Motilal Oswal Demat Account Opening Process Step by Step.

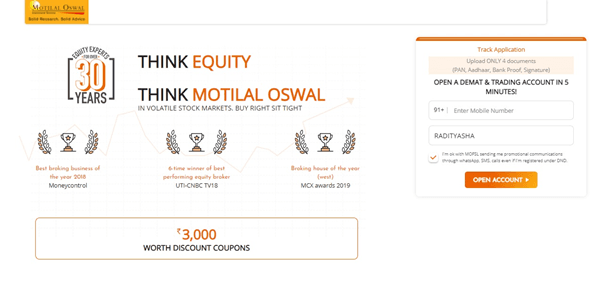

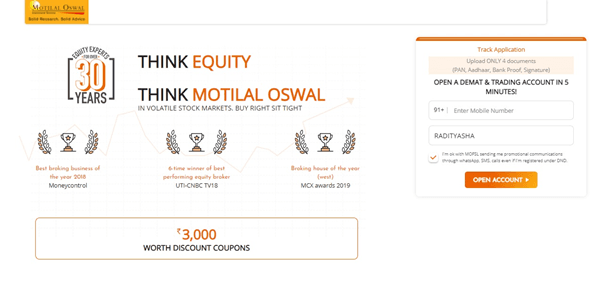

Steps 1

Click on ‘Open Your Account’ to visit Motilal Oswal and start your account opening process. Enter your mobile number in order to get the OTP. Check the declaration box and click proceed to continue.

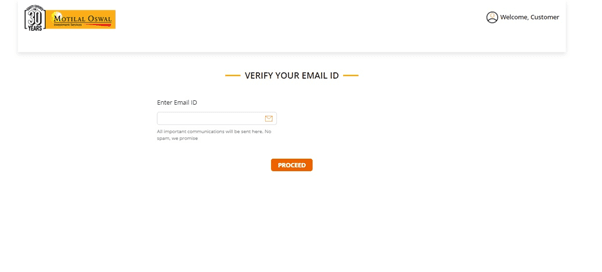

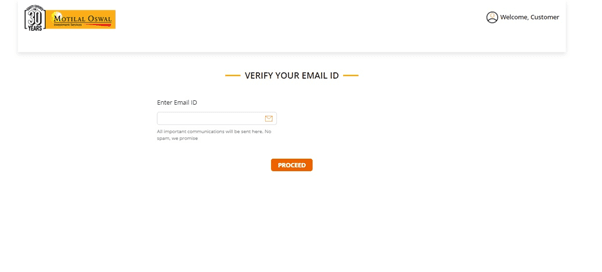

Steps 2

Enter your Email Address and click to proceed further.

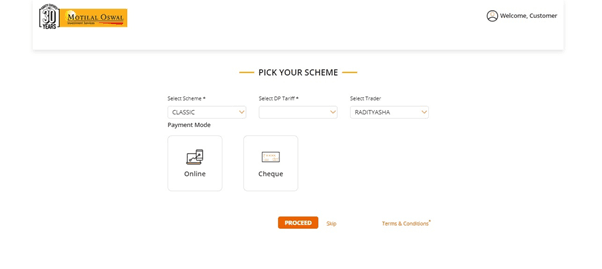

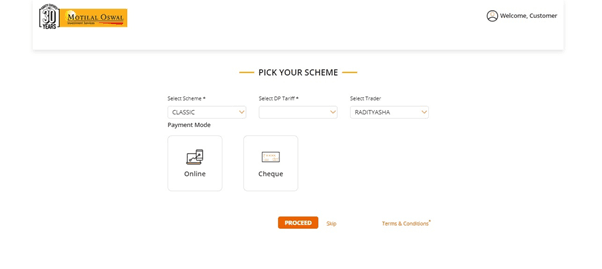

Steps 3

Now you need to Select the Scheme and DP Tariff as per your convenience from the annual subscription packs and click proceed.

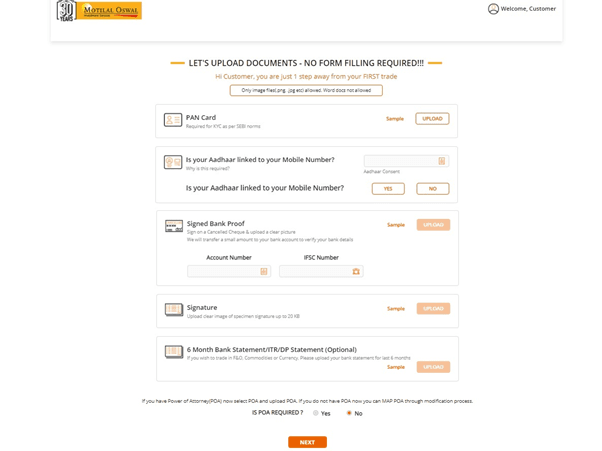

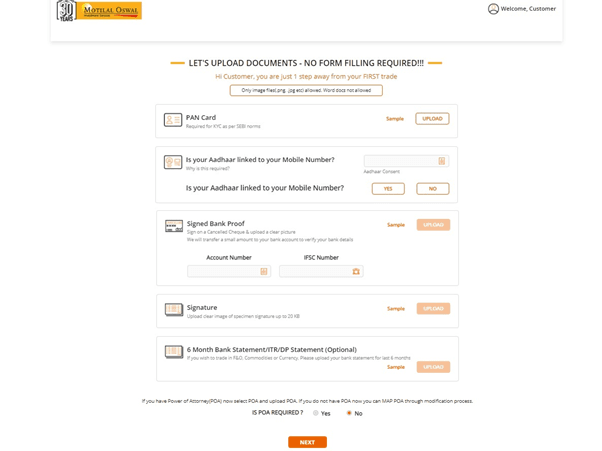

Steps 4

Now upload the required documents in the specified file format. Click to the next button below to continue.

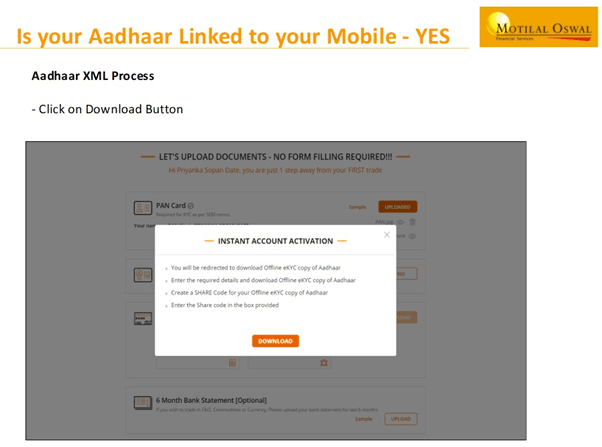

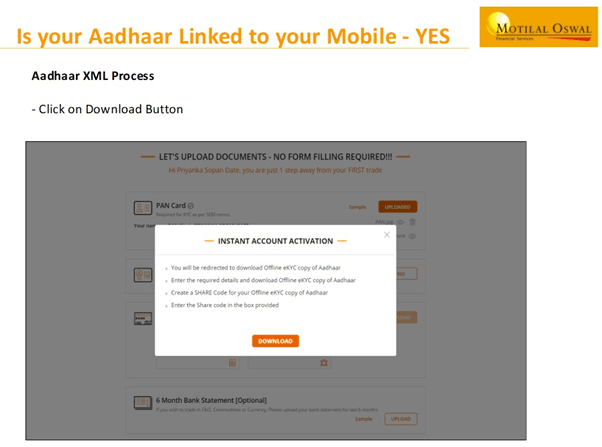

Steps 5

Now, if you have opted for online Aadhar linking process, then Instant Account Activation message will popup on your screen. Click on Download Button to Continue.

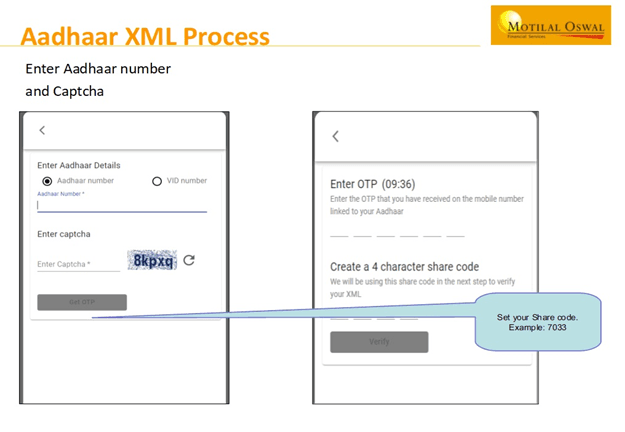

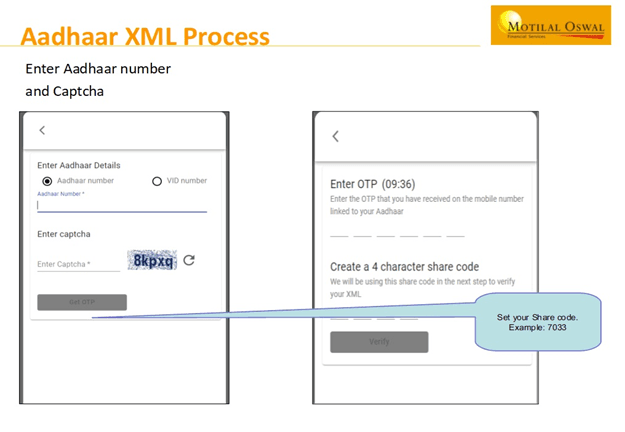

Steps 6

Then you will be redirected to Aadhar portal, here you will be required to enter your Aadhar Number and the OPT which you have received.

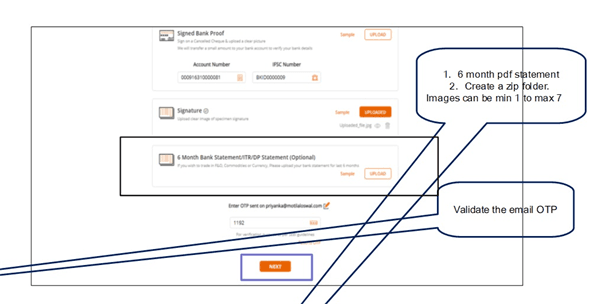

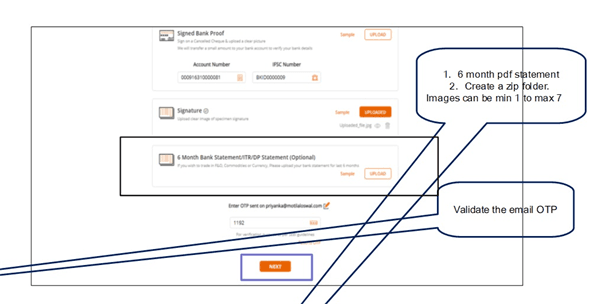

Steps 7

Now Upload your 6 months bank statement, if you want to opt for Derivative segment or else only equity account will be opened.

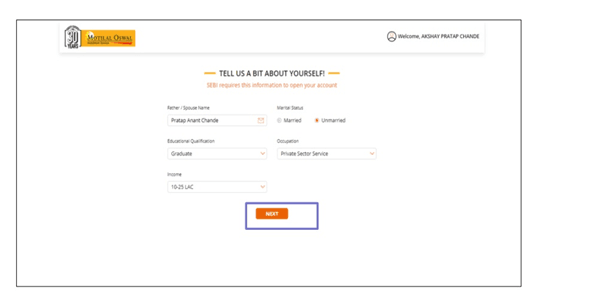

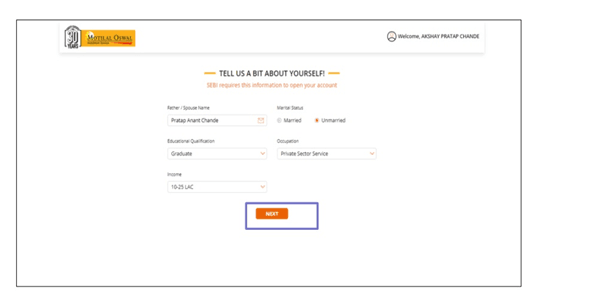

Steps 8

Steps 9

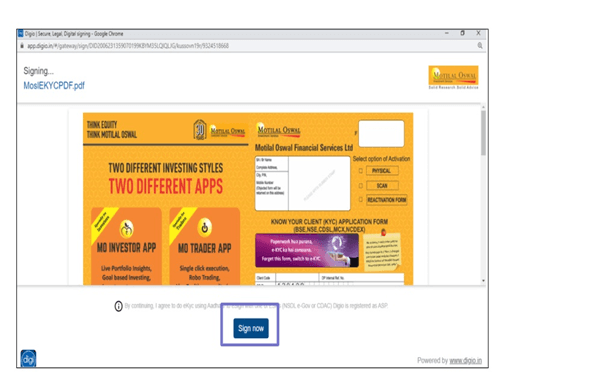

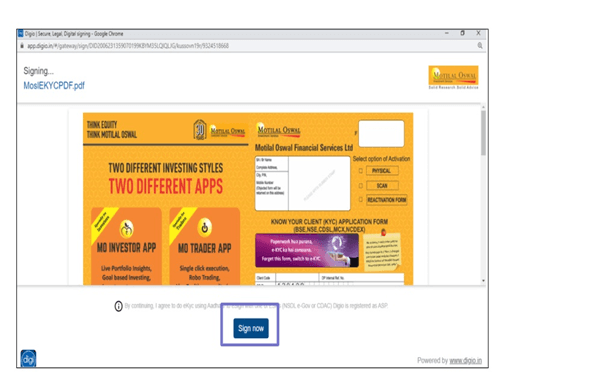

In the next step, you will be redirected to the e-sign process where you will be required to set you pin or Biometric and now you will be required to enter OTP which you have received previously. Now click on the Sign now button.

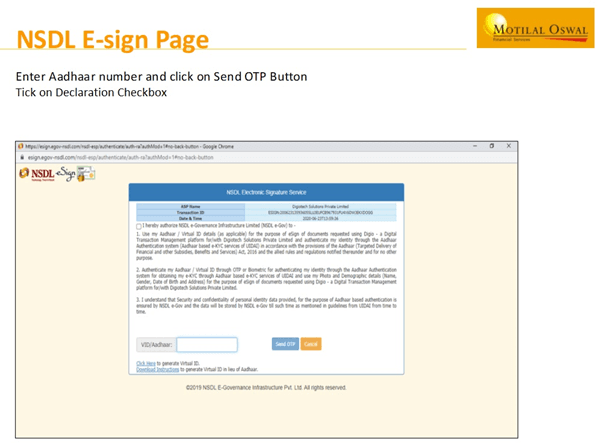

Steps 10

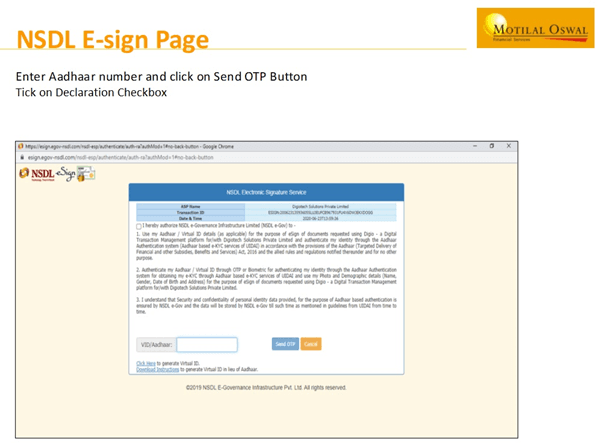

Enter your Aadhaar number in order to receive OTP. Click on the Send OTP button to continue.

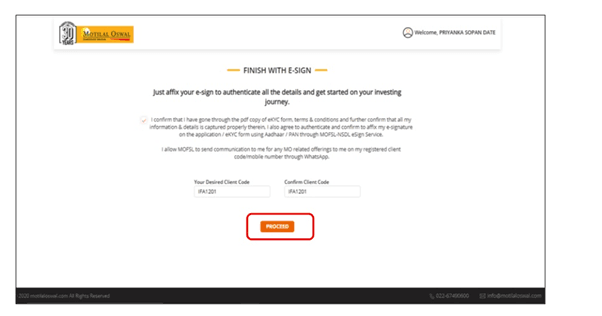

Steps 11

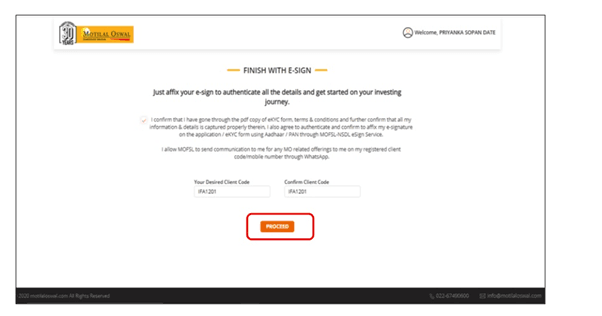

Now you will receive a confirmation message, and then you will have to confirm your Client code and click on the proceed button.

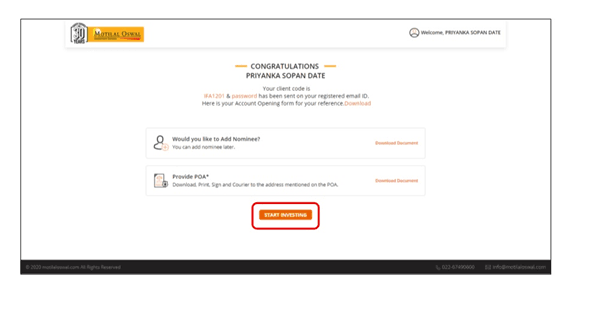

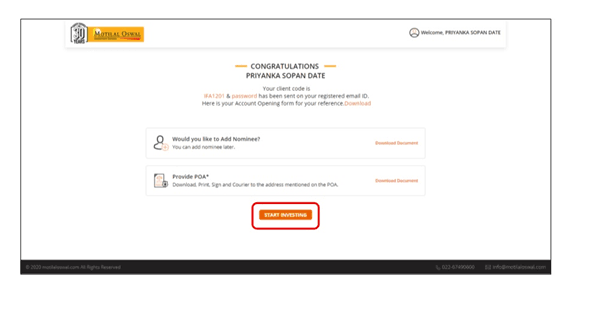

Steps 12

In this step you can download you Nominee and POA form. And can start investing.