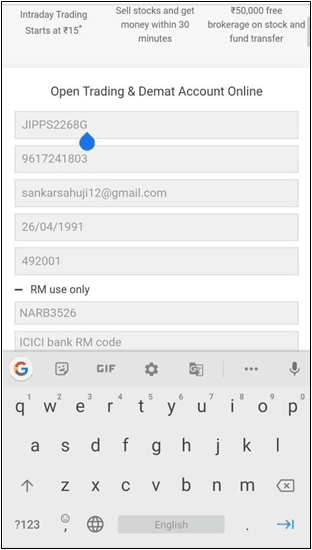

ICICI Direct Demat Account Opening - Documents Required.

Documents List

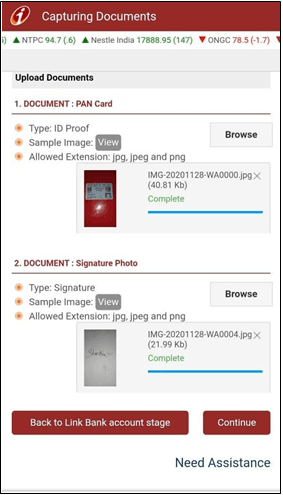

- A scanned copy of your PAN card

- A scanned copy of Aadhar Card

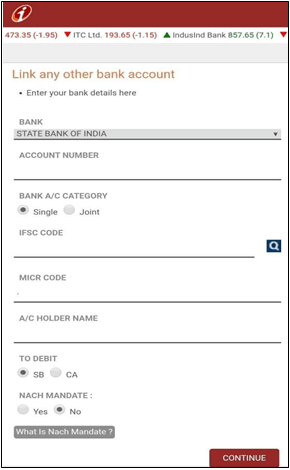

- Cancelled Cheque/Bank statement to link your bank account

- A scanned copy of your signatures - Income Proof (Only required if you wish to trade in Futures & Options, Currency or Commodities)

Additional terms and conditions

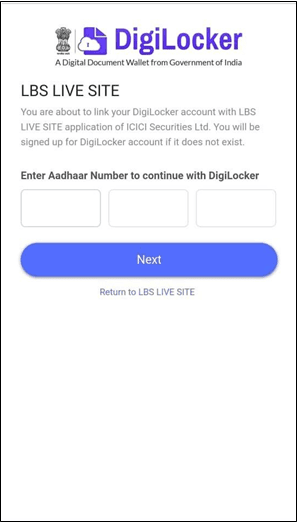

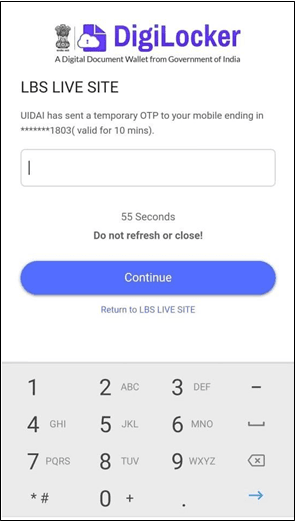

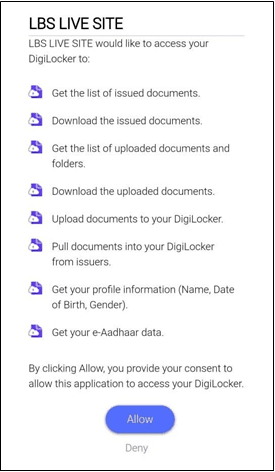

- You must have an active mobile number linked with your Aadhaar card. This is to complete the eSign-in/DigiLocker process which requires OTP verification. If your mobile number is not linked with your Aadhar card, then visit the nearest Aadhaar Seva Kendra to get it linked.

- Make sure that the bank statement you are uploading has an Account number, IFSC and MICR code printed on it. If these are not clearly visible, then your application may be rejected.

- The cheque must have your name clearly inscribed on it.

- Signature should be done with a pen on a blank paper and should be clearly visible. Use of pencils, sketch pens or markers will get your application rejected.

- You can submit any of the following documents as an income proof:

Form-16

Income Tax Return Acknowledgment

Latest 6-month Bank statement

Latest salary slip

Networth certificate from a CA

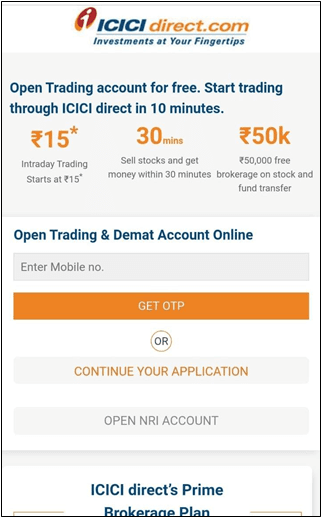

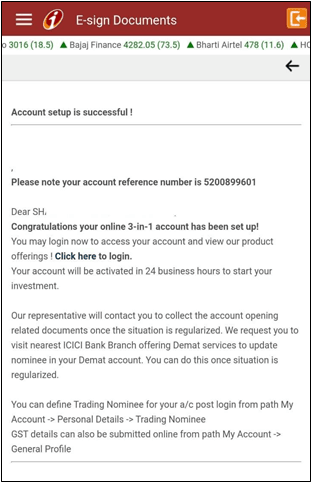

Open Demat Account