FYERS Demat Account Opening Process Step by Step.

Steps 1

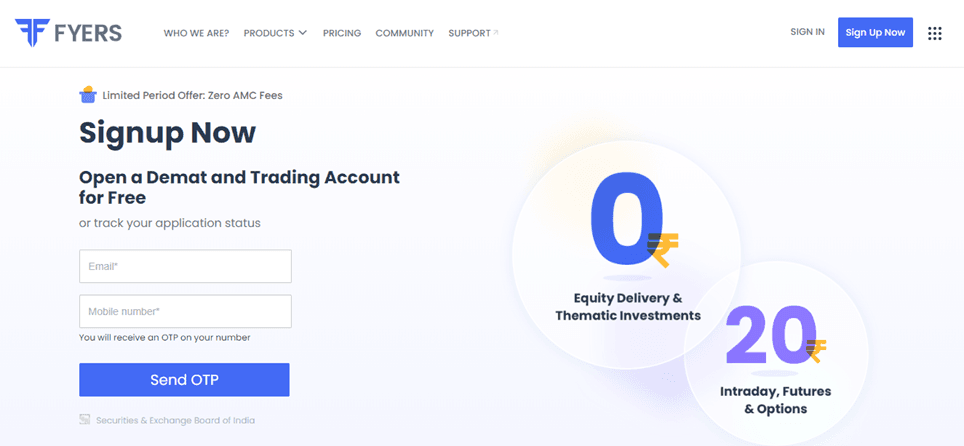

Click on ‘Open Your Account’ to visit FYERS and start your account opening process. Click on the SIGNUP button.

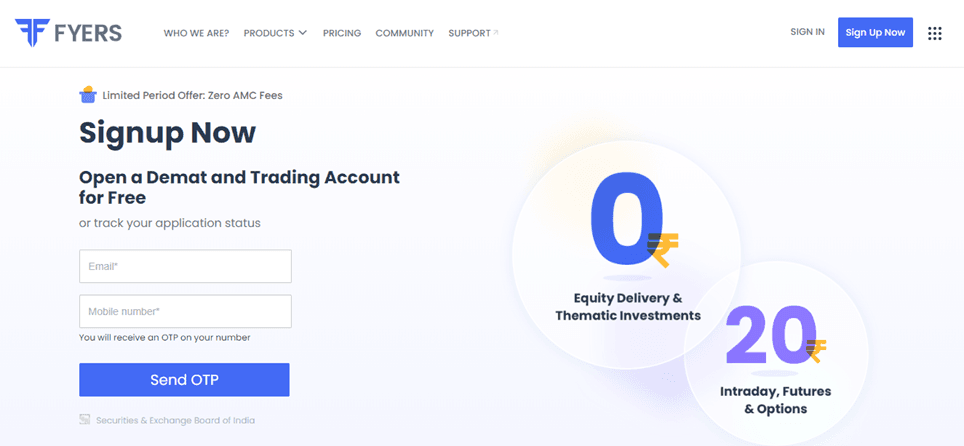

Steps 2

Enter your email address and mobile number to sign up. Once you fill both the requirements, click on Send OTP.

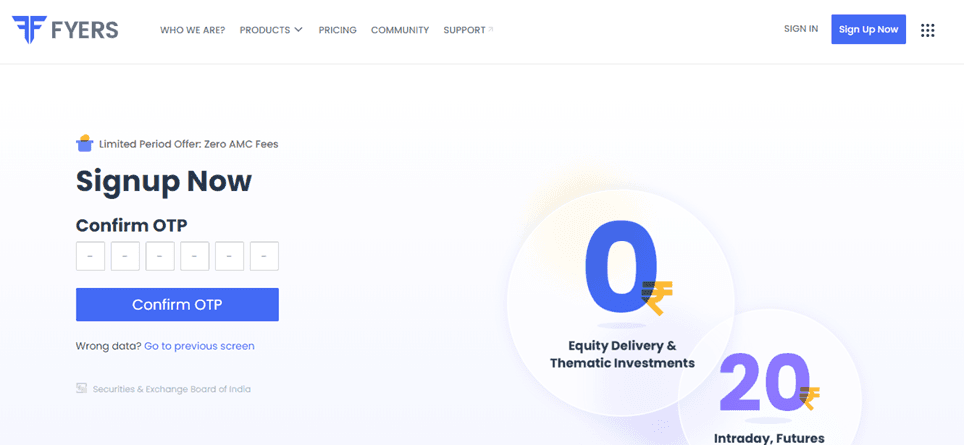

You will receive an OTP on your registered mobile number via SMS notification or WhatsApp.

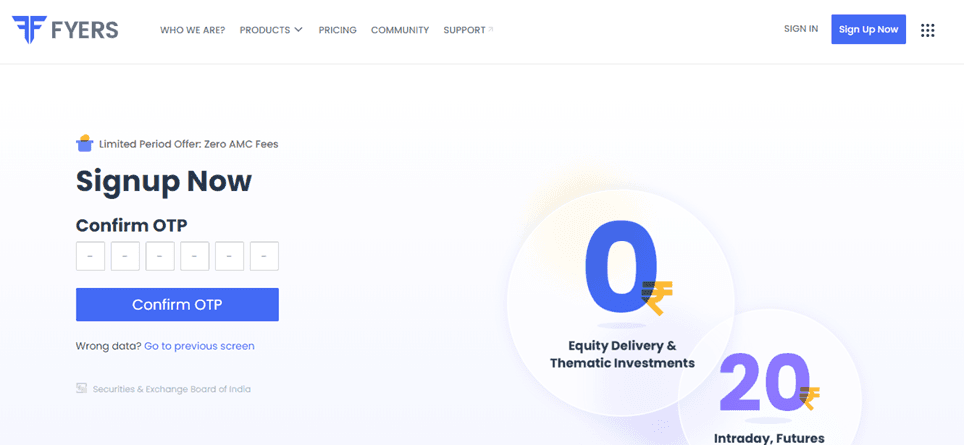

Steps 3

Enter OTP in the given space. You get a new notification on SMS or WhatsApp stating “THANK YOU FOR REGISTERING YOUR DETAILS WITH FYERS ALONG WITH AN INSTRUCTIONAL VIDEO LINK FOR ACCOUNT OPENING”

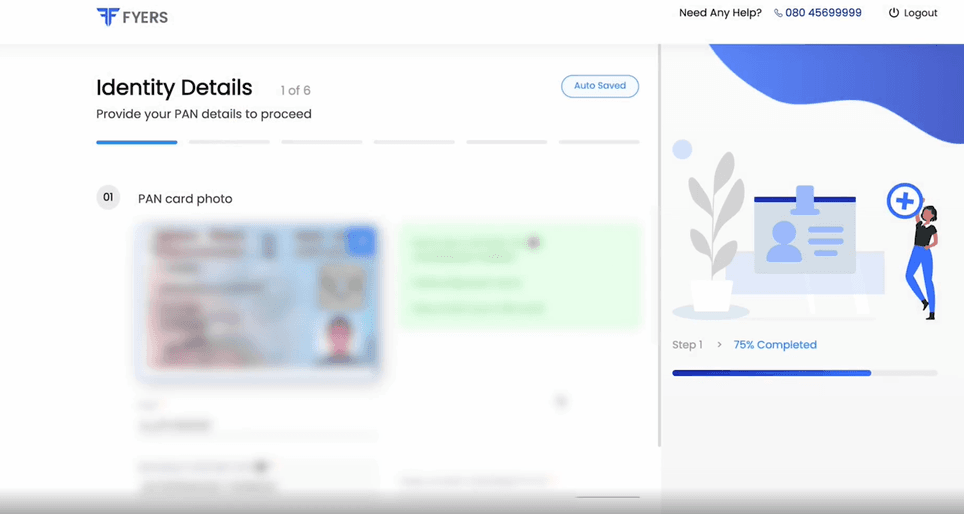

Steps 4

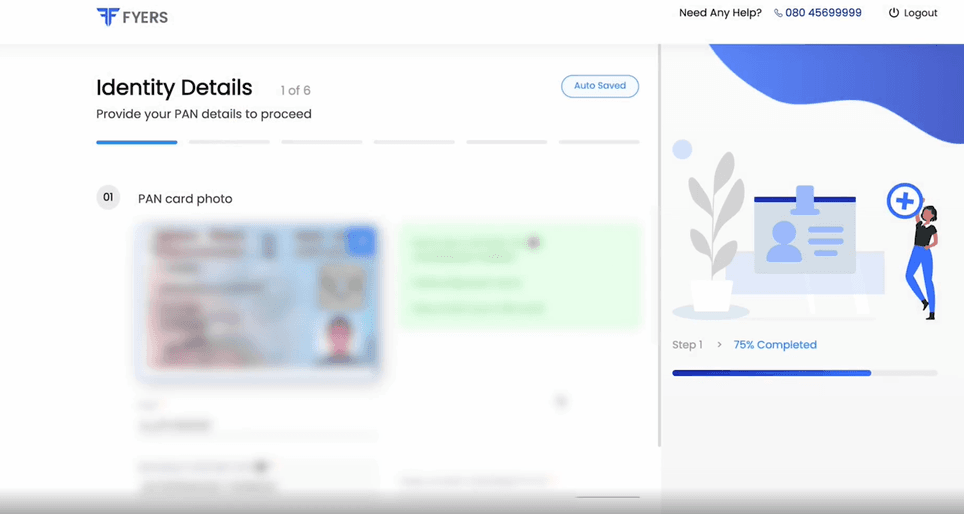

Enter your identity details and upload a clear photo of your PAN CARD.

Steps 5

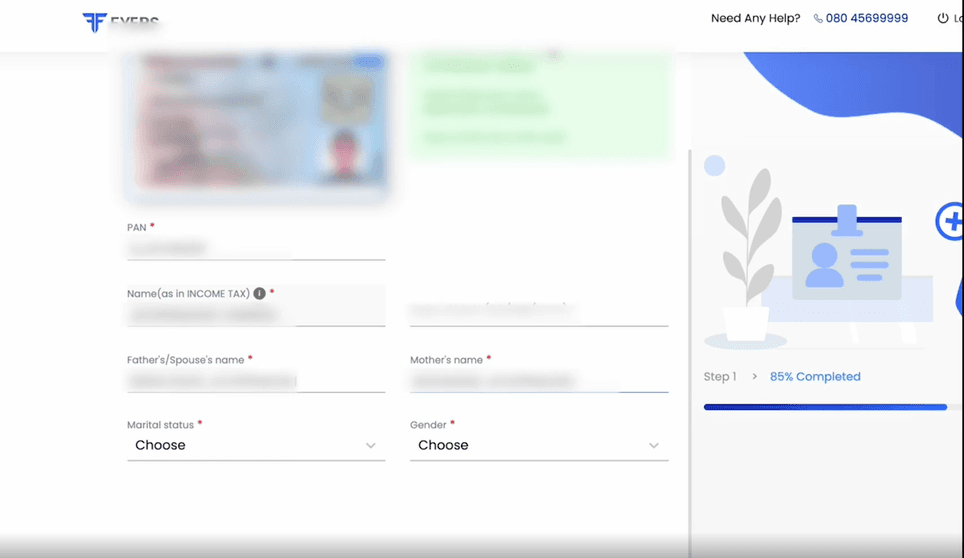

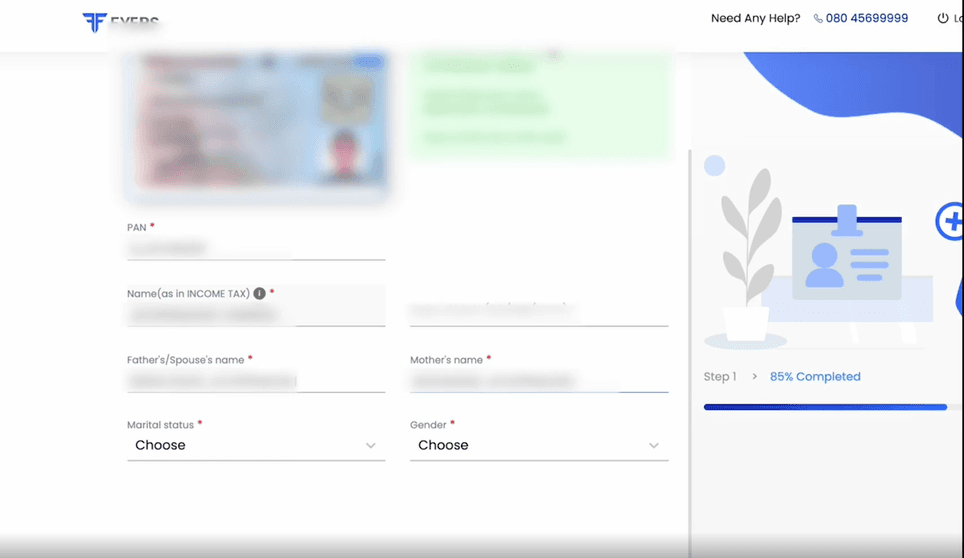

As you scroll down, enter the below details.

1.Father’s/spouse name

2.Mother’s name,

3.Date of birth

4.Marital status

5.Gender

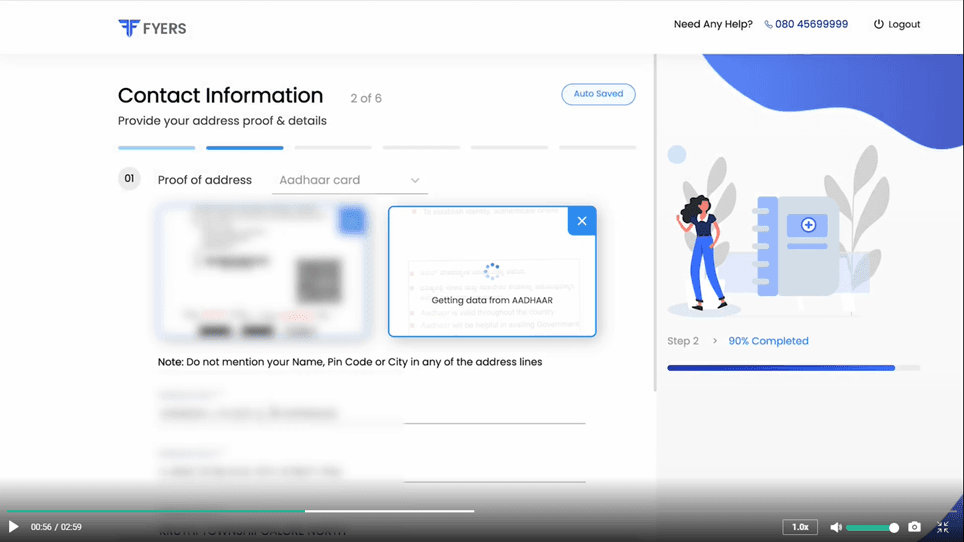

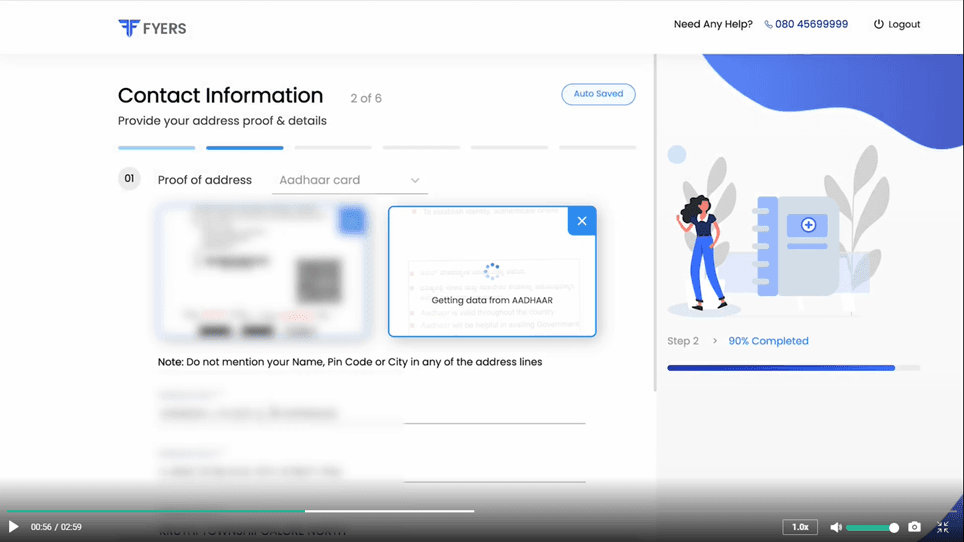

Steps 6

Share your address proof. You can attach any of the below documents as address proof:

1.Aadhar Card

2.Voter ID

3.Driving License

4.Passport

5.Ration Card

6.Registered Lease

7.Sale Agreement of Residence

8.Latest Phone Number

9.Gas OR Electricity Bill

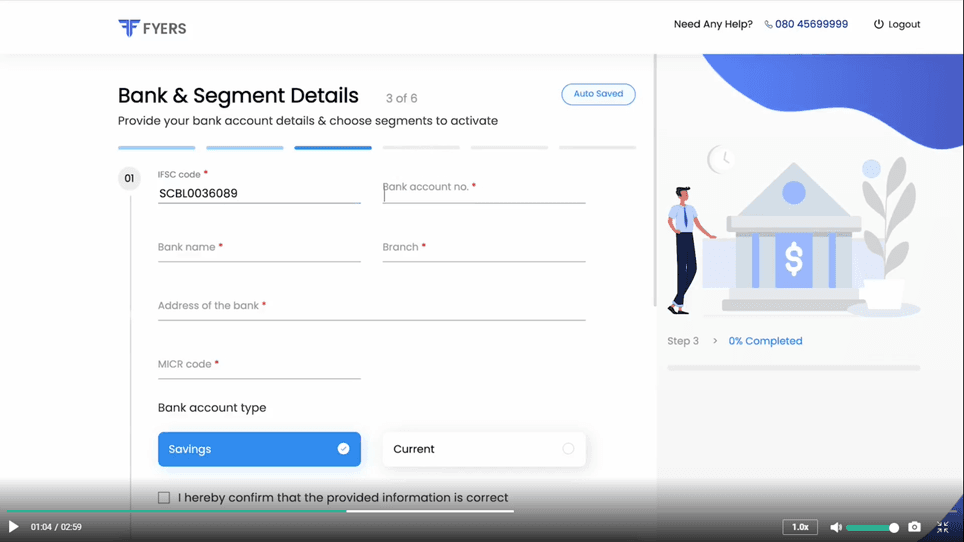

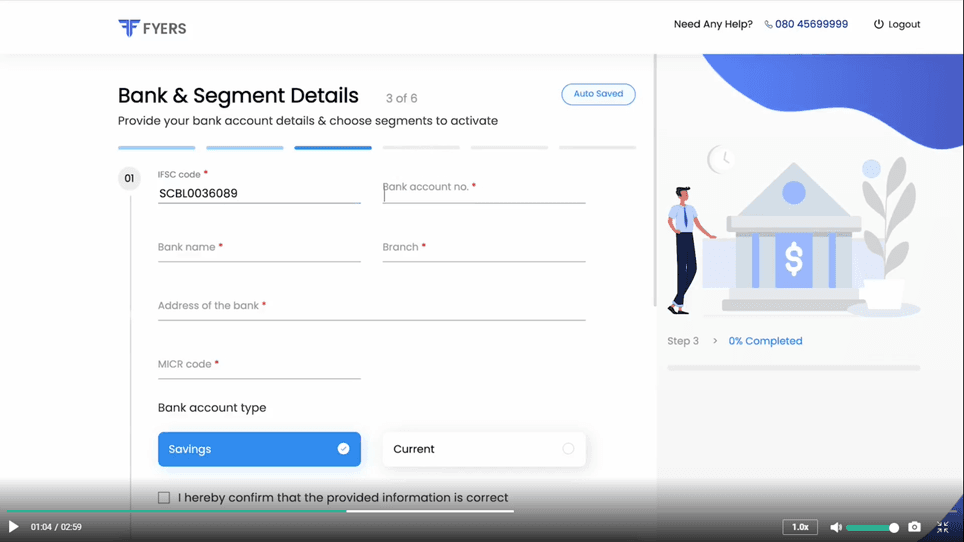

Steps 7

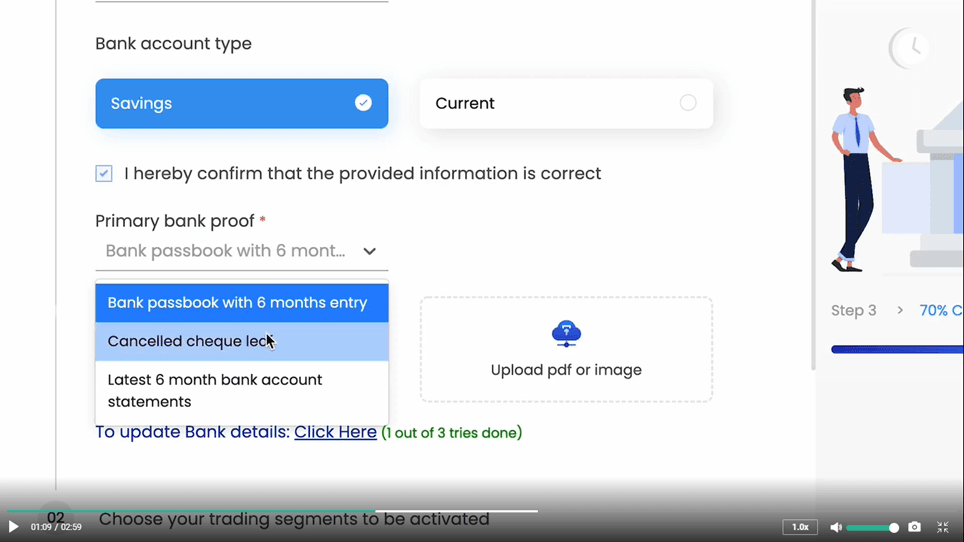

Provide your bank account details that you wish to link your Demat account with. Details asked includes IFSC Code, Bank Account number, Bank Name, Bank’s address, MICR code, account type.

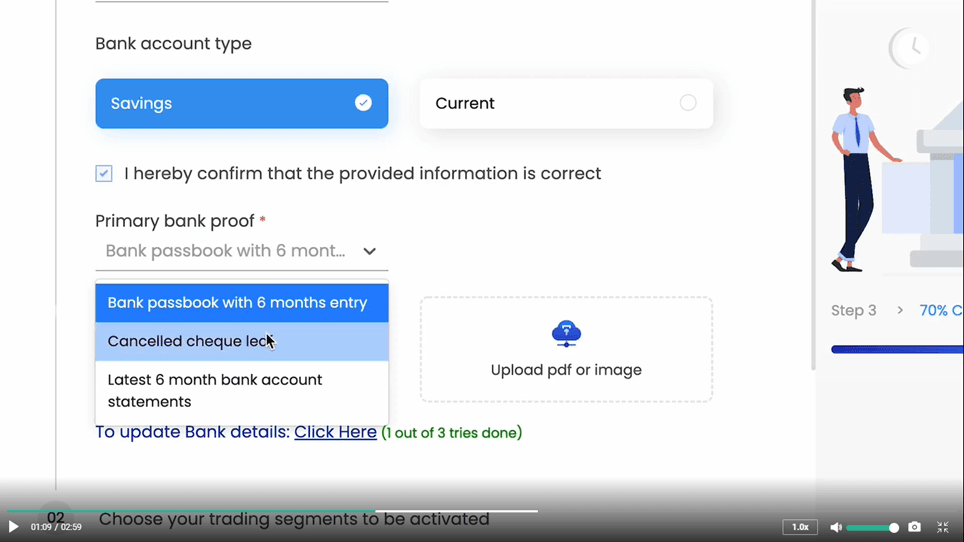

Steps 8

After providing your bank details, share the primary bank proof by adding any of the three options in the dropdown. The option includes the bank’s passbook, canceled cheque, or latest six months bank statement. Financial Documents like statement and other docs is required to activate derivatives, if that's not provided only EQ segments will be activated.

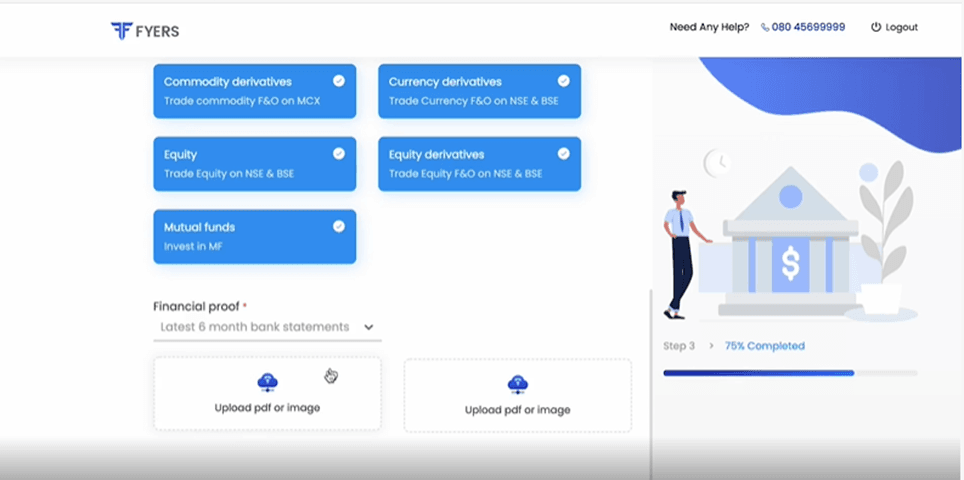

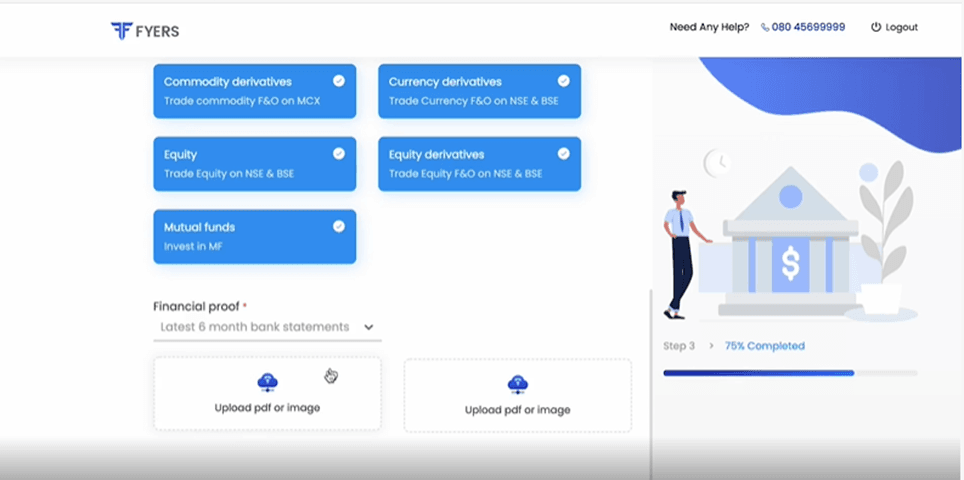

Steps 9

Scroll down further and choose the trading segment that you want to activate, like commodity derivatives, currency derivatives, equity, equity derivatives, and mutual funds. Then, submit your financial proof by choosing one of the options from the drop-down. You can provide your latest six months bank or holdings statement or the latest ITR copy.

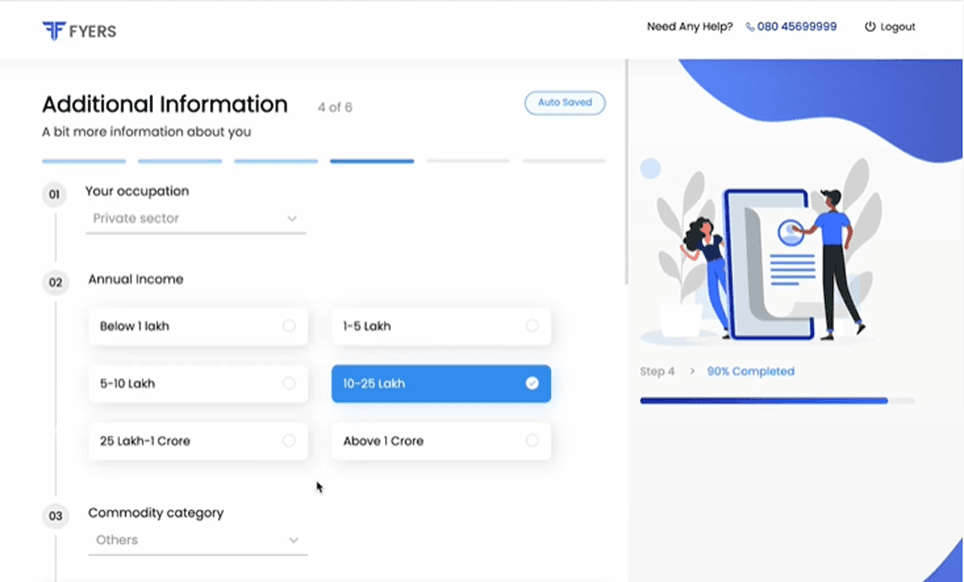

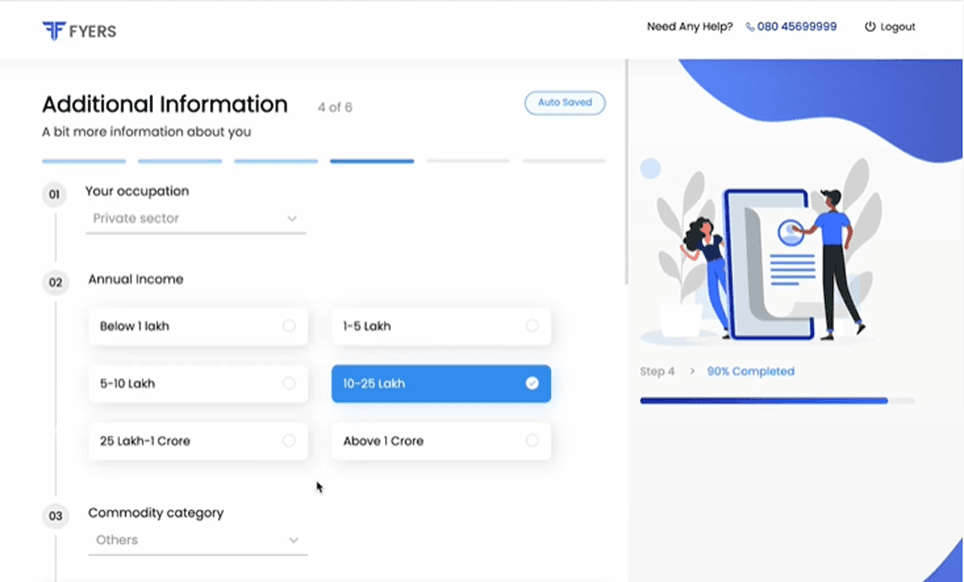

Steps 10

Provide additional information like your occupation, annual income etc. Also select your commodity category and proceed further.

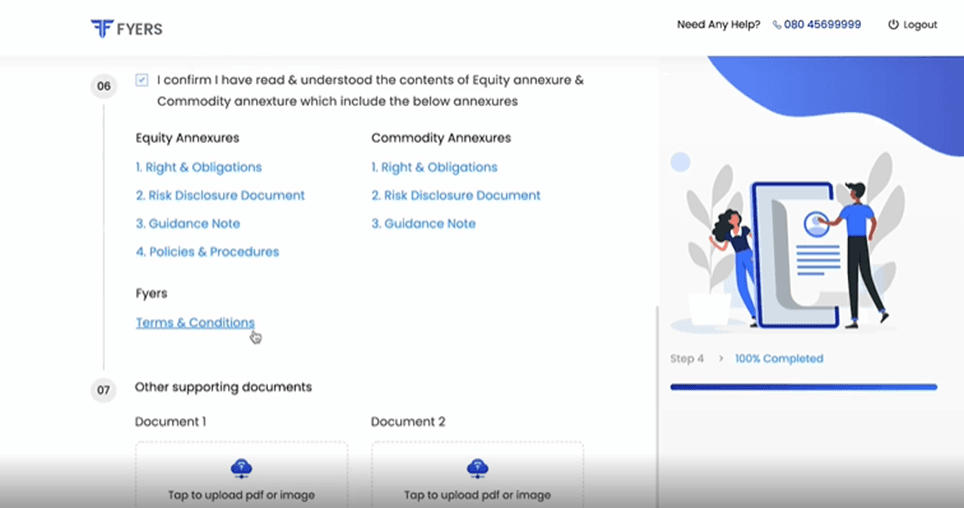

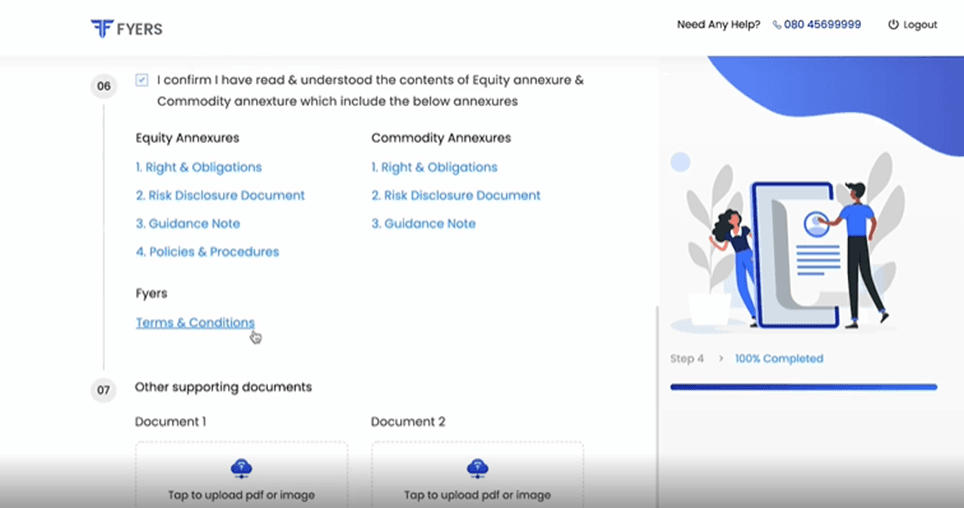

Steps 11

After providing all the details, acknowledge that you have read and understood the content of both annexures- equity and commodity. If you want to give more information, you can upload any of your supporting documents. If not, directly tap on the continue button.

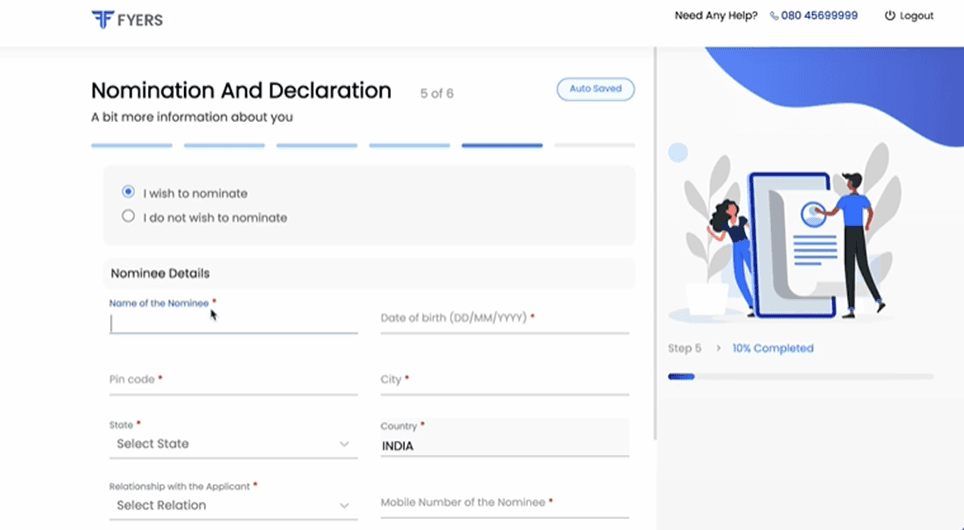

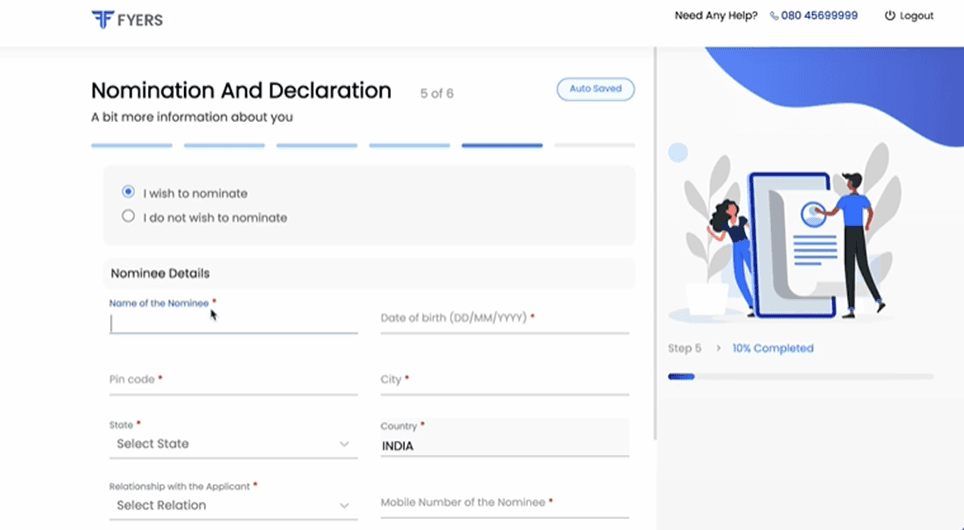

Steps 12

You can add the nominees or declare to opt out of nomination to proceed further.

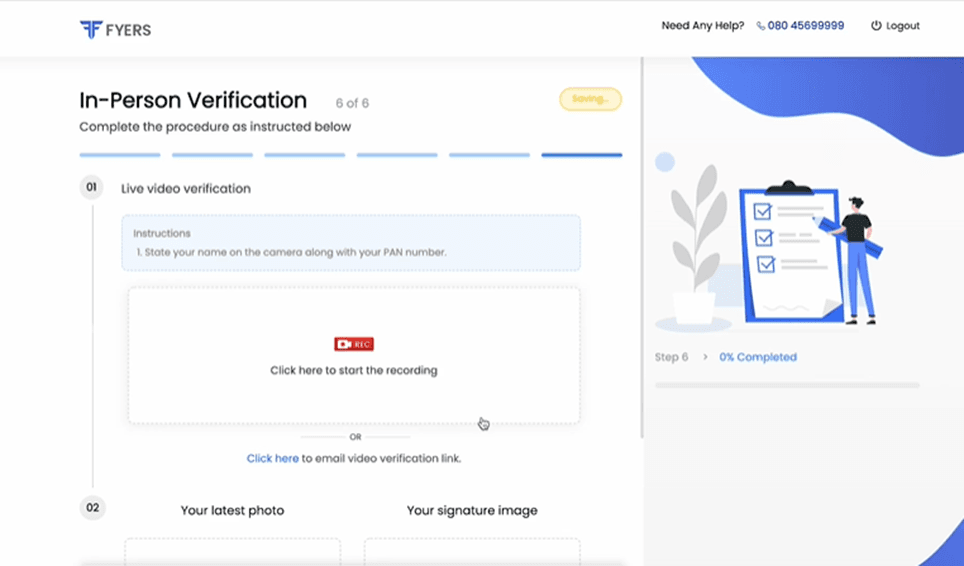

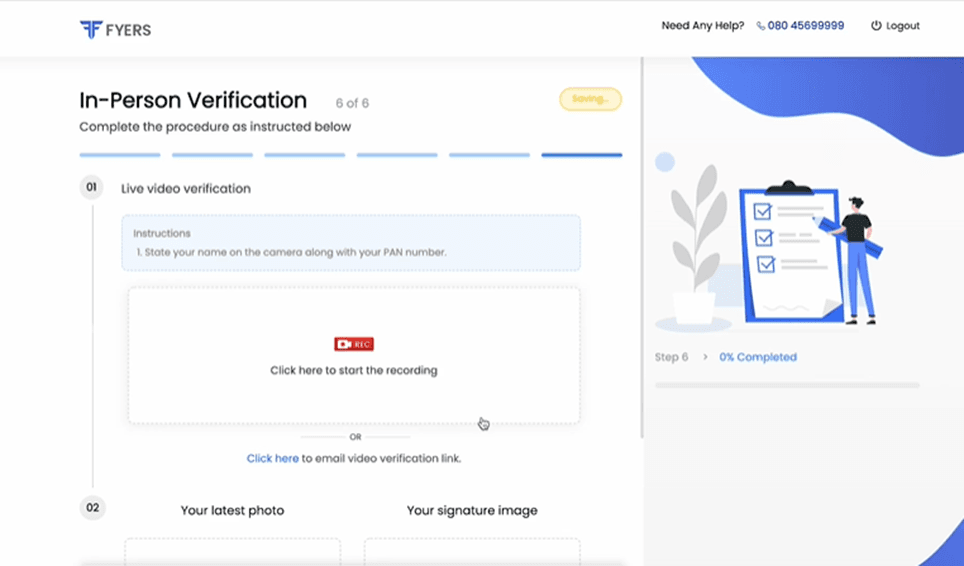

Steps 13

For In-Person Verification, upload a live video, a picture of yourself and a picture of your signature. These pictures can be taken as live pictures or uploaded from your device.

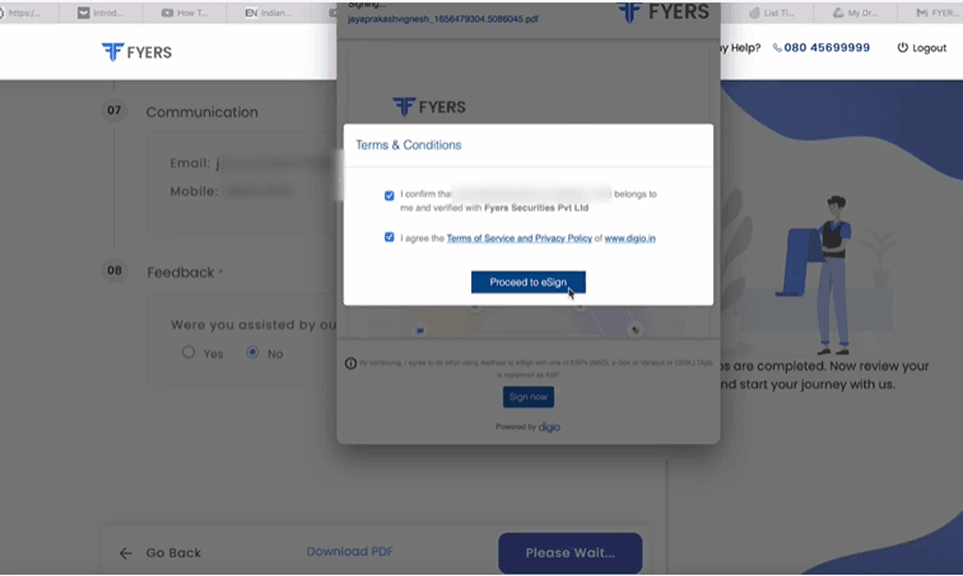

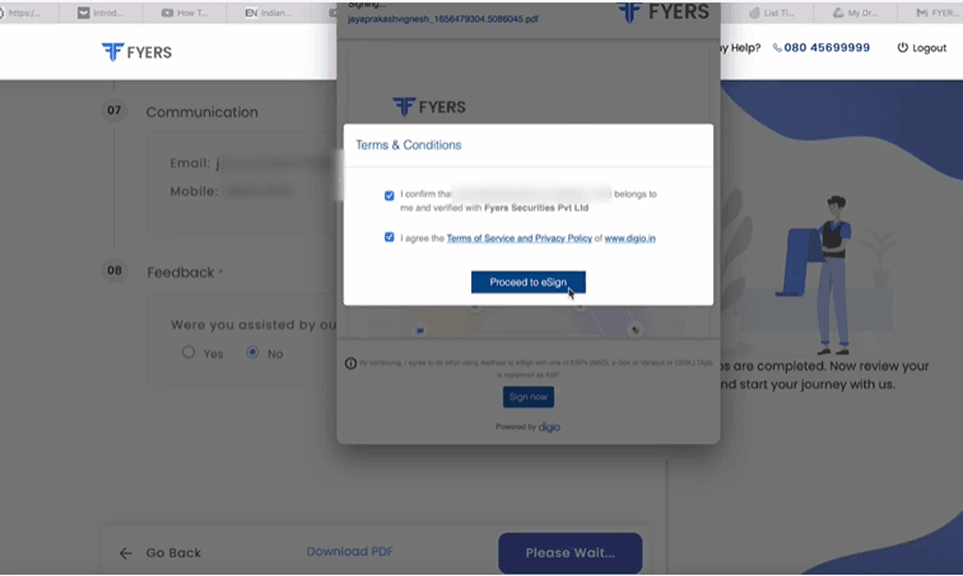

Steps 14

Review the details provided by you in the previous steps then click on “Proceed to e-sign” button.

You will be taken to enter your Aadhar card details and then you will receive OTP on the registered mobile number.Enter this OTP to complete the e-signing process.

This finishes the online account opening process. You will be redirected to a “Thank you” page and an email confirmation will be sent to you as well.