IIFL Demat Account Opening Process Step by Step.

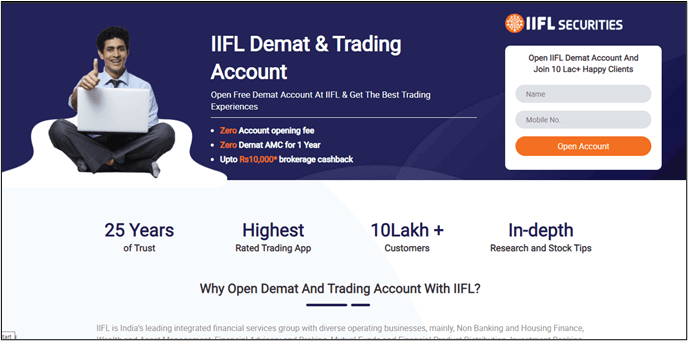

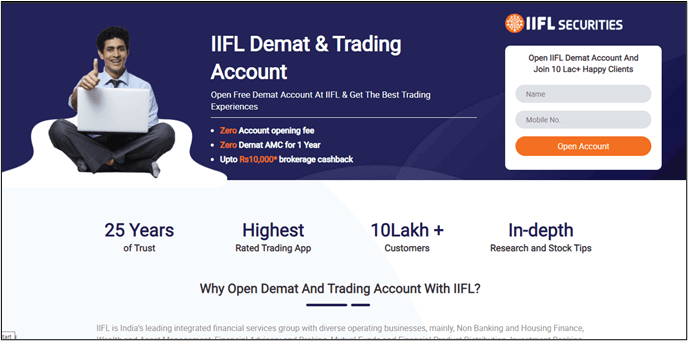

Steps 1

Click on ‘Open Your Account’ to visit IIFL and start your account opening process. Now fill the dialog box on the right side of the screen with your name and mobile number. Click Open Account to continue.

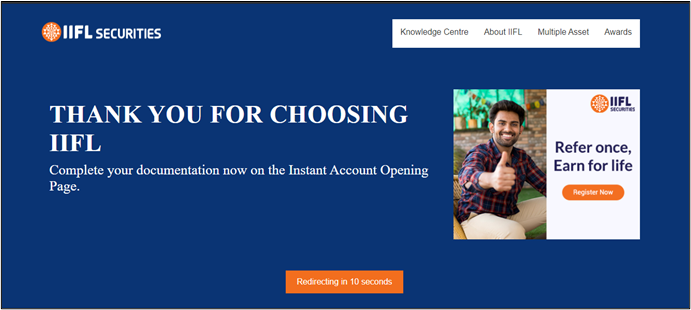

Steps 2

You will be redirected to a new page in the next 10 seconds. Don't refresh or close the window.

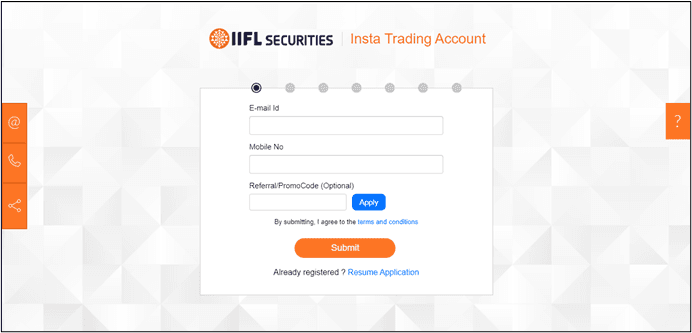

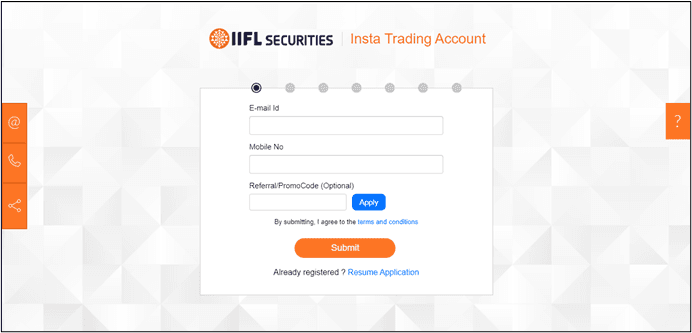

Steps 3

Now enter your mail id and mobile number. Click Submit to continue.

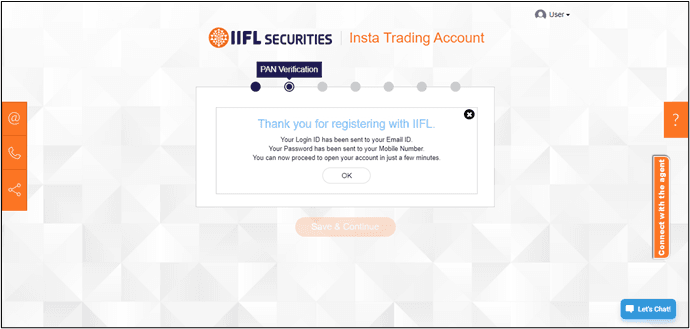

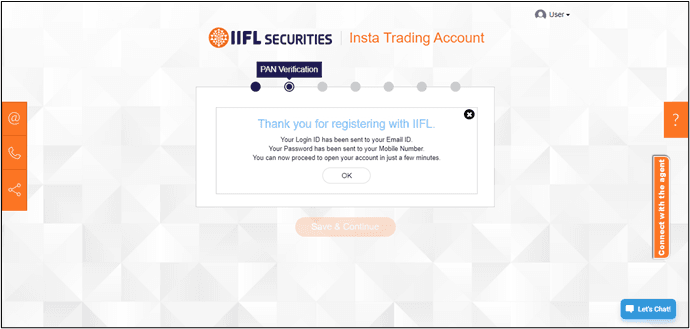

Steps 4

You will now receive a login id on your email whereas the password would be sent on your mobile number.

Steps 5

Enter the Pan number followed by your Date of Birth.

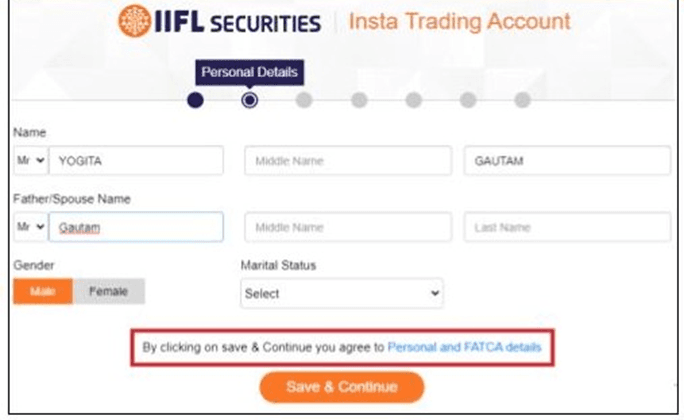

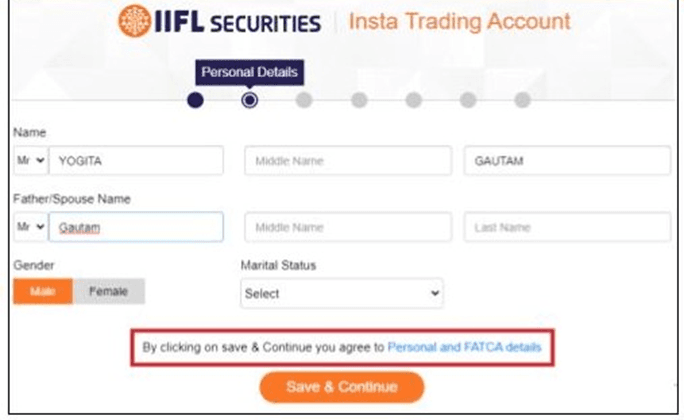

Steps 6

After the verification of the OTP, enter your details. Now enter the details related to your address Click Save and continue button to proceed further.

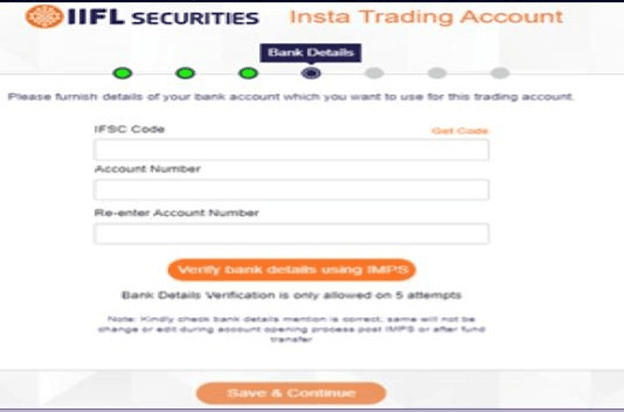

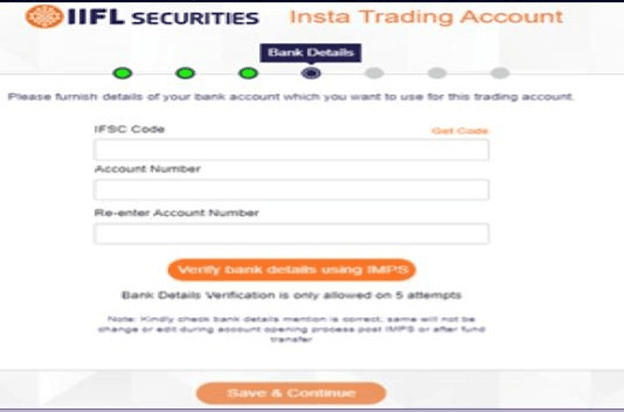

Steps 7

Now enter your bank account details and click verify bank details using IMPS. Once done click save and continue.

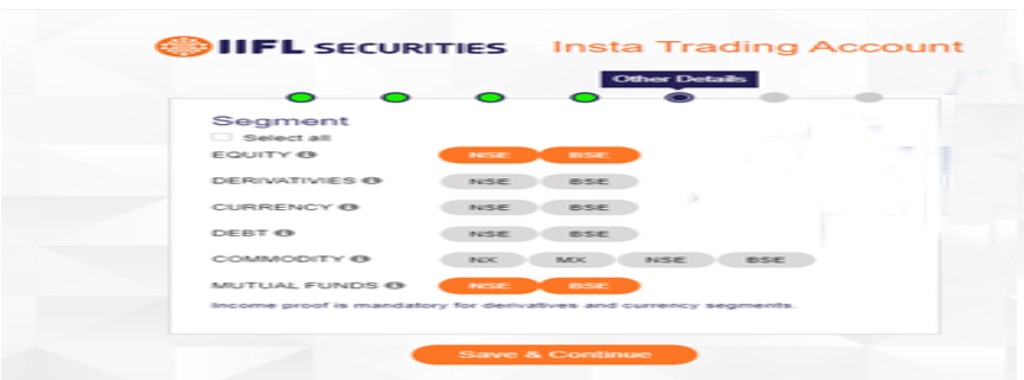

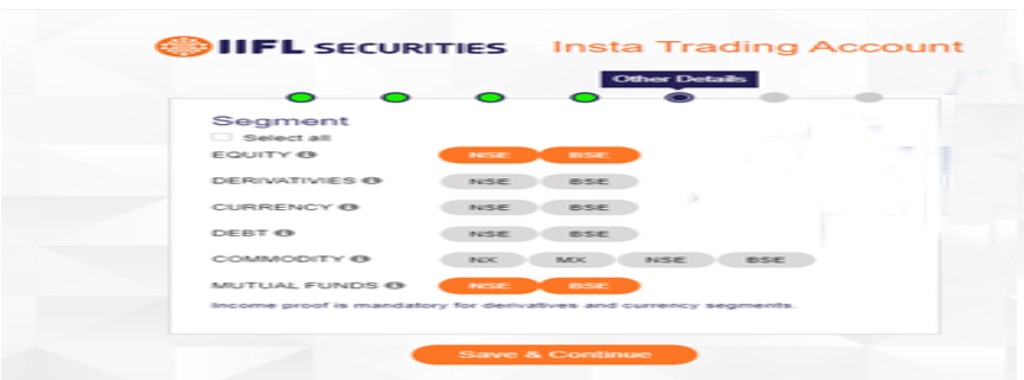

Steps 8

Select the segments and its subsequent stock exchange (NSE/BSE) you wish to trade-in. Click Save and Continue to proceed.

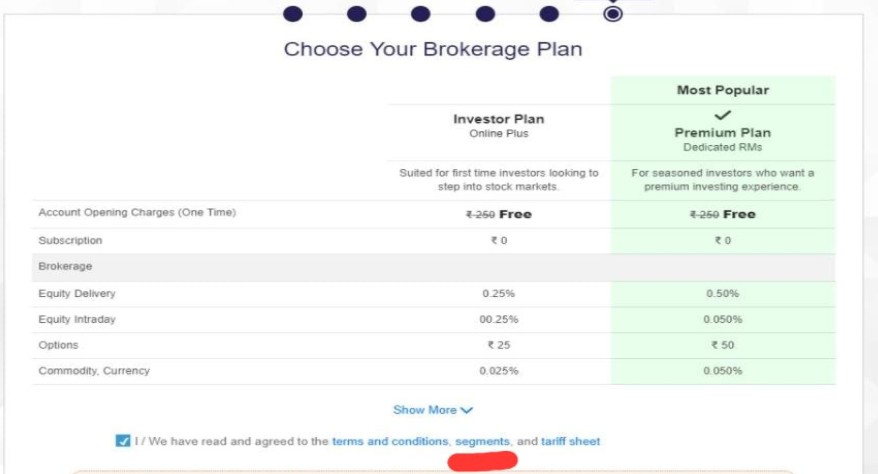

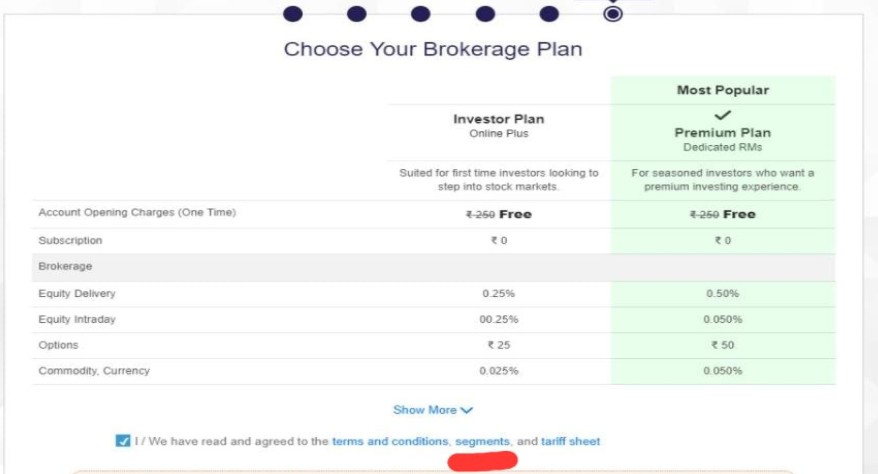

Steps 9

Now choose the brokerage plan as per your convenience. Check the declaration box and click next to continue.

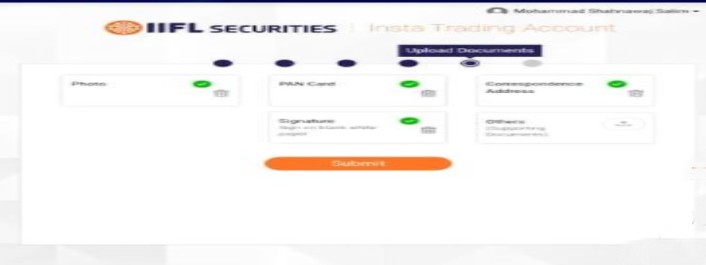

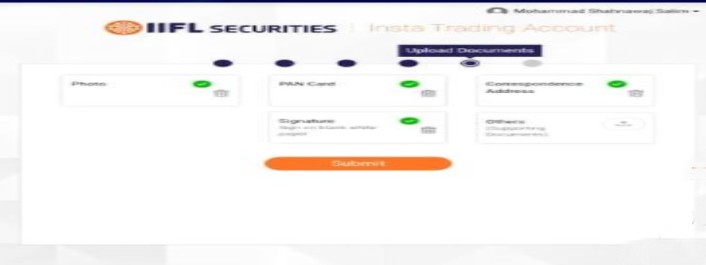

Steps 10

Now upload your essential documents. Please note that the size of the document should not be more than 400 Kb. Click the submit button to continue.

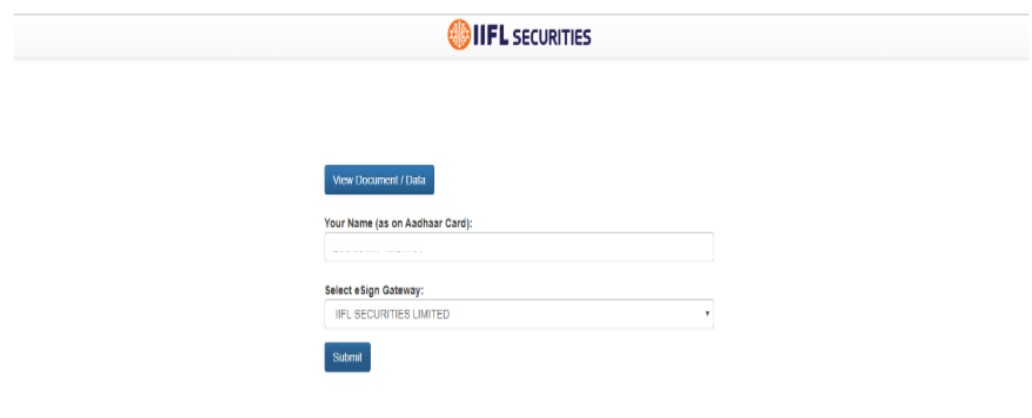

Steps 11

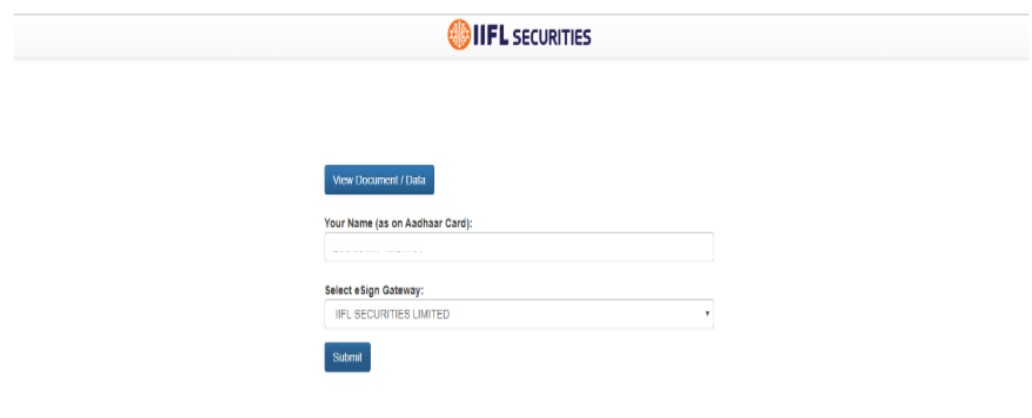

Now to eSign your account opening form, click the proceed button.

Steps 12

Enter your name and select IIFL SECURITIES LIMITED. Click submit to continue.

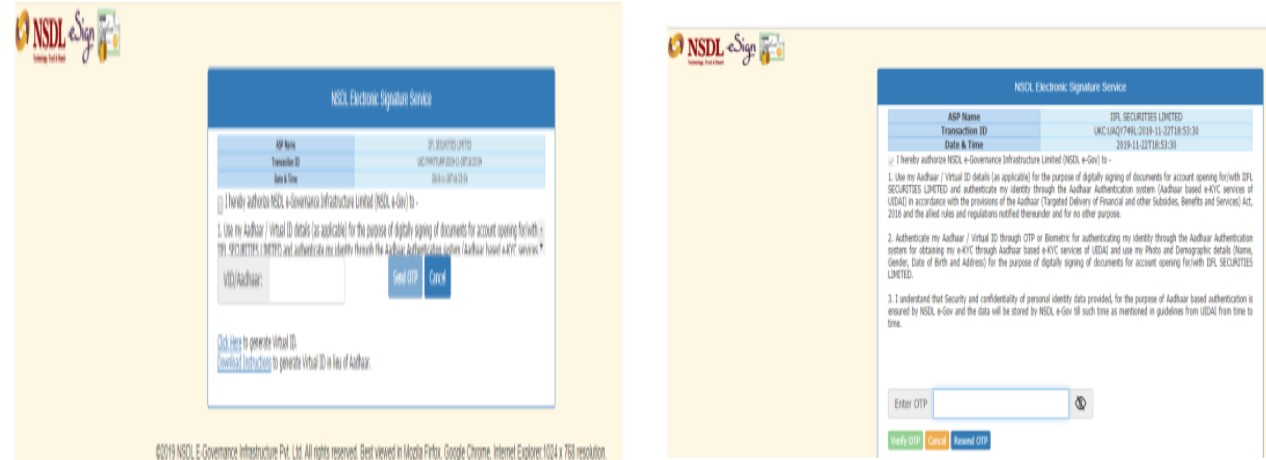

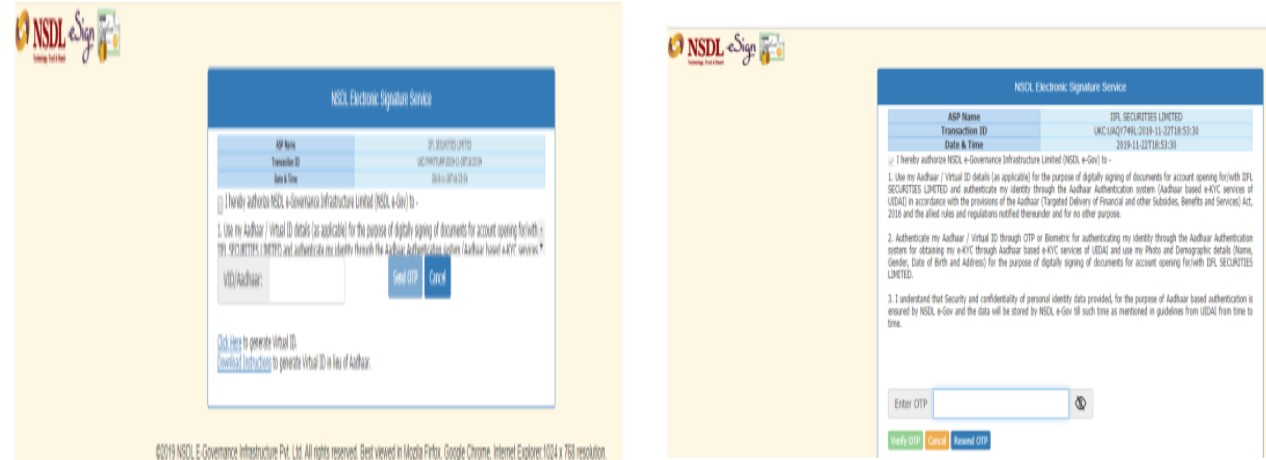

Steps 13

Now enter your 12 digit aadhaar number and verify it by entering the OTP received on your registered mobile number. Your account would be now created in 1-2 days after the application has been processed successfully.

NOTE

You can also E-sign with e-Mudra if you don't have your aadhaar card linked with your mobile number. e-Mudra requires a PAN card to be uploaded.

NOTE

You can also E-sign with e-Mudra if you don't have your aadhaar card linked with your mobile number. e-Mudra requires a PAN card to be uploaded.