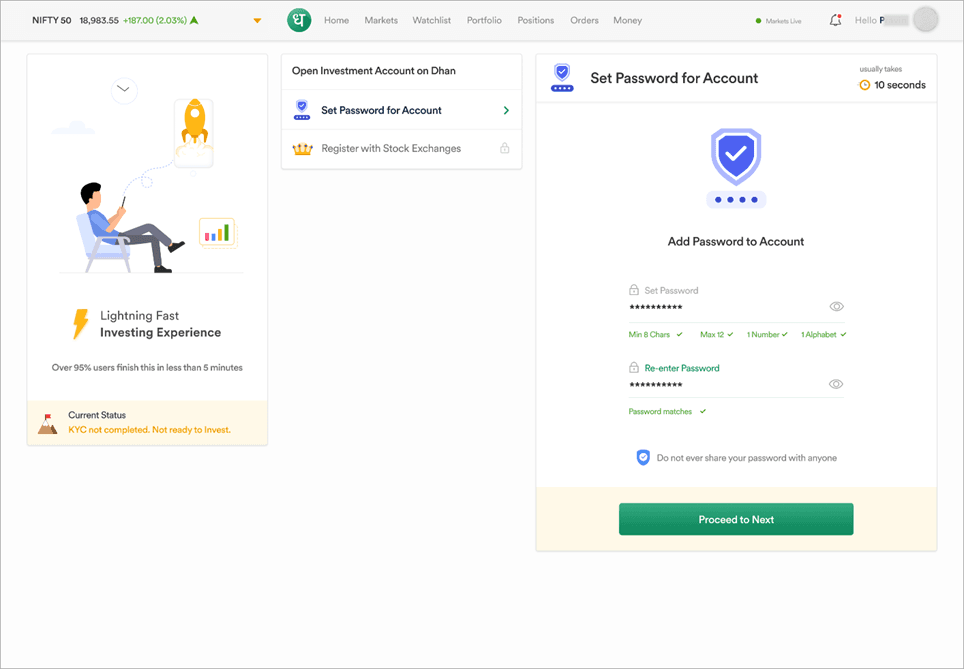

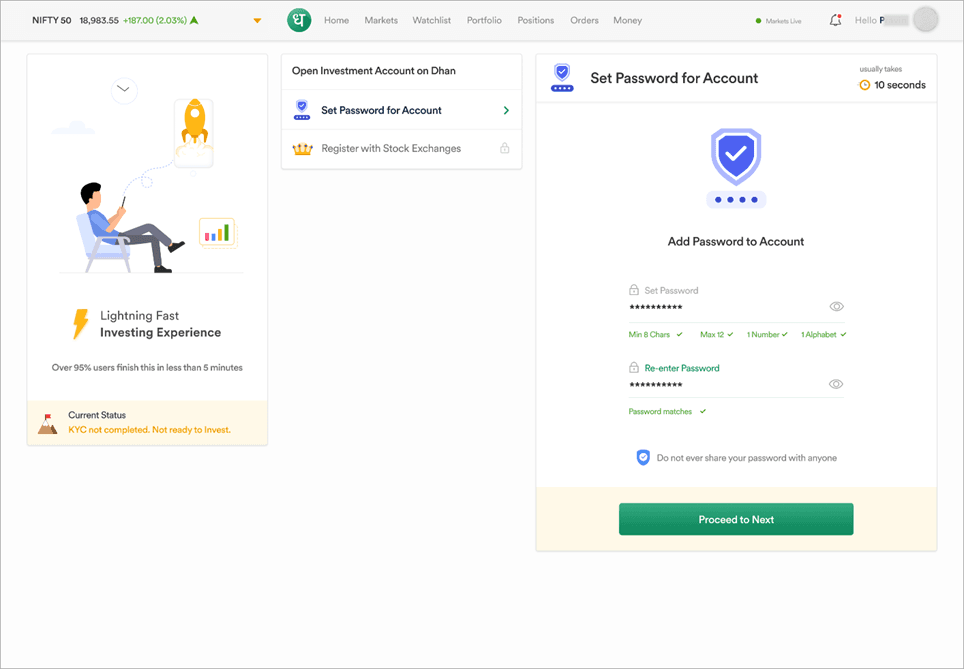

Steps 15

Now set a password for your account.

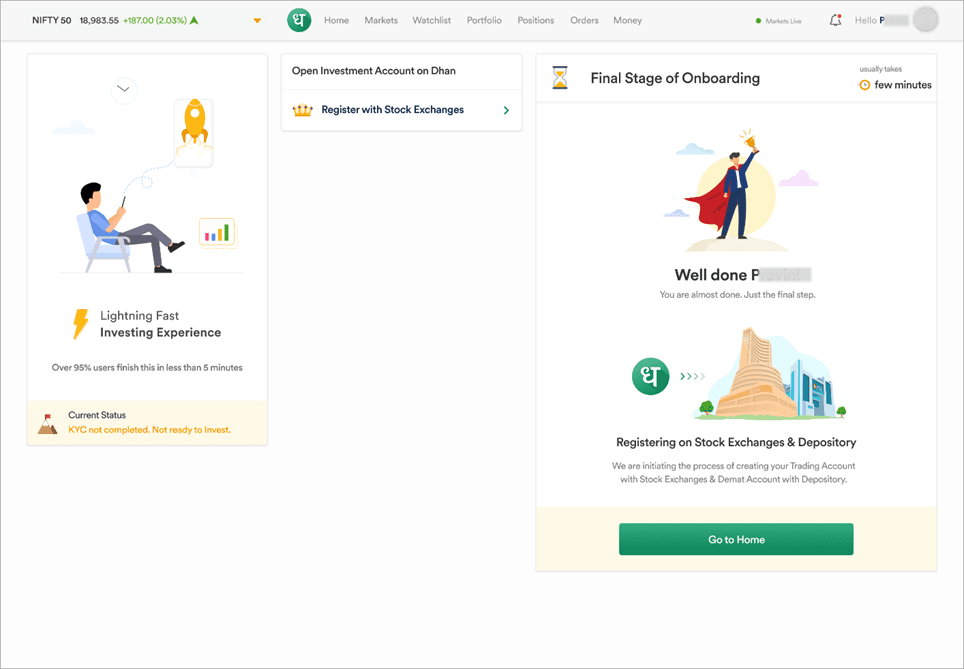

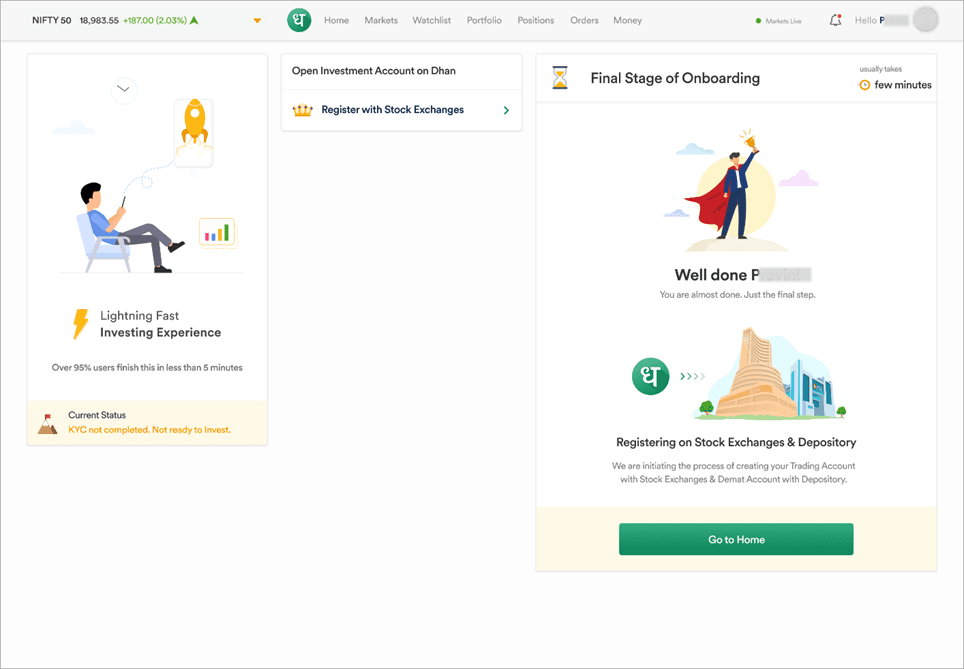

Steps 16

It takes 10 mins to open your account. You will also get the login credentials to your trading account in the welcome mail. Happy Investing.